In particular, Mr. Nguyen Chi Trung registered to sell 430,000 VDS shares that he currently holds, expecting to reduce his ownership from over 768,000 shares (a ratio of 0.29%) to over 338,000 shares (a ratio of 0.13%). The transaction will be executed during the period of September 11th to October 10th.

Mr. Trung stated that he is undertaking this transaction due to personal financial needs. Considering the closing price of VDS shares on September 5th was VND 24,600/share, it is estimated that the VDS Board member could recoup nearly VND 11 billion.

Mr. Nguyen Chi Trung, born in 1978, holds a Bachelor’s degree in Economics and a Master’s degree in Business Administration. Mr. Trung was elected as a VDS Board member on April 5th, 2022.

According to VDS‘s introduction, Mr. Trung joined Rong Viet in 2007 and has made significant contributions to the operations of the Brokerage Business Division as well as the development and expansion of Rong Viet. He has held various positions, including Brokerage Director, Saigon Branch Director, and Director of the Brokerage Division (2007-2013), and Vice President cum Director of Nha Trang Branch (2013-2020).

He also served as Deputy Director of Securities Services – Retail Clients at SSI Securities Corporation (2020-2/2022) and Vice/Head of Brokerage at Vietnam Industrial and Commercial Bank Securities Corporation – Ho Chi Minh City Branch (2001-2006).

Board Member Nguyen Chi Trung – Photo: VDS

|

Mr. Trung is not the only one; a few days ago, two other VDS shareholders also announced their plans to sell a large number of shares they hold from September 8th to October 6th, all due to personal financial needs.

Specifically, Board Member and General Director Nguyen Thi Thu Huyen intends to sell 940,000 shares, expecting to reduce her ownership to over 512,000 shares (a ratio of 0.19%). The other shareholder, Pham My Linh, registered to sell 5 million shares, thereby reducing her ownership to nearly 25 million shares (a ratio of 9.35%).

Notably, Ms. Pham My Linh is the mother of Board Member Pham Huu Luan (born in 1998) – who currently holds over 130,000 VDS shares (a ratio of 0.049%). In fact, Ms. Linh used to be a VDS Board member but resigned on March 13th, 2023. Subsequently, Mr. Luan was elected to the Board on April 6th, 2023.

Previously, a low-profile shareholder, Mr. Nguyen Hoang Hiep, announced that he had sold 10 million shares on August 21st, reducing his ownership to nearly 32.7 million shares (a ratio of 12.23%). This transaction was most likely conducted through a matching method with a scale of up to VND 234 billion.

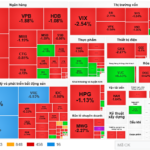

The continuous registration to sell shares by VDS leaders and major shareholders occurs amid the company’s stock reaching a historical peak, following a strong upward trend since the second half of April, accompanied by a sudden surge in trading volume.

| VDS share price hits an all-time high with a surge in trading volume |

In other recent news, VDS has successfully issued 4.7 million ESOP shares (a ratio of 1.76%) to 207 employees. The distribution list includes many VDS leaders, especially those who have just registered to sell shares, such as Ms. Nguyen Thi Thu Huyen (nearly 260,000 shares) and Mr. Nguyen Chi Trung (over 160,000 shares). These shares are expected to be transferred during September-October 2025.

At the 2024 Annual General Meeting of Shareholders held on April 3rd, 2025, VDS shareholders approved a plan to issue a total of 77 million shares to increase the charter capital in 2025. The first phase includes 24.3 million bonus shares (a ratio of 10:1) and 4.7 million ESOP shares at a price of VND 10,000/share, and the second phase involves offering a maximum of 48 million shares in private placement.

If successful, the company’s charter capital will increase to VND 3,200 billion. All proceeds will be used to supplement operating capital for margin lending/pre-trading, proprietary trading/underwriting, and participation in the bond market. As of June 11th, 2025, the company has completed the issuance of 24.3 million shares as dividends for 2024.

In addition to the above plans, the AGM also approved the 2025 dividend plan in shares with a scale of VND 272 billion, equivalent to a ratio of 10:1, based on the estimated charter capital at the end of 2025 of VND 2,720 billion (excluding the private placement).

Regarding business results, in Q2/2025, VDS posted a post-tax loss of nearly VND 7 billion, while in the same period last year, the company recorded a profit of over VND 121 billion. The company explained that this was due to the negative impact of US trade and tariff policies on the Vietnamese stock market, which affected investment and brokerage business activities.

– 09:33 09/08/2025

Anxiety Among Shareholders as Phat Dat’s Chairman Registers to Sell up to 88 Million Shares

“A recent filing by the Chairman of Phat Dat has investors on edge. The chairman has registered to sell 88 million PDR shares, a move that has the market abuzz with speculation. With the sale coming on the heels of a holiday, all eyes are on the stock’s performance and the impact this move could have on the broader market.”