I. MARKET ANALYSIS OF SECURITIES AS OF SEPTEMBER 04, 2025

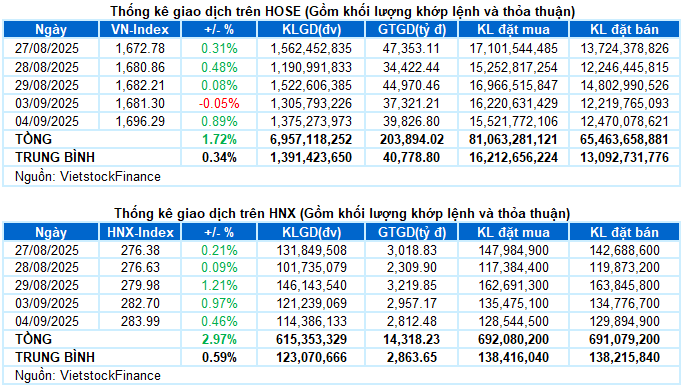

– The main indices rose in the trading session on September 4th. Specifically, VN-Index increased by 0.89%, reaching 1,696.29 points; HNX-Index also rose by 0.46%, reaching 283.99 points.

– The trading volume on the HOSE floor slightly increased by 3.9%, reaching nearly 1.3 billion units. Meanwhile, HNX recorded nearly 109 million units, a decrease of 6.9% compared to the previous session.

– Foreign investors continued to net sell with a value of more than 795 billion VND on the HOSE and 40 billion VND on the HNX.

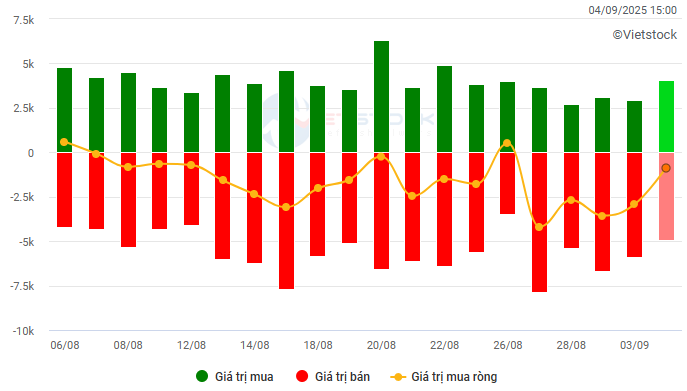

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: Billion VND

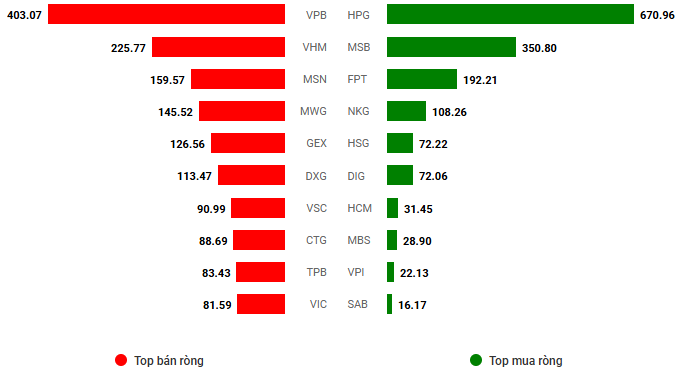

Net trading value by stock code. Unit: Billion VND

– VN-Index experienced a fierce tug-of-war on low liquidity on September 4th. After 3 unsuccessful approaches to the 1,690-point mark in the morning session, profit-taking pressure caused the index to turn down before the lunch break. This scenario repeated in the afternoon session when the VN-Index rebounded and re-challenged the 1,690-point threshold. This time, the strong comeback of pillar stocks at the end of the session helped the index break through successfully. The VN-Index closed at 1,696.29 points, up nearly 15 points from the previous session.

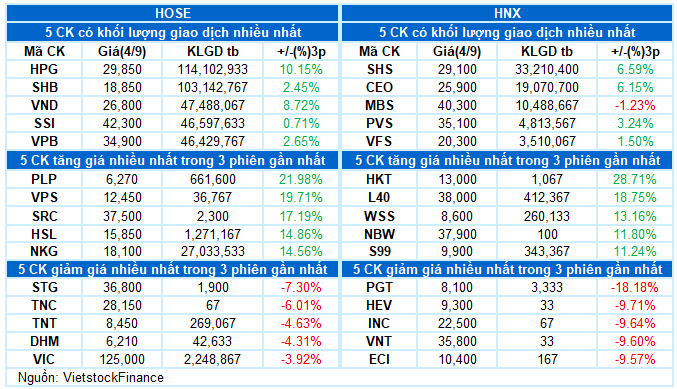

– In terms of impact, VCB and HPG were the two main drivers, contributing 3.8 points and 3.2 points to the VN-Index, respectively. Following were VPB, FPT, and LPB, which added a total of more than 2 points. In contrast, VHM, MBB, and VJC were the codes with the most negative impact, causing the index to lose nearly 1 point.

