The stock market soared at the beginning of the week of September 3-5, following a glorious August, with record liquidity. The VN-Index surpassed its highest August level and the psychological threshold of 1,700 points, albeit with a significant decline in liquidity, narrowing profit-taking opportunities. This resulted in substantial selling pressure in the subsequent session. By the week’s end, the VN-Index had dropped by -0.91% to 1,666.97 points.

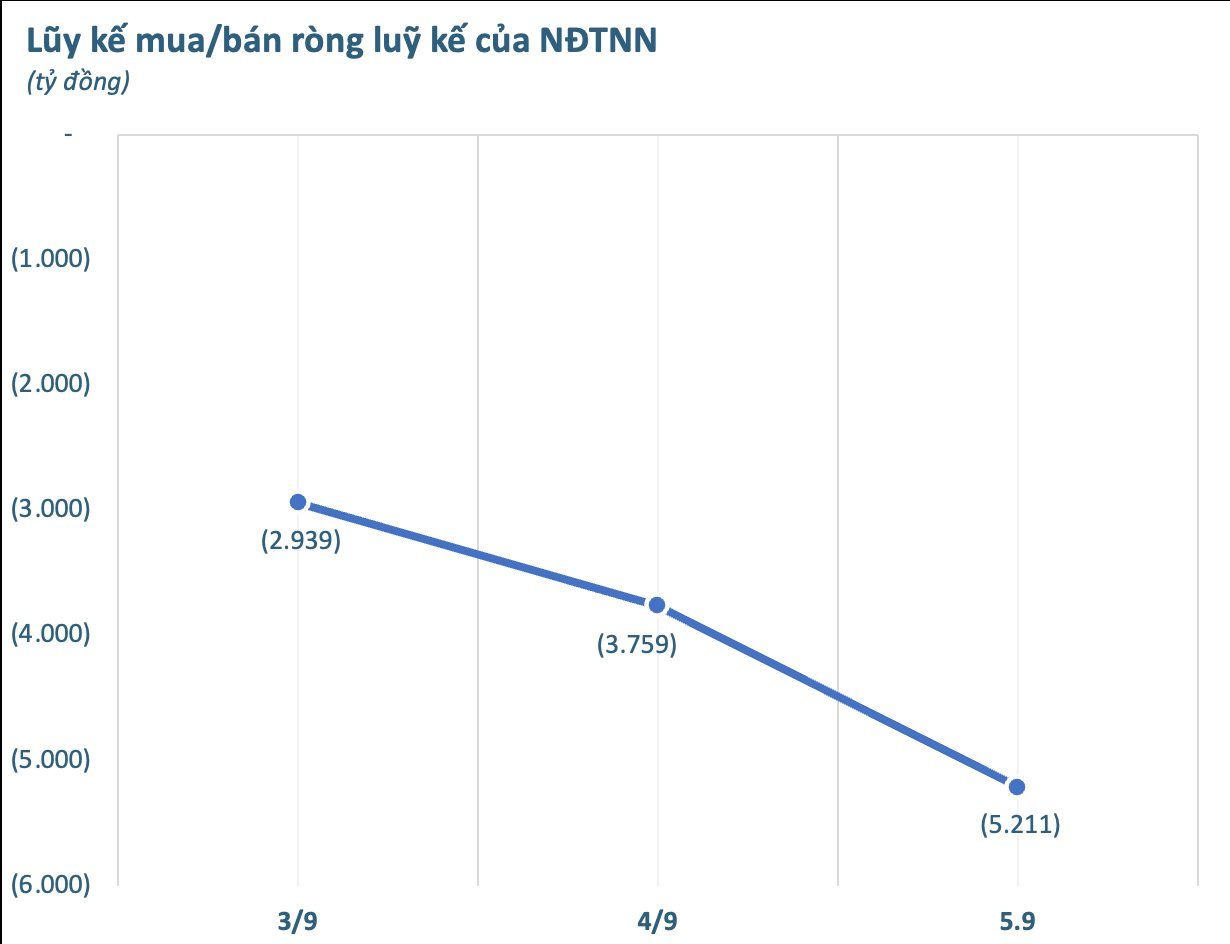

In terms of foreign investment transaction value, this group continued to experience strong net selling pressure in the billions of VND. In total, over the course of three sessions, foreign investors sold a net amount of more than 5,211 billion VND.

Focusing on individual exchanges, foreign investors net sold 4.988 trillion VND on the HoSE, 158 billion VND on the HNX, and 65 billion VND on the UPCoM.

