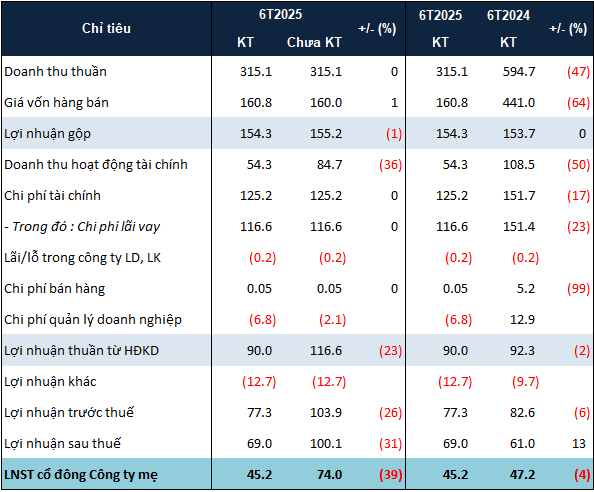

The main reason for the decrease stems from DLG’s financial revenue, which stood at just over VND 54 billion, a 36% decline compared to the consolidated financial statement for Q2 2025.

In its explanation, DLG attributed the drop in financial revenue to adjustments in interest income from lending activities compared to the previous review.

It is worth noting that Phu Thanh Gia Pleiku Company accounted for the largest proportion in DLG’s short-term lending with nearly VND 420 billion in loans as of the end of June 2025, a decrease of over 4% from the beginning of the year. Notably, DLG has set aside a provision of more than VND 127 billion for this loan as the collateral only amounted to nearly VND 293 billion.

|

DLG’s reviewed business results for the first six months of 2025. Unit: Billion VND

Source: VietstockFinance

|

While providing an unqualified opinion, the auditing firm highlighted certain matters that warrant emphasis in DLG’s 2025 semi-annual reviewed financial statements.

According to the auditors, there are significant uncertainties that may cast substantial doubt on the Company’s ability to continue as a going concern due to short-term debt exceeding total current assets by nearly VND 530 billion. Additionally, DLG recorded accumulated losses of over VND 2,400 billion as of the end of June 2025.

On a positive note, the company’s operating cash flow during the first half of 2025 remained positive, helping to reduce accumulated losses and repay principal and interest on bank loans totaling more than VND 207 billion. The Board of Directors is currently negotiating a debt restructuring and repayment plan with banks for the 2025-2026 period.

Furthermore, the auditors of the H1 2025 financial statements drew attention to the 2024 semi-annual financial statements, which were audited by a different firm and received a qualified opinion due to the inability to assess the recoverability of loans and other short-term receivables as of June 30, 2024. Regarding this issue, DLG stated that they have recovered, supplemented collateral, and made full provisions related to these loans and receivables in 2024 and the first six months of 2025.

– 15:33 09/05/2025

“Novaland Fails to Repay Over VND 2,500 Billion in Principal and Interest on Bonds in the First Half of 2025”

As of the end of the first half of 2025, Novaland has been unable to repay over VND 2,523.4 billion in principal and interest on six bond lots, citing difficulties in arranging funds.