“Banking Goes Digital: Revolutionizing Security and Convenience in Vietnam”

Illustrative image

According to statistics from the State Bank of Vietnam (SBV), as of August 15, 2025, the banking sector has successfully collected and biometrically verified over 123.9 million individual customer profiles (CIF), representing 100% of individual transaction accounts conducted through digital channels. For organizational customers, over 1.3 million profiles have been biometrically verified, also achieving 100% coverage of digital transaction accounts. This initiative has yielded significant results in data cleansing, with a reduction of over 59% in fraud cases and a 52% decrease in accounts related to fraudulent activities compared to pre-verification figures.

The National Credit Information Center (CIC) has collaborated with Department C06 of the Ministry of Public Security to complete six offline data verification and cleansing campaigns, encompassing approximately 57 million customer profiles. 63 credit institutions and foreign bank branches have implemented chip-based ID card applications via counter devices, while 57 credit institutions and 39 e-wallet organizations have adopted mobile app-based solutions. Additionally, 32 credit institutions and 15 intermediary payment organizations are in the process of integrating VNeID.

Cashless Payment Trends: From January to July 2025, compared to the same period in 2024, cashless transactions witnessed a substantial surge, increasing by 44.40% in volume and 25.04% in value. Specifically, internet-based transactions grew by 49.65% in volume and 35.61% in value, while mobile phone transactions rose by 38.34% in volume and 21.24% in value. QR code payments exhibited remarkable growth, climbing by 66.73% in volume and an impressive 159.58% in value. Transactions through the Inter-bank Electronic Payment System increased by 4.41% in volume and 45.27% in value, while those through the Financial Switching and Electronic Clearing System rose by 15.77% in volume and 3.77% in value.

In the same period, ATM transactions continued their downward trend, decreasing by 15.83% in volume and 4.97% in value, indicating a shift in consumer preferences away from cash withdrawals and towards more convenient and modern cashless payment methods.

Meeting Cashless Payment Demands for National Holidays: To date, 32 units have linked with VNeID to facilitate social security payments, including 28 banks and foreign bank branches (Vietinbank, BIDV, Vietcombank, LPBank, Vikki Bank, MBBank, PvcomBank, HDBank, CoopBank, ShinhanBank, TPBank, NCB, Nam A Bank, KienlongBank, Agribank, BVBank, ACB, MSB, Sacombank, BaoViet Bank, Techcombank, ABBANK, VIB, VPBank, SaigonBank, VietABank, MBV, OCB) and four intermediary payment service providers (VNPT Money, Mobifone Money, Viettel Money, and MOMO).

In response to the Prime Minister’s Official Dispatch No. 149/CD-TTg dated August 28, 2025, regarding gifts for citizens on the occasion of the 80th anniversary of the August Revolution and National Day, the SBV issued Document No. 7599/NHNN-TT on August 29. This document instructed banks and foreign bank branches to ensure the smooth and continuous operation of payment systems, providing uninterrupted gift transfers to citizens while collaborating closely with local authorities, the State Treasury, and other relevant parties.

Banks, foreign bank branches, and intermediary payment service providers have proactively guided customers on linking their accounts to receive social security benefits quickly, conveniently, and securely. Additionally, the SBV has adjusted the operating hours of the Inter-bank Electronic Payment System during the National Day holiday to ensure uninterrupted transaction services.

“Techcombank Partners with VNeID App: Empowering Customers to Securely Access Social Welfare Payments with Ease.”

“Techcombank, one of Vietnam’s leading joint-stock commercial banks, has taken a significant step towards enhancing its customer experience by integrating with the national digital identity application, VNeID. This integration aims to facilitate faster, safer, and more convenient disbursement of social welfare payments to its valued customers.”

“VIB and the “Trendsetting Card Strategy”: From Vision to Vanguard.”

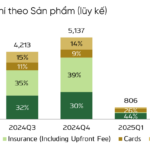

Vietnam International Commercial Joint Stock Bank (HOSE: VIB) has reached a remarkable milestone of 1 million credit cards, solidifying its successful “Leading the Card Trend” strategy implemented over the past seven years. This achievement underscores the bank’s unique vision, as the number of cards has grown tenfold since 2019. VIB has risen to the top, ranking among the leading Mastercard spenders and among the top 3 spenders in the entire market. The bank has also established collaborations with all three major international card organizations: Visa, Mastercard, and American Express.

“Vietcombank’s Service Fee Income Takes a Hit: Is Bancassurance to Blame?”

Since the mass waiver of fees in 2022, Vietcombank has experienced a consistent decline in net profit from its service operations. From 2025 onwards, the bank will also no longer recognize upfront fees from its exclusive insurance agreement with FWD, indicating a further decrease in revenue streams.

Unleashing VIB’s Fintech DNA: Engineering the Super Quartet – a Personalized Financial Ecosystem

“Vietnam is among the fastest-growing digital payment markets in the region. According to the State Bank of Vietnam, the value of cashless transactions in 2024 was 26 times the GDP, with 87% of the adult population having access to financial services. With this backdrop, superficial improvements are not enough to create a sustainable competitive advantage.”