Deputy Minister of Finance Tran Quoc Phuong

|

Deputy Minister of Finance Tran Quoc Phuong |

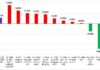

The Deputy Minister assessed that the above figures show a significant improvement compared to previous periods. Compared to the plan assigned by the Prime Minister (including additional assignments during the year), the disbursement rate reached 46.3%. If calculated based on the initial target set by the Prime Minister at the beginning of the year, the rate was 49.5%. This year’s disbursement speed is much higher than in previous years.

Compared to the same period last year (with a disbursement rate of 40.4%), this year’s disbursement is higher in both relative and absolute terms, with a difference of approximately VND 135,000 billion. However, to achieve the goal of 100% disbursement of the full-year plan as required by the Government, there are still many challenges that need to be addressed with more drastic and synchronized solutions.

Regarding the difficulties and obstacles, four main groups can be identified:

First is the issue of organizing and rearranging the apparatus of local authorities at two levels. The restructuring of the administrative structure and the change in the two-level government model have had a certain impact on the results of public investment disbursement. For example, regarding the completion of the commune-level organization, some communes have not yet completed their organization, lacking some positions related to public investment, such as accounting and project management. Therefore, procedures related to projects, settlement, and disbursement must wait to be completed.

To address this issue, the Politburo and the Central Committee have directed localities to urgently review and complete their personnel to ensure smooth operations and maintain the progress of public investment disbursement.

Second, some projects need to be reviewed and adjusted to fit the new two-level government model. Many works that were previously managed by the district level now have to be transferred to other units or focal points. Although the Central Committee has provided very specific guidance, during the implementation process in the localities, some diverse obstacles arise due to varying conditions and situations in each locality. However, the localities have made great efforts to overcome these difficulties and obstacles.

Third is related to capital allocation. Through a review from the beginning of the year until now, there is still a portion of the central budget capital that has not been allocated, estimated at about VND 38.5 trillion. According to reports, 18 out of 42 ministries, central agencies, and 29 out of 34 localities have not fully allocated the central budget capital assigned to them. One of the main reasons is that some projects have not been approved yet. This is partly due to the rearrangement of the administrative apparatus, including the merger and adjustment of functions of some agencies, which takes additional time for stabilization and review of the investment portfolio. In addition, some projects, after re-evaluation, must change investors, convert functions, or temporarily suspend implementation. This also affects the time and progress of project approval.

In addition, there are difficulties in institutions and laws. At the 9th session, the National Assembly amended a number of laws related to public investment, including the Law on Public Investment, GDP, and some other normative legal documents. The law has taken effect, but the central decrees, circulars, and guiding documents are gradually being completed and will be promulgated as soon as possible.

Currently, there are two decrees under the responsibility of the Ministry of Finance, which are in the final stage of preparation for submission to the Government for issuance, namely the Decree guiding the Law on Public Investment and the Decree guiding GDP. The Ministry of Finance has completed the work of synthesizing opinions and will soon resubmit them to the Government Office so that they can be issued soon.

Fourth is a group of issues related to the implementation process. For public investment, implementation is very important. A typical difficulty is the site clearance, price fluctuations of raw materials, and problems in the investment procedures for project development. In addition, there are some objective factors such as weather effects that delay the project progress.

Apart from subjective factors, there are also objective reasons such as adjustments in planning, design changes, or regulations related to construction. Planning is a key factor that directly affects investment progress and effectiveness. After rearranging the apparatus, many localities have to spend more time to complete the transition steps before they can build, adjust and synchronously implement the projects.

To handle this issue, the Government has issued Resolution No. 66.2/2025, emphasizing the directive role of the National Assembly and the Government in reviewing and adjusting planning. At the same time, it provides mechanisms to remove difficulties and reform administrative procedures to facilitate timely adjustment and implementation of projects. These regulations are not only for public investment projects but also have important implications for projects invested with non-budget capital. This is a key issue that needs attention and close coordination from localities to ensure effectiveness.

To achieve the goal of nearly 100% disbursement of the plan, the Ministry of Finance proposes that ministries, branches, and localities continue to strongly implement the proposed solutions and drastically implement the documents of the Government and the Prime Minister such as Message No. 47, No. 60, Directive No. 05, Resolution No. 226, etc. On that basis, the Ministry of Finance requests ministries, branches, and localities to continue to strongly implement the proposed solutions and drastically and synchronously remove difficulties and obstacles to promote disbursement progress in the coming time.

The Government’s directive documents have been very clear, so ministries, branches, and localities need to continue to drastically implement the solutions. In addition, to overcome difficulties at the grassroots level, it is necessary to ensure that all regulations and guidance are implemented synchronously and suit the locality’s situation. The guiding documents need to be urgently completed and promulgated so that the grassroots levels can apply them immediately, avoiding the situation of having to spend a lot of time asking for opinions step by step, slowing down the implementation progress.

After the decrees and circulars are completed, the Ministry of Finance will soon issue specific guides for the grassroots levels that lack experience, such as communes that do not have specialized project management units. The establishment or consolidation of public non-business units and commune-level project management units is necessary to improve the efficiency of public investment management.

Regarding personnel and capital use, it is necessary to request localities to regularly review and supplement plans. If there is a case where the assigned capital is not fully utilized, they must promptly report to the Government to adjust, transfer capital to sectors, localities, or projects with better demand and disbursement capacity.

In terms of institutions and laws, the Ministry of Finance is making efforts to soon issue important documents, creating a favorable legal corridor for the implementation of public investment.

Regarding the organization of implementation, it is proposed that ministries, branches, and localities continue to pay more attention and focus on two key points: (1) speeding up the progress of project implementation to create a large disbursement volume, especially in the last months of the year; (2) promptly handling problems in management, from accounting procedures to personnel work, to ensure smooth operations.

For projects that need adjustment, the competent authorities need to build specific guides with a unified nature applied nationwide to reduce cumbersome procedures and avoid the situation of continuous questioning and answering between levels. With all the synchronous solutions being deployed, it is expected that in the coming time, the progress of disbursement of public investment capital will be strongly improved, bringing the implementation results closer to the set target of 100% of the plan.

Unlocking Green Finance in Vietnam: From a “Common Language” to an International Financial Center

Experts have outlined a clear roadmap to boost sustainable investment in Vietnam. The government’s introduction of a “common language” is seen as a breakthrough policy move, while the future establishment of an International Financial Center is expected to be the “key” to enhancing transparency and investor confidence. These foundational solutions aim to bridge the gap between the massive capital requirements for Net Zero goals and the current market’s modest size.

Why Did Grab Vietnam Request Mordor Intelligence to Retract Its Taxi Market Reports?

Grab Vietnam vehemently denies ever discussing or providing any business information or transactional data to Mordor Intelligence.

“Vietnam’s Export Superstar: Unlocking the Secrets to Record-Breaking Success”

In the first eight months of the year, Cambodia’s imports of an unexpected product from Vietnam surged.