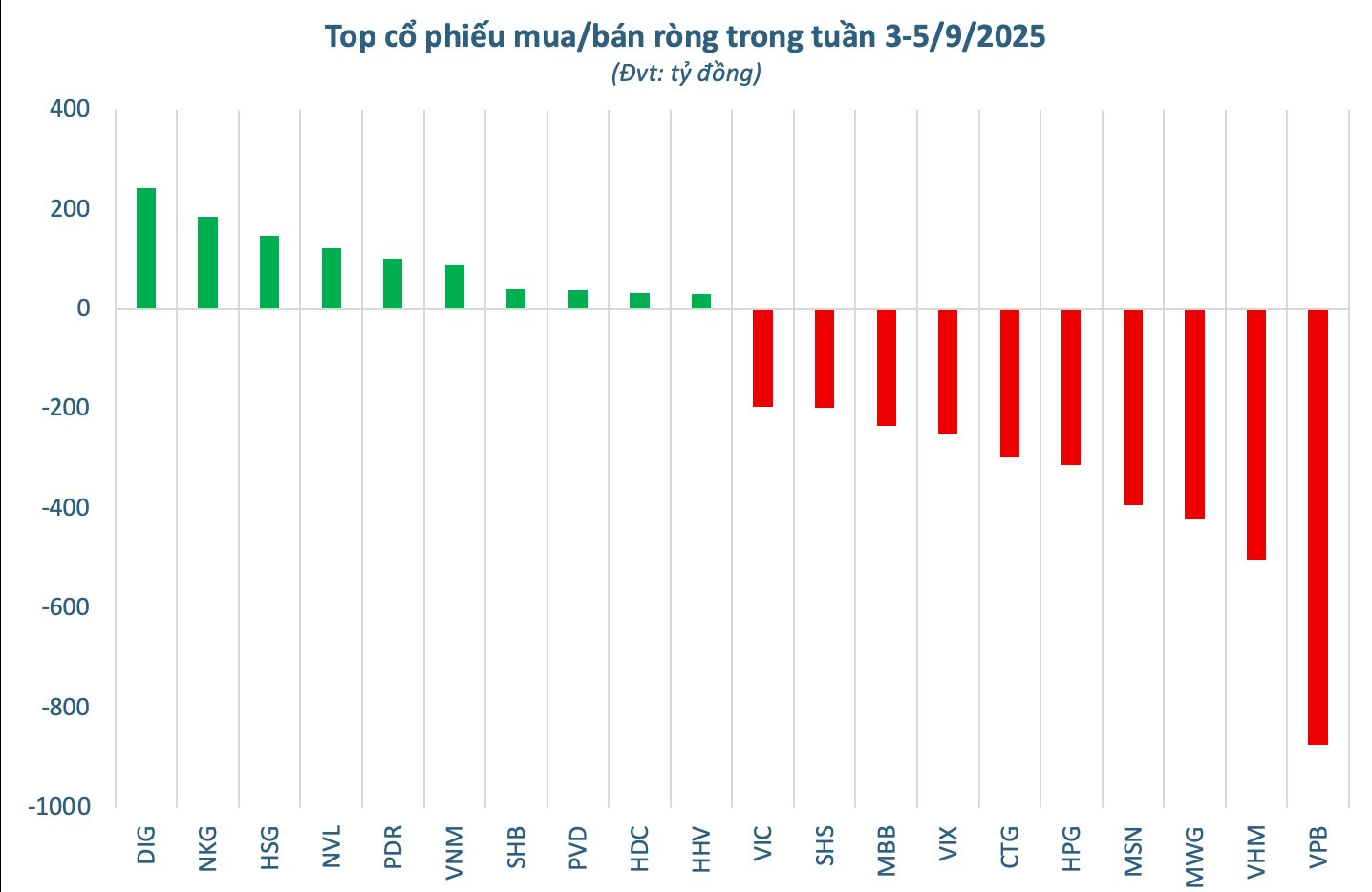

In the first week of September, the focus of net selling remained on large-cap stocks, with VPB taking the lead as foreign investors offloaded a net amount of 873.6 billion VND, far surpassing the rest. This was followed by VHM with a net selling value of 502.1 billion VND and MWG with 418.2 billion VND. Several other stocks also experienced significant capital outflows, including MSN (391.8 billion), HPG (311.3 billion), CTG (297.1 billion), VIX (249 billion), and MBB (232.7 billion). VIC, SHS, STB, and DGC also recorded net selling amounts of approximately 190-197 billion VND.

On the contrary, despite the pervasive net selling pressure, the market witnessed positive foreign investment inflows in several stocks. DIG topped the net buying list with a value of 244.4 billion VND, followed by NKG (187.3 billion VND) and HSG (147.6 billion VND). Notable net buying was also observed in NVL (123.5 billion), PDR (102.6 billion), VNM (90.5 billion), and groups SHB, PVD, HDC, HHV, VPI, and SAB.

VN-Index Hits Record High, Surpassing 1,700 Points for the First Time

The Vietnamese stock market has been on a remarkable upward trajectory, and this trend has caught the attention of industry leaders and analysts alike. With the VN-Index surging, predictions are now being made that the index could reach a staggering 1,800 points this year and potentially go even higher in the near future. This has sparked excitement and interest among investors, who are now keenly watching this market’s every move.

“Vietnam’s Stock Market Upgrade: A Transformational Story”

As of March 2025, Vietnam is on the FTSE Watch List and is considered a strong contender for reclassification from a Frontier to a Secondary Emerging Market.