The Vietnamese government recently issued Decree 232/2025 on August 26, amending and supplementing several articles of Decree 24/2012 on gold business management. The decree, which takes effect on October 10, 2025, introduces a significant change by abolishing the state monopoly on gold bar production. This move marks a turning point in the management of the gold market.

Soaring Gold Prices

Representatives of Phu Quy Gold and Silver Jewelry Group believe that with the participation of qualified banks and enterprises in the gold bar market, the gap between domestic and global prices will surely narrow, bringing more stability to the market and curbing speculation. They shared, “This positive development safeguards the interests of citizens and investors and contributes to macroeconomic stability.”

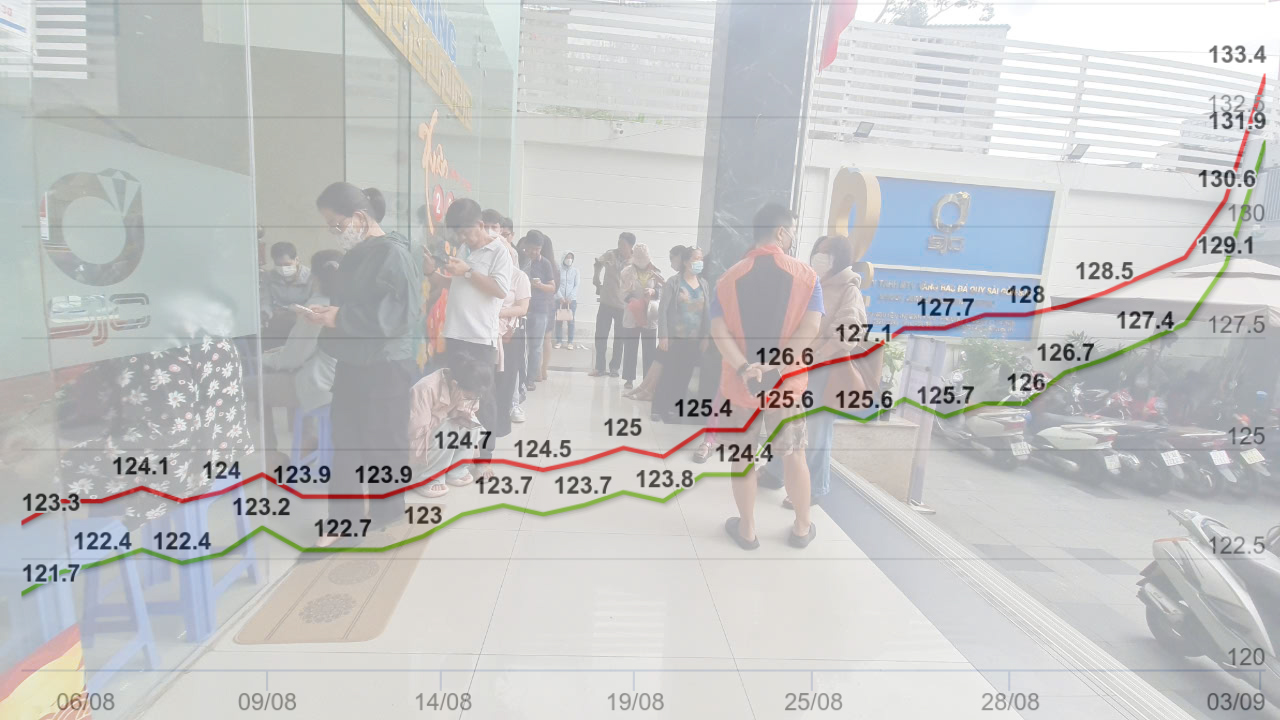

However, the market has witnessed a contrasting scenario in recent days. The news of ending the gold bar production monopoly has failed to cool down gold prices. Within a few days, SJC gold bar prices surged from 125.7 million VND per tael for buying and 127.7 million VND per tael for selling to 131.9 – 133.4 million VND per tael (buying and selling), an increase of about 6 million VND each way. Plain gold rings and 24K gold jewelry also climbed to 125.5 million VND per tael for buying and 128 million VND per tael for selling, about 5 million VND higher than before.

This price “fever” has led to a rush among people to buy gold. On September 3 in Hanoi, many gold shops were crowded with customers lining up from morning to evening just to buy a few taels of gold rings or bars. At Bao Tin Minh Chau store on Tran Nhan Tong street, the staff said that the gold rings sold out just 30 minutes after opening, even with a purchase limit of one tael per customer.

The situation was similar in Ho Chi Minh City. Dozens of customers queued at the Saigon Jewelry Company (SJC) headquarters to wait for their turn to buy gold. When the staff announced that SJC gold bars were sold out, they immediately switched to buying plain gold rings, despite a daily purchase limit of half a tael per person.

According to financial expert Phan Dung Khanh, domestic gold prices have been strongly influenced by the global market and limited supply recently. International gold prices have officially hit a new historical peak above $3,530 per ounce due to increased demand for safe-haven investments. Many investors have even cashed out of stocks (which have performed well since the beginning of the year) and turned to gold, causing a sudden surge in demand for this asset.

