According to a recent announcement by the Hanoi Stock Exchange (HNX), Becamex IDC, a leading industrial investment and development corporation (listed on HoSE as BCM), has successfully completed a private placement of bonds.

On August 29, 2025, Becamex IDC offered 20,000 bonds with the code BCM12502 to the domestic market. Each bond had a face value of VND 100 million, resulting in a total issuance value of VND 2,000 billion. The bonds have a four-year term and are expected to mature on August 29, 2029.

Details about the bondholders, issuance purposes, and collateral were not disclosed. However, according to HNX records, these bonds offer a combined interest rate of 10.5% per annum.

Illustrative image

Earlier, on August 6, 2025, the company successfully issued 5,000 bonds with the code BCMH12501, totaling VND 500 billion. These bonds have a three-year term and will mature on August 6, 2028.

Conversely, on September 3, 2025, Becamex IDC made a principal payment of VND 800 billion and over VND 35 billion in interest for the BCMH2025002 bond lot, fully redeeming this bond lot as scheduled.

This particular bond lot had a total issuance value of VND 2,000 billion and was issued on August 31, 2020, with a five-year term maturing on August 31, 2025.

In the first half of 2025, Becamex IDC made timely interest payments totaling over VND 643 billion for 12 bond lots issued by the company. The payment values ranged from nearly VND 10.6 billion to nearly VND 66.2 billion per bond interest period.

In other news, Becamex IDC has recently released documents for the second round of written shareholder opinions in 2025. The company seeks approval to change its name from Becamex IDC to Becamex Group and to relocate its head office to the 10th floor of mPlaza Saigon, 39 Le Duan, Saigon Ward, Ho Chi Minh City.

The record date for Becamex IDC shareholders was set as August 28, 2025, and the company will collect written shareholder opinions until 5:00 PM on September 29, 2025.

“Sunbay Ninh Thuận: A Troubled Resort’s Financial Woes Persist with a Staggering First-Half Loss of VND 290 Billion”

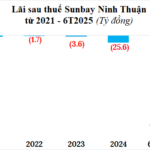

The first half of 2025 saw Sunbay Ninh Thuan JSC (SBPC) plunge into a staggering loss of nearly VND 290 billion, marking yet another period of relentless losses for the company. This persistent streak of unprofitability dates back to 2021 when the enterprise first started disclosing its financial reports on HNX, and profitability remains elusive.

“BMSC Seeks $2 Billion in Bond Offering to Refinance Bank Debt”

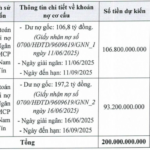

On September 5th, the Board of Directors of Bao Minh Securities Joint Stock Company (BMSC, UPCoM: BMS) passed a resolution to issue the 1st round of private bonds in 2025, aiming to raise VND 200 billion to restructure bank loans.

The Rising Titans: HOSE Welcomes Three New Members to the $10 Billion Capitalization Club

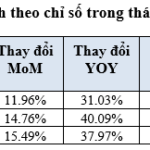

In August 2025, the HOSE witnessed a remarkable surge with key indices climbing upwards. This positive momentum was further emphasized by the growth of most sectoral indices compared to the previous month. Riding on this wave of optimism, HOSE proudly welcomed two more businesses with a market capitalization of over USD 1 billion each and an additional three enterprises with a market cap exceeding USD 10 billion.

Why Thuduc House’s Stock Is in Hot Water

The stocks of Thu Duc Housing Development Joint Stock Company have been placed under control from April 9, due to the company’s post-tax profit loss in 2023 and 2024.