VN-Index had a stellar August, recording its highest monthly gain since 2007, led by strong performances in the Banking, Securities, and Real Estate sectors. Market liquidity increased by 27% from the previous month, reflecting investors’ positive sentiment.

In a recently published report, Agriseco Securities assessed that the VN-Index is likely to maintain its positive trend in September due to supportive factors. Notably, there are expectations that Vietnam will be considered for an upgrade from a frontier market to an emerging market during the FTSE Russell’s review at the end of September or early October.

Additionally, the Federal Reserve is expected to cut interest rates by 0.25 percentage points in the middle of the month. Agriseco also forecasts impressive Q3 2025 earnings growth across various sectors.

However, there are risks to monitor, including: strong net selling pressure from foreign investors amid high exchange rates, profit-taking after a rapid increase, and short-term fluctuations due to ETF portfolio restructuring.

Based on this assessment, Agriseco Research recommends that investors prioritize stocks with solid financial foundations, reasonable valuations, and profit growth prospects for Q3 2025. These stocks should ideally be industry leaders.

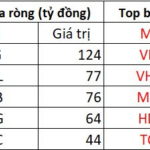

Agriseco’s Recommended Portfolio for September 2025

In the Banking sector, Agriseco Research selects Vietinbank (CTG) as a potential stock with promising profit growth prospects for the last six months of the year. Key drivers include a 16% credit growth in 2025, significant revenue from personal lending, and expectations of NIM recovery to 2.9-3.2% due to low funding costs and high demand for retail credit in the last quarter. Additionally, CTG’s consistently decreasing credit risk provision also positively impacts year-end profits.

In the Port sector, Gemadept (GMD) is considered a promising choice. The Nam Dinh Vu port’s third phase is in progress and expected to be operational by October 2025, with an annual capacity of 800,000 TEUs. This expansion will increase Nam Dinh Vu’s capacity by 60% and GMD’s by 23%.

In Southern Vietnam, Gemalink’s phase 2A, with an investment of nearly $200 million, is expected to add 600,000 TEU/year capacity from 2027, increasing Gemalink’s capacity by 50%.

Moreover, in Q3 2025, a 10% increase in deep-water port handling charges is anticipated, benefiting GMD’s business as the company owns the largest deep-water port capacity in the country. This rate is expected to rise by another 10% in 2026.

Agriseco believes that Hoa Phat Group (HPG)‘s steel consumption growth momentum will be sustained due to positive signals in the real estate market. The number of newly licensed projects in Q2 2025 increased by 28.9% compared to the previous quarter. Public investment disbursement as of July also rose by 25.8% compared to the same period last year and continues to grow.

Since July 2025, the application of anti-dumping duties on Chinese HRC has created favorable conditions for HPG to expand its domestic market share. In this context, the sixth blast furnace of the second phase of Dung Quat 2, expected to operate from September, will significantly increase capacity, bringing the total HRC capacity to 9 million tons/year. This combination of protective policies and increased production is anticipated to enhance HPG’s ability to meet domestic demand and strengthen its competitive advantage.

Additionally, two real estate companies, Nam Long Investment Corporation (NLG) and Hoang Huy Financial Services Investment Joint Stock Company (TCH), are highlighted in Agriseco’s potential stock list. Agriseco analysts expect NLG’s sales to continue growing due to new projects, driving its business performance in the coming years. This optimism is based on the recovery of the real estate market in provinces near Ho Chi Minh City, such as Long An and Dong Nai, thanks to infrastructure development and provincial mergers.

NLG’s net profit in 2025 is forecast to increase by over 30% year-on-year due to financial revenue from the sale of a 15.1% stake in the Izumi City project to Tokyu Corporation. This transfer’s proceeds are expected to be recorded in the second half of 2025.

In the Construction sector, Vinaconex (VCG) is forecast to record an extraordinary profit in 2025 due to its divestment from Vinaconex ITC. Regarding its core business, the acceleration of sales and deliveries of high-profit margin projects like Vera Diamond City and Vinaconex Diamond Tower is expected to drive Vinaconex’s real estate segment. The infrastructure construction segment is also assessed positively, with many projects ahead of schedule.

Expert Insights: VN-Index Expected to Resume Uptrend Soon, But Hold Off on New Investments for Now

The MBS expert believes that the market remains on a positive trajectory and is poised to rebound swiftly. The underlying strength is evident as buying pressure absorbs profit-taking, indicating a robust foundation for a potential upswing.

Challenges Remain to Achieve the Target of Fully Disbursing Public Investment Capital, Says Deputy Finance Minister.

As of the regular Government press conference for August 2025, Vice Minister of Finance Tran Quoc Phuong shared positive updates on the disbursement of public investment capital for the first eight months of the year, totaling nearly VND 410 trillion.