A.P. Moller Capital, a global investment firm specializing in infrastructure investments, has announced a strategic investment in ALS Cargo Terminals JSC (ALSC). The investment was made through the Emerging Markets Infrastructure Fund II (EMIF II), with the participation of VinaCapital through its LogiVest fund.

This marks the beginning of A.P. Moller Capital’s expanded investment strategy in transportation and logistics in Vietnam, in collaboration with VinaCapital.

A.P. Moller Capital was established based on over 120 years of transportation and infrastructure experience of the A.P. Moller Group, with a wide investment network in developing markets. The company has dedicated teams in Singapore and has been present in Vietnam since 1923.

In Vietnam, this is A.P. Moller Capital’s first investment in the transportation sector, following previous investments in renewable energy through Verdant Energy.

The investment in ALSC is also the third transaction for EMIF II, which plans to allocate 50% of its capital to South Asia and Southeast Asia.

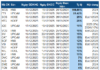

ALSC is currently a leading air cargo handler at Noi Bai International Airport, handling approximately 250,000 tons of cargo annually. The company is an important partner for several international airlines, including Korean Air, Emirates, and Cathay Pacific, and aims to expand its scale in the next phase.

At the signing ceremony, Mr. Jens Thomassen, Deputy CEO of A.P. Moller Capital, stated that they will support ALSC in improving operational efficiency, implementing automation technologies, enhancing services, and initiating ESG initiatives.

Additionally, Mr. Don Lam, CEO of VinaCapital, emphasized that investing in logistics infrastructure is crucial for Vietnam to sustain its robust growth trajectory. This collaboration also marks a new phase of comprehensive cooperation between VinaCapital and A.P. Moller Capital, providing ALSC with additional resources for its development.

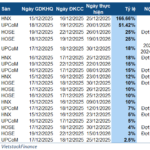

The agreement is currently undergoing necessary procedures and awaiting approval from the management agency. The transaction is expected to be completed by the end of Q3 2025.

Large private corporations invest in aviation infrastructure and services

With the strong growth in air transport demand in Vietnam, driven by increasing passenger and cargo volumes year over year, numerous large private corporations have been actively investing in aviation infrastructure and services. This has contributed to shaping a new era for the industry.

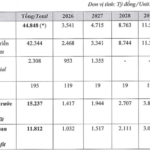

Sun Group has been approved for a nearly VND 22,000 billion expansion of Phu Quoc International Airport, proposed the construction of Van Phong and Phan Thiet airports, and launched Sun Phu Quoc Airways with a capital of VND 2,500 billion.

T&T Group, in collaboration with Capital A (AirAsia), proposed an aviation-industrial urban complex in Quang Tri and invested over VND 5,800 billion in Quang Tri Airport, expected to be operational by 2026. They are also a strategic shareholder of Vietravel Airlines.

Vietjet commenced the construction of a VND 1,700 billion aircraft maintenance center in Long Thanh.

Masterise Group invested nearly VND 121,000 billion in the construction of Gia Binh Airport, aiming for a 5-star Skytrax standard.

“7 Creative Strategies to Raise $7 Billion for Ho Chi Minh City’s International Financial Center”

I can also offer some suggestions for subheadings if you wish, to further enhance the article’s appeal and provide a clear structure for readers.

The bustling city of Ho Chi Minh is set to invest a substantial sum of 7 billion USD in the development of an International Financial Center. This ambitious project aims to establish the city as a prominent financial hub, not just in Vietnam but also on a global scale. With this significant investment, the city plans to create a thriving ecosystem that attracts international businesses and investors, fostering economic growth and cementing its position as a leading financial destination.