– VN30-Index closed with a strong increase of 1.29%, stopping at 1,883.59 points. The breadth of the basket favored the buying side with 22 stocks rising, 6 falling, and 2 standing. Among them, HPG stood out with an outstanding increase of 6%. In addition, VCB, SSB, SSI, MSN, MWG, LPB, and TPB also attracted positive cash flow, all rising by more than 2%. On the opposite side, VJC and SHB were at the bottom with adjustments of more than 1%.

In terms of sectors, materials led the table with a positive increase of 2.78%, mainly contributed by the impressive performance of steel stocks such as HSG, NKG, and TLH, which hit the daily limit, HPG (+6.04%), VGS (+4.47%), TVN (+4.65%), GDA (+5.56%), etc.

With their large capitalization, financial stocks also made a significant contribution to today’s gain as they unexpectedly rebounded strongly towards the end of the session, notably VCB (+2.84%), VPB (+1.16%), SSI (+2.3%), MSB (+3.93%), TPB (+2.14%), SHS (+1.75%), OCB (+1.8%), and HCM (+2.95%).

Meanwhile, energy was the only sector to close in the red, mainly due to selling pressure from BSR (-0.73%), VTO (-1.22%), VIP (-1.08%), and CLM (-4.63%).

VN-Index surged after continuous tug-of-war in the session, setting a new peak (based on closing price) and approaching the 1,700-point threshold. If the trading volume exceeds the 20-day average in the coming sessions, the uptrend will be reinforced.

II. TREND AND PRICE MOVEMENT ANALYSIS

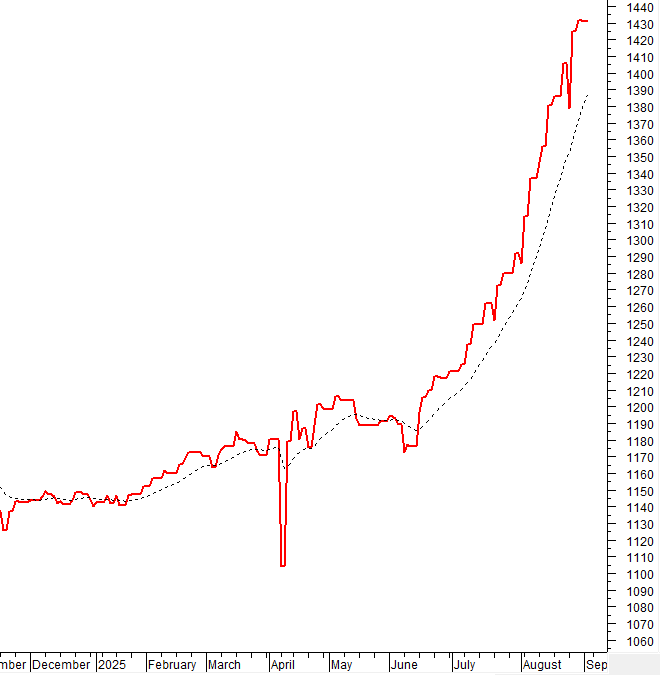

VN-Index – Setting a new peak

VN-Index surged after continuous tug-of-war in the session, setting a new peak (based on the closing price) and approaching the 1,700-point threshold.

If the trading volume exceeds the 20-day average in the coming sessions, the uptrend will be reinforced.

HNX-Index – Increasing for the 6th consecutive session

HNX-Index increased for the 6th consecutive session, but the gain narrowed towards the end, reflecting that the profit-taking pressure at the old peak of August 2025 (corresponding to 285-289 points) still exists.

In addition, trading volume continued to fall below the 20-session average. This will need to be improved for the index to break through this resistance zone in the future.

Analysis of Money Flow

Fluctuation of smart money flow: The Negative Volume Index indicator of VN-Index is above the EMA 20-day line. If this status continues in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Fluctuation of foreign capital flow: Foreign investors continued to net sell in the trading session on September 4, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS AS OF SEPTEMBER 04, 2025

Department of Economic Analysis & Market Strategy Advisory, Vietstock Consulting

– 17:17 09/04/2025

Stock Market Week Sept 03-05, 2025: The Unexpected Drop After Hitting 1,700 Points

The VN-Index took a surprising tumble during the week’s final session, bringing an end to four consecutive weeks of gains. This sudden shift highlights the intense profit-taking pressures at play in the higher price ranges, with persistent foreign sell-offs further exacerbating the situation and significantly impacting investor sentiment.

Foreign Sell-Off Continues: Nearly 3,000 Billion VND Offloaded, Which Stocks Took the Biggest Hit?

In the afternoon trading session, PDR stocks witnessed a robust net foreign purchase, leading the market with a value of 96 billion VND.