However, Mr. Khanh predicts that this upward trend may only last in the short term and is unlikely to explode as strongly as last year and the beginning of this year. The reason is that factors such as geopolitical tensions or tariff policies are no longer as hot. Moreover, international gold prices have been breaking records for the past two years, and the recent rate of increase has slowed down. “The USD/VND exchange rate has increased but is well managed by the State Bank, so it usually only affects the short term. The new gold policy under Decree 232 is expected to reduce the gap between domestic and international gold prices in the medium term. Therefore, it is difficult for domestic gold prices to rise sharply as in the previous period,” Mr. Khanh assessed.

Soaring gold prices have led to a rush among people to buy gold. Photo: LAM GIANG

Scarce Supply

Commenting on the continued surge in gold prices despite the end of the gold bar production monopoly, Mr. Dinh Nho Bang, Chairman of the Vietnam Gold Business Association, said that opening up production would increase the variety of products in the market, but not all enterprises could participate. To qualify, enterprises must have a minimum charter capital of VND 1,000 billion, and commercial banks must have VND 50,000 billion. These requirements are considered necessary to ensure that only organizations with strong financial potential and transparent governance can enter a sensitive market like gold bars.

Mr. Bang also drew attention to the issue of gold raw material supply. “Since Vietnam does not have commercial gold mines, gold bar production must rely on imports, as well as quotas, permits, and monetary policies in each period. Therefore, we cannot assume that ending the monopoly will immediately change the market; instead, we must consider many coordinating factors,” he emphasized.

According to the Chairman of the Vietnam Gold Business Association, whether gold prices will decrease depends on the balance of supply and demand. If demand is high but supply is not guaranteed, prices will be difficult to lower. On the other hand, if the import of gold raw materials is opened and enterprises have a source for processing, prices may stabilize and fall.

From the perspective of a gold business enterprise, Mr. Tran Huu Dang, General Director of AJC Gold and Silver Jewelry Joint Stock Company, attributed the situation to the fact that the current supply depends entirely on the amount sold by the State Bank through four large commercial banks (Agribank, Vietcombank, BIDV, and VietinBank), SJC Company, and the amount of gold sold by the people. But recently, both the state and the people have sold very little. Meanwhile, international gold prices have continuously set new records, surpassing the $3,500 per ounce mark, and money has flowed into gold as a safe haven, causing domestic prices to soar to 133.4 million VND per tael, 15-20 million VND higher than the world price.

However, Mr. Dang remains optimistic about the medium-term outlook as enterprises are allowed to import gold. At that time, eligible units will proactively produce gold bars, rings, and jewelry, thereby cooling down prices and bringing domestic developments closer to the world market. “Decree 232 also paves the way for enterprises to buy and sell gold raw materials, ensuring a stable supply and creating opportunities for the development of jewelry and fine arts industries. With the Ministry of Finance proposing to reduce the export tax on gold jewelry to 0%, this will be a great boost for Vietnamese goods to expand into the international market,” Mr. Dang expected.

Another member of the Vietnam Gold Business Association assessed that the domestic gold price could not narrow the gap with the world price because the core issue was the lack of gold imports for production and business. Although four commercial banks have been found to meet the conditions for gold bar production, they are still in the process of obtaining permission. Large enterprises are also waiting for specific guidance from the State Bank on the management, import, production, and business processes of gold raw materials. “When these regulations are put into practice, enterprises can choose the right time to buy world gold, produce gold bars, and sell gold raw materials to processing units. This synchronized operation will help cool down the Vietnamese gold market and gradually narrow the price gap with the world market,” the member opined.

Should a Gold Tax be Imposed?

Regarding the question of whether a tax should be imposed to curb gold speculation, Mr. Dinh Nho Bang opined that managing the gold market is a long-term process inseparable from other macroeconomic policies. The stock market, bank interest rates, real estate, and other investment channels directly impact capital flows. When these channels operate effectively, people will not pour money into gold. “Moreover, gold is recognized by the Constitution as a legitimate asset and a right of citizens to own. They have the right to invest according to their wishes. Therefore, it is important not only to manage the gold market but also to formulate reasonable policies for other investment channels to optimize capital allocation and bring more benefits to the people. In other words, managing the gold market is not everything; it needs to be placed in the context of macroeconomic policies,” Mr. Bang analyzed.

The Golden Contrast: A Tale of Soaring Prices

The gold price surge has left small jewelry shops in a peculiar predicament. While a rise in gold prices typically signals prosperity for gold businesses, smaller retailers are facing a unique challenge. Their primary focus on jewelry sales becomes a double-edged sword when customers flock to purchase gold bars and coins instead. This shift in demand dynamics has small jewelry retailers struggling to adapt, witnessing a stagnant business despite the favorable market conditions.

The Soaring Price of Gold: An Unexpected Turn of Events

“The SJC gold bar prices soar to new heights as small gold shops push the price to a record high of VND 139 million. This surge has caught the attention of experts, who now warn of potential risks associated with the SJC gold market. With the prices skyrocketing, investors and buyers must stay vigilant and informed to navigate this volatile market.”

The Unaffordable Gold Conundrum: A Tale of Wealth and Woes

This morning, gold prices surged to unprecedented levels, with SJC gold bullion reaching a staggering 130 million VND per tael, and gold rings nearly touching the same milestone. An unprecedented surge in demand from buyers has left gold businesses depleted, with some retailers running out of stock entirely, resulting in waiting periods of up to 15 days for eager customers eager to get their hands on the precious metal.