The Ministry of Finance proposes to the Government a revision of the personal income tax schedule, reducing the number of tax brackets from seven to five while maintaining the highest tax rate at 35%.

Currently, the progressive tax schedule for income from salaries and wages consists of seven tax brackets: 5%, 10%, 15%, 20%, 25%, 30%, and 35%. In practice, the Ministry of Finance noted that some consider the current schedule unreasonable, with too many brackets and narrow gaps between them. This can lead to tax bracket jumps when aggregating income at the end of the year, resulting in increased tax liability and more tax returns, even when the additional tax amount is not significant.

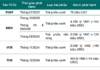

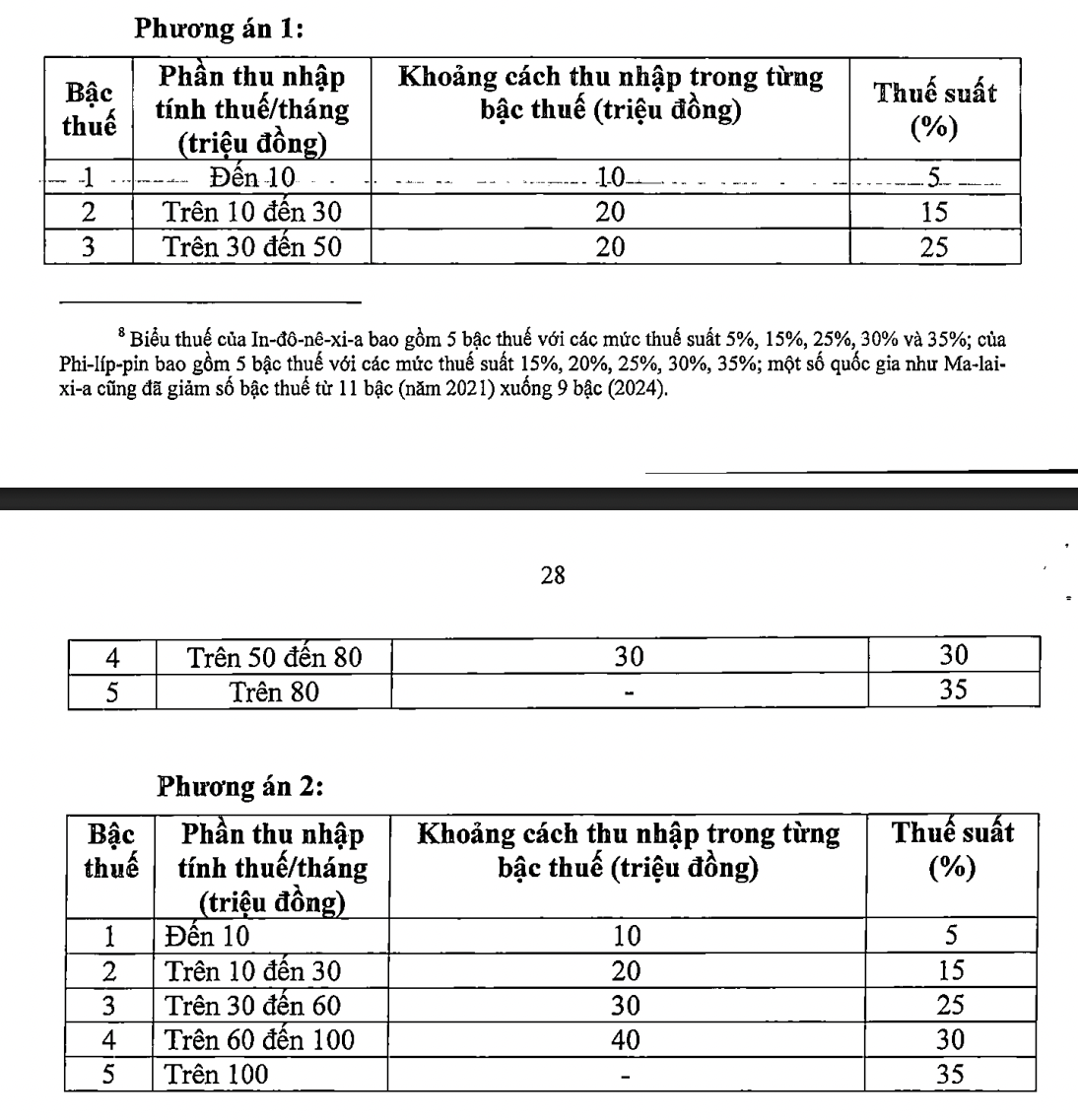

The recent trend in some countries is to simplify the tax schedule by reducing the number of brackets. Previously, the drafting agency proposed two options for amending the tax schedule, both of which condensed the brackets to five but with different income ranges for each bracket.

