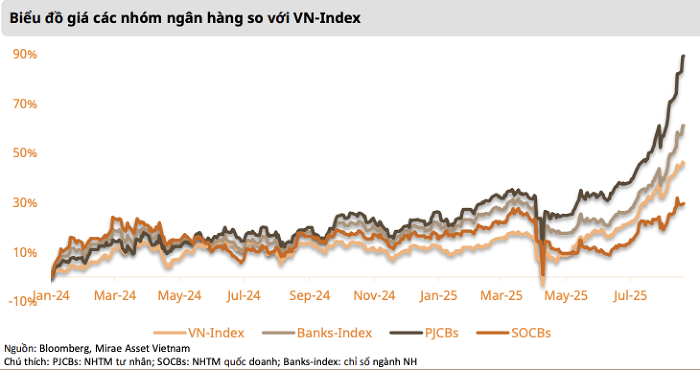

Since the beginning of July, bank stocks have witnessed a rare historic surge in prices. Notably, several bank stocks have recorded impressive returns of 40-50%, with some even reaching 80-90% within just two months.

According to Mirae Asset Vietnam Securities, the recovery in the banking sector’s profits remains modest and largely relies on cost-cutting efforts and recognition of non-recurring income. In comparison to the rapid rise in stock prices, profit growth has been relatively subdued, while the outlook is only considered neutral.

Instead, market sentiment has swiftly shifted from excessive pessimism over new tariff risks to optimism as the actual imposed tariffs were not overly negative or “abnormal,” thus not diminishing the country’s competitive advantage.

In parallel, the narrative of market upgrade and attractive profits from equity investments has lured strong foreign capital inflows while also attracting money from non-professional investor groups, similar to the “cheap money” phase in 2021.

Notably, credit growth during this period has not only focused on the economy’s key sectors but has also flowed robustly into securities lending, contributing to improved capital market liquidity.

(Source: Mirae Asset)

Mirae Asset attributes the strong attraction of bank stocks to two main reasons.

Firstly, banks remain the “backbone” of the economy, exhibiting a sustainable growth trend in both asset size and profits. The financial reports of this group are also highly transparent due to their adherence to stringent standards and the supervision of the State Bank of Vietnam (SBV).

Secondly, with their large market capitalization, bank stocks can absorb substantial capital inflows without significantly impacting liquidity, thus providing favorable conditions for institutional investors.

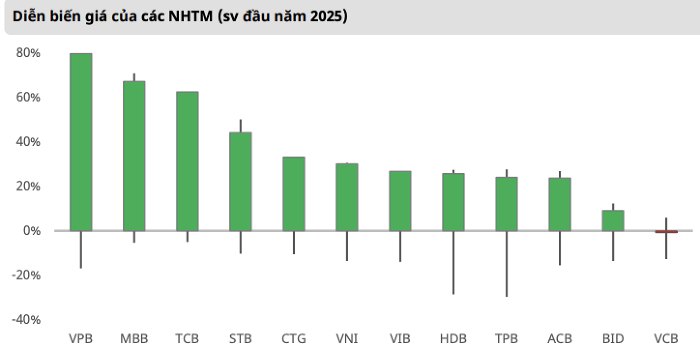

However, Mirae Asset also noted that the price performance of bank stocks has been uneven. Mid-sized and small commercial banks have outperformed thanks to their remarkable profit breakthroughs. In contrast, state-owned banks showed mixed results, with VietinBank (CTG) surging by 30% compared to 2024 due to a 46% year-on-year profit increase in the first half of 2025, while BIDV (BID) and Vietcombank (VCB) only witnessed modest gains as profits stagnated, lacking prominent investment narratives.

In the private sector, names like VPBank (VPB), Sacombank (STB), and MB (MBB) demonstrated improvements in both profits and asset quality. These banks also benefited from unique investment stories, such as partial divestment in subsidiaries, expected to generate substantial extraordinary profits.

Additionally, this group profited from policies promoting the private sector, especially large corporations that have been long-term strategic partners.

(Source: Mirae Asset)

According to Mirae Asset, the valuation of many banks has already surpassed the +1 standard deviation (SD) threshold, with some even approaching the +2 SD level. This makes initiating new investment positions riskier relative to the expected profits.

Nevertheless, the upward trend could persist in the short term, driven by leveraged lending momentum, at least in the third and fourth quarters of 2025. Notably, investment narratives surrounding Techcombank, VPBank, and MB remain appealing and could push valuations toward the +2 SD threshold.

On the other hand, defensive stocks like BID and VCB, which are currently trading at reasonable valuations, may be more suitable for a buy-and-hold investment strategy.

However, Mirae Asset also cautions that the high valuations seen presently are unlikely to be sustained without fundamental support, and a deep correction is almost inevitable once the “cheap money” phase passes.

Firstly, credit flowing into leveraged lending is expected to be redirected to more stable and higher-yielding segments as credit demand recovers. While low inflation, a prerequisite for robust credit growth, is currently low, maintaining this level is challenging.

“Overall, the sector’s bull run may continue in the near term, but participation at this stage carries significant risks, especially for new investors,” Mirae Asset assessed.

The Evolution of Banking in Q2 2025: A Comprehensive Overview

The recently released investment banking report by Rong Viet Securities (VDSC) offers intriguing insights into the industry’s performance in Q2 2025. This comprehensive report paints a detailed picture of the sector’s health, providing valuable information for investors and industry stakeholders alike.

“How Can Banks Retain Customers Amidst Intensifying Competition?”

The banking industry is evolving, and with it, the way banks retain customers is also changing. Institutions are now diversifying their services, embracing digital transformation, and focusing on sustainable practices to stay competitive in the race for deposits.