Amidst the stock market “party”, the shares of Saigon General Service JSC (Savico, code: SVC) also traded brightly with a surging session, with the market price soaring to 29,400 VND/share.

Notably, SVC has witnessed a price increase of over 34% within a month, marking its highest level in 14 months (since July 2024). As a result, its market capitalization has risen to nearly 1,960 billion VND.

This surge in the share price followed the announcement of a high dividend ratio. Specifically, the company notified that the ex-dividend date is September 11, for a 2024 dividend payout in shares with a ratio of 40%.

With over 66.6 million shares in circulation and a payout ratio of 40% (shareholders owning 10 shares will receive 4 new shares), SVC will issue more than 26.6 million shares as dividends. After the issuance, the charter capital is expected to increase from over 666 billion VND to nearly 933 billion VND.

According to the resolutions of the 2025 Annual General Meeting of Shareholders, the 2024 dividend was distributed in two forms: 5% in cash (equivalent to approximately 33 billion VND, paid at the end of September 2024) and 40% in shares. This is the first time Savico has combined cash and share dividends, instead of solely cash dividends as in previous years.

According to our research, Savico is a subsidiary of Tasco Auto – a wholly-owned subsidiary of Tasco. It is known that Tasco Auto (formerly known as SVC Holdings JSC) mainly operates in real estate and automobile retail and distribution.

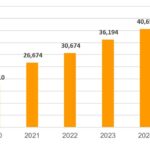

Tasco Auto is currently the controlling shareholder of Savico and, at the same time, one of the largest automobile distributors in the country, having sold over 40,500 vehicles in 2024, accounting for a 13.7% market share. Tasco Auto is also the official importer of international brands such as Volvo, Lynk & Co, Zeekr, and Geely, with a distribution network of 126 showrooms nationwide.

In another development, on July 16, Savico’s Board of Directors approved the proposal to dissolve Otos JSC – the owner of the online automobile business platform Otos.vn, established in 2014.

Furthermore, Savico has just passed a resolution to invest additional capital in Tasco Automobile Business Co., Ltd. (Tasco RT). Accordingly, Savico will contribute an additional 720 billion VND to Tasco RT, comprising 220 billion VND of Savico’s own capital and 500 billion VND in loans.

The purpose of this capital contribution to Tasco RT is to invest in the development of the Geely and Lynk&Co brand showroom chain nationwide, which may include multiple investment phases, with the first phase focusing on the showroom network in the Northern region.

Regarding the 2025 business plan , Savico sets a consolidated revenue target of over 29,700 billion VND (up 20% year-on-year), a sales volume of 42,495 vehicles (up 5%), but expects a net profit of 83 billion VND, a decrease of nearly 17%.

For the first half of 2025 , Savico recorded revenue of 12,276 billion VND and after-tax profit of 148 billion VND, up 30% and 55.8%, respectively, compared to the first half of 2024, equivalent to completing 41.3% of the revenue target and 73.6% of the annual business plan.

For the first six months of 2025 , Savico recorded revenue of 12,276 billion VND and after-tax profit of 148 billion VND, up 30% and 55.8%, respectively, compared to the same period in 2024, equivalent to completing 41.3% of the revenue target and 73.6% of the annual business plan.

“SHB’s Steadfast Commitment to Sustainable Growth: A Comprehensive Partnership Strategy.”

SHB, or the Saigon – Hanoi Commercial Joint Stock Bank, is committed to a strategy of comprehensive and sustainable development. We forge strong partnerships with leading state-owned and private economic groups, both domestic and international, as well as businesses with robust ecosystems, supply chains, and satellite companies. Our focus also extends to small and medium-sized enterprises, and we are dedicated to expanding our reach to individual customers.

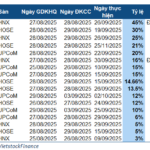

The Ultimate Dividend Stock for the Week of August 25-29: PV GAS Shines Bright with a Massive $200 Million Payout Ahead of the Long Weekend

“This week, leading up to the National Day holiday on September 2nd, a total of 17 companies will be finalizing their cash dividend distributions. The highest rate among these businesses stands at an impressive 45%, equating to VND 4,500 per share owned. A substantial return for shareholders as we head into the holiday period.”

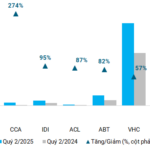

Seafood in Q2: Capitalizing on the Tax “Loophole” from the US

The second quarter of 2025 witnessed a remarkable surge in seafood exports, particularly tra fish, as the US postponed its retaliatory tariffs for an additional three months until after July 9. This strategic move provided a window of opportunity for businesses to ramp up their shipments to key markets, resulting in exceptional revenue and profit growth for the industry.

Yuanta Securities Adjusts 2025 Business Plan

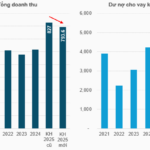

On August 12, the Board of Directors of Yuanta Securities Vietnam JSC convened a meeting to discuss and approve significant matters, including the adoption of a new business plan for 2025. This revised strategy projects an average margin lending balance of VND 5.042 trillion and a total revenue of VND 793.6 billion, reflecting a 9% and 4% decrease, respectively, from the initial plan.