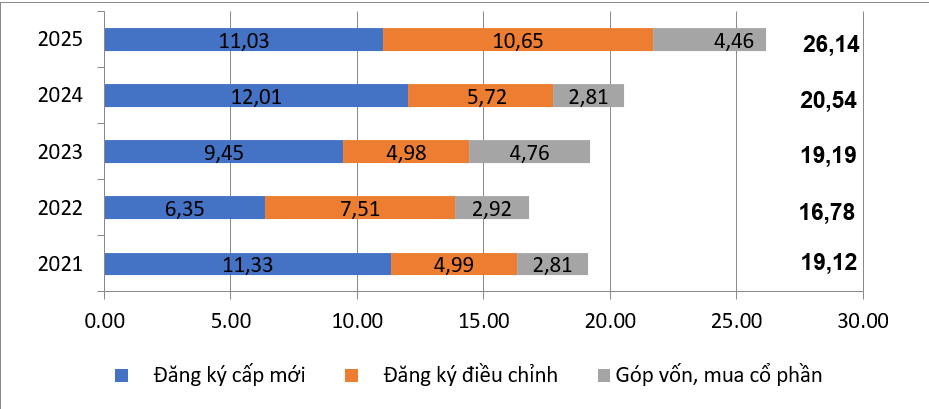

Foreign investment in new projects reached an impressive level, with 2,534 projects licensed and a registered capital of 11.03 billion USD. This marks a 12.6% increase in the number of projects compared to the previous year, despite a slight 8.1% dip in registered capital. The manufacturing industry attracted the most foreign direct investment, with registered capital reaching 6.53 billion USD, accounting for 59.2% of the total newly registered capital. Real estate business activities followed closely with 2.37 billion USD, making up 21.5%, while other industries accounted for 19.3% with 2.13 billion USD.

In terms of locality, Bac Ninh province is currently leading the country in attracting new FDI, with nearly 1.5 billion USD in registered capital in the first eight months of 2025. Ho Chi Minh City ranks second with 1.3 billion USD in new FDI, followed by Hai Phong, Hung Yen, and Gia Lai, with newly registered FDI in the same period reaching 1.2 billion USD, 1.1 billion USD, and 1 billion USD, respectively.

The report also highlights an increase in registered capital adjustments, with 996 projects licensed from previous years registering an additional investment of 10.65 billion USD, a significant 85.9% rise compared to the same period last year.

Combining the newly registered capital and the registered capital adjustments of previously licensed projects, the foreign investment in the manufacturing industry reached 13.64 billion USD, accounting for 62.9% of the total newly registered and additional capital. Real estate business activities attracted 4.98 billion USD, making up 23.0%, while other industries accounted for 14.1% with 3.06 billion USD.

Foreign Investment in Vietnam from 2021 to 2025 (in billion USD)

In terms of capital contribution and share purchases, there were 2,245 transactions with a total value of 4.46 billion USD, a substantial 58.8% increase compared to the previous year. Of these, 882 transactions involved capital contribution to increase the charter capital of enterprises, valued at 1.61 billion USD, while 1,363 transactions involved foreign investors buying domestic shares without increasing charter capital, valued at 2.85 billion USD.

The manufacturing industry attracted the most capital contribution from foreign investors, with 1.65 billion USD, accounting for 37.0% of the total value. Professional and scientific and technological activities followed with 981.7 million USD, or 22.0%, while other industries accounted for 41.0% with 1.83 billion USD.

Foreign direct investment (FDI) disbursement in Vietnam for the first eight months of 2025 is estimated at 15.40 billion USD, an increase of 8.8% compared to the same period last year. This marks the highest FDI disbursement for the January-August period in the last five years.

An Ambitious Province: Targeting Record-Breaking Economic Growth Without Mergers

The province of Quang Ninh has set an ambitious target for its economic growth this year, aiming for a 14% increase in GRDP – the highest goal in its history and 2% higher than the government’s target. This bold aspiration presents both a challenge and an opportunity to solidify its position as a leading growth hub in Northern Vietnam. To turn this record-breaking vision into reality, Quang Ninh is implementing a comprehensive range of strategic solutions across vital sectors.

A Rewarding Quarter for CII Shareholders: Over VND 300 Billion in Dividends to be Distributed in Q4

“CII is set to reward its shareholders with a 5% dividend payout, marking a significant shift from the past two quarters, where efforts were focused on diverting resources towards the ambitious $1.7 billion highway project. This move underscores CII’s commitment to balancing growth initiatives with shareholder value.”

“Vietnam’s Economic Outlook: Positive Trajectory Ahead, Yet Credit Quality Requires Vigilant Management”

The economic outlook for Vietnam is positive, according to both domestic and foreign experts, with a stable BB+ credit rating maintained. However, three significant challenges remain: dependence on the US and Chinese markets, a lagging logistics system, and a credit-to-GDP ratio that has climbed to 135%, nearly double the international average.

Market Upgrade: When Will Foreign Capital Join the Fray?

The future of Vietnam’s stock market was the focus of a recent webinar, ‘Finance Industry 2025: On the Cusp of an Upgrade’, hosted by Vietcap Securities (VCI). Industry experts shared their insights and outlook on the market’s potential as it stands at the precipice of an upgrade.