Two proposed adjustments to the tax schedule are presented, with the Ministry of Finance recommending Option 2.

After gathering feedback, the Ministry of Finance reported that the majority favored Option 2, which features five tax brackets but adjusts the income ranges to provide more flexibility at higher brackets. Specifically, taxable income up to VND 10 million per month is subject to a 5% tax rate; income from VND 10 million to VND 30 million is taxed at 15%; VND 30 million to VND 60 million is taxed at 25%; VND 60 million to VND 100 million is taxed at 30%; and income above VND 100 million per month is subject to a 35% tax rate.

However, there were also suggestions to further widen the income ranges within the higher brackets, lower the tax rates within each bracket, and reduce the highest tax rate from 35% to a lower percentage (30% or 25%).

In response to these suggestions, the Ministry of Finance shared that several countries in the region maintain a 35% tax rate for the highest bracket (such as Thailand, Indonesia, and the Philippines) or even higher at 45% (including China, South Korea, Japan, and India).

The drafting agency explained that adjusting the tax rates while increasing the personal exemption amount and adding additional deductions (for medical and educational expenses) would reduce the overall tax burden and provide relief to taxpayers. As a result, many individuals with average and lower incomes would no longer be subject to personal income tax. For those with higher incomes, the tax burden would also be reduced compared to the current system.

For example, an individual with one dependent and a monthly income of VND 20 million is currently paying VND 125,000 in personal income tax. With the proposed changes in Option 2, including the increased personal exemption and the new tax schedule, this individual would no longer be liable for any tax.

For an income of VND 25 million per month, the tax liability would decrease from the current VND 448,000 to VND 34,000 per month (a reduction of approximately 92%). With a monthly income of VND 30 million, the tax liability would decrease from VND 968,000 to VND 258,000 per month (a reduction of about 73%).

According to the 2024 Household Living Standards Survey by the General Statistics Office, the average income per capita in Vietnam is VND 5.4 million per month. The richest 20% of the population, considered high-income earners, have an average income of VND 11.8 million per month per person. The drafting agency believes that the proposed personal exemption amount of VND 15.5 million per month is nearly three times the average per capita income and also exceeds the average income of the highest-income group.

The new tax schedule aims to target individuals with medium-to-high incomes. Specifically, the 5% tax rate in Bracket 1 applies to taxable income from VND 0 to VND 10 million per month, which corresponds to a monthly income of VND 20 million to VND 35 million for individuals with one dependent. The 15% tax rate in Bracket 2 applies to taxable income from VND 10 million to VND 30 million per month, equivalent to an income of VND 35 million to VND 56 million for individuals with one dependent.

In terms of budgetary impact, the personal exemption amount in Option 1 is estimated to reduce revenue by VND 12 trillion, while Option 2 would reduce revenue by approximately VND 21 trillion. Adjusting the tax schedule in Option 1 would result in a revenue reduction of VND 7.12 trillion, while Option 2 would reduce revenue by VND 8.74 trillion.

The Ministry of Finance recommends that the Government adopt Option 2.

“The Benefits of Registering for a 17% Tax Rate: Why It’s a Smart Move for Your Business”

The Ministry of Finance has recently submitted to the Ministry of Justice a dossier for appraisal of the Personal Income Tax Law (amended). This latest draft features several significant changes, most notably the introduction of a mechanism to calculate taxes on income and apply a 17% tax rate for households and individuals with business revenues exceeding the prescribed threshold.

“A 20% Tax on Capital Gains: Concerns and Clarifications Needed”

The proposed 20% tax on stock market profits has sparked concerns among investors and experts alike, who deem the rate excessive. This move could potentially deter individual investors from participating in the market, as an overly high tax rate may dampen their enthusiasm and motivation to engage in stock market activities.