On September 5th, Vietnam’s stock market once again surprised investors. Just 15 minutes after the opening auction, the VN-Index surged nearly 13 points, officially crossing the 1,700-point threshold, a level unprecedented in the market’s 25-year history.

Prospects Remain Positive

After all, just a few months ago, when the market was hovering around the 1,400-1,500 point range, few could have imagined that one day, the VN-Index would reach such heights. However, since the sharp decline in April, the strong recovery has consistently pushed the market upward, ushering in one of the most exciting periods for Vietnamese stocks.

The upbeat mood continued until late afternoon when, unexpectedly, selling pressure intensified, causing the VN-Index to plunge by nearly 30 points. At the close, the index fell to 1,666.97 points – the sharpest drop in the past ten days. Securities companies led the downward spiral with a decline of over 4.2%, followed by banks at 2.45%, while real estate dropped by less than 1%. Foreign investors also net sold nearly VND 1,400 billion, focusing on banking and securities stocks HCM, VND, VCI, and VIX.

Mr. Tran Minh Tam from Ho Chi Minh City, an investor with a preference for bank stocks, described the experience as “a rollercoaster ride” as he witnessed the market’s rapid fluctuations. “In the early afternoon, I purchased 4,000 MBB shares at VND 28,200 per share, but just an hour later, the price dropped to VND 27,400, resulting in a 3% loss for me,” Mr. Tam said.

Nevertheless, many securities companies and financial institutions maintain that this correction is short-lived and that the market outlook remains positive. Notably, the expectation of a market upgrade is becoming a significant driving force. The latest report from HSBC Vietnam’s Global Investment Research team indicates that FTSE – a global market assessment and ranking organization – will consider promoting Vietnam from a frontier market to an emerging market during its October 2025 review. Vietnam has already met seven out of nine FTSE criteria, with the remaining two criteria related to “settlement cycle” and “failed trade costs” being improved thanks to the new KRX trading system implemented in May.

“Despite the impact of US tariff policies, the VN-Index has still risen by approximately 40% since the beginning of the year, making it one of the best-performing markets globally,” said HSBC experts. “The upgrade means that Vietnam will automatically be included in various indices. It is estimated that this promotion could attract an additional $3.4 billion into the stock market.”

Regarding actively managed funds, HSBC forecasts capital inflows into the stock market to range from $1.9 billion to $7.4 billion, depending on Vietnam’s weight in the index. In the most optimistic scenario, FTSE’s reclassification could bring a maximum of $10.4 billion to the Vietnamese stock market, but this would be distributed in phases.

Vietnamese stocks are currently one of the strongest performers in the region. Photo: HOANG TRIEU

Relieving Pressure on the Credit System

According to experts, upgrading Vietnam’s stock market is not merely a technical advancement but also opens up opportunities to attract foreign capital, especially from institutional investors. As this capital flows more robustly into the market, stocks will become an essential capital mobilization channel, helping to relieve pressure on the banking credit system and promoting sustainable development.

Associate Professor Dr. Nguyen Huu Huan, a lecturer at the University of Economics Ho Chi Minh City (UEH), analyzed that for the stock market to become an effective capital mobilization channel, Vietnam needs more institutional investors, especially foreign ones. In parallel, the market must offer quality commodities, meaning more prominent enterprises in production and business must be listed on the exchange to attract foreign capital.

He also emphasized the role of investment funds, suggesting that this form should be further developed to encourage individual investors to entrust their investments rather than trading directly.

“In developed countries, individual investor transactions account for only a small proportion, while in Vietnam, this figure reaches 85-90%. If we want a stable and less volatile market, we must promote professionalism through funds,” said Mr. Huan.

The expert also proposed increasing the quantity and quality of listed commodities, ensuring financial transparency, and developing derivative products to attract more institutional investors.

Dr. Nguyen Anh Vu, Head of the Finance and Banking Faculty at the University of Banking Ho Chi Minh City, noted that Vietnam’s stock market has shown significant improvement in liquidity. From the low of over 1,200 points in early April to the VN-Index touching the 1,700-point milestone, the index has risen by about 35%, an impressive figure in history. Notably, some trading sessions have broken records, with liquidity surpassing $3 billion (equivalent to VND 80 trillion), making Vietnamese stocks one of the strongest performers in the region.

According to Mr. Vu, these positive results stem from various internal factors: the government’s promotion of administrative reforms and streamlining of the apparatus, along with the development of the private sector and large-scale infrastructure projects.

More importantly, bottlenecks in real estate procedures and legal issues have gradually been resolved, while monetary policies have been relaxed, facilitating capital inflows into the market. These are also fundamental drivers for Vietnam’s journey towards stock market upgrade.

Foreign Capital Will Flow in After the Upgrade

Mr. Vu also pointed out that, in the current context, the market is easily attracting ETF funds, which typically invest ahead of a market’s upgrade from frontier to emerging status. This implies that large-cap stocks, particularly those in the VN30 basket, will garner more attention. However, he cautioned investors to remain prudent.

“Typically, the market tends to rise ahead of expectations of an upgrade due to the fear of missing out on potential gains. But in reality, foreign capital only flows in significantly once the upgrade decision is officially announced,” Mr. Vu explained. “Therefore, the medium-term trend of the market remains positive, but there will be adjustments when it hits significant psychological thresholds, which is entirely normal. Such adjustments are necessary for the market’s healthy and sustainable development.”

He also emphasized that the nature of the upgrade does not immediately improve the business performance of all enterprises. “While the VN-Index may surge, stock prices do not increase uniformly. Some may stagnate, while others may rise too quickly, pushing up the P/E ratio. Therefore, investors need to be discerning in selecting companies with solid business fundamentals for long-term investment rather than chasing short-term trends,” the expert advised.

Market Beat: Profit-Taking Pressure Mounts, VN-Index Down Over 29 Points

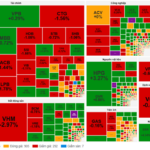

The market closed with the VN-Index down 29.32 points (-1.73%), settling at 1,666.97; while the HNX-Index fell 3.32 points (-1.17%) to 280.67. The sell-off dominated today’s trading session, with 477 decliners against 319 advancers. The large-cap basket, VN30, mirrored the broader market with 24 losers, 3 gainers, and 3 stocks closing unchanged.

Market Pulse, September 3rd: Foreigners’ Robust Selling of Blue-chips, VN-Index Hanging at 1,680 Points

The trading session concluded with the VN-Index dipping 0.91 points (-0.05%) to 1,681.3. In contrast, the HNX-Index climbed 2.72 points (+0.97%), finishing at 282.7. The market breadth tilted towards gainers, as 468 stocks advanced against 268 decliners. However, the large-cap VN30 index painted a different picture, with 15 stocks falling, 12 rising, and 3 unchanged, resulting in a sea of red.

The Rising Tide of Bank Stock Frenzy

In August, bank stocks continued to be the market’s powerhouse, surging ahead and outperforming the VN-Index with impressive growth rates.