Vietnam’s Ministry of Finance is driving reforms to upgrade the stock market

|

Accelerating Reforms to Upgrade the Market

According to the Ministry of Finance, regarding the issue of upgrading Vietnam’s stock market, FTSE Russell has highly appreciated recent reforms. In particular, Circular No. 68/2024/TT-BTC, effective from November 4, 2024, and Circular No. 18/2025/TT-BTC, issued on April 26, 2025, removed the pre-deposit mechanism, bringing the market closer to international standards. Additionally, the implementation of the KRX information technology system, the issuance of a new circular on registration, depository, clearing, and payment, along with the legal framework for the new trading mechanism, were also positively evaluated.

The annual market classification results by FTSE Russell are expected to be announced on October 7, 2025. In August, the Ministry of Finance also implemented several important solutions to facilitate foreign investors’ participation in the market.

Firstly, the Ministry of Finance submitted to the Government a decree amending and supplementing a number of articles of Decree No. 155/2020/ND-CP. Notably, it stipulates that public companies must complete the notification of foreign ownership ratio within 12 months from the effective date of the decree to ensure transparency. At the same time, the Ministry of Finance is also coordinating with relevant ministries and sectors to amend the Law on Investment and guiding documents, aiming to increase the foreign ownership ratio in sectors unrelated to national security and defense. As a result, the maximum foreign ownership ratio in public companies will be raised.

In parallel, the Ministry of Finance closely coordinated with the State Bank of Vietnam in amending Circular No. 17/2024/TT-NHNN. This circular is expected to bring more conveniences for foreign investors, such as allowing authorization for financial institutions to open, close, and use payment accounts; eliminating the requirement for consular legalization of account opening documents; removing biometric requirements for electronic account opening and withdrawals; permitting the use of the SWIFT system; and minimizing requirements for documents and signatures. Therefore, once issued, the circular will significantly contribute to facilitating international capital flows.

Implementing the Resolution on the International Financial Center

On June 27, 2025, the National Assembly passed Resolution No. 222/2025/QH15 on the International Financial Center (IFC) in Vietnam, which took effect on September 1, 2025. On August 1, 2025, the Prime Minister issued Decision No. 1646/QD-TTg establishing the Steering Committee for the IFC. On the same day, the Steering Committee issued Decision No. 114/QD-BCDTT, along with an action plan for implementation.

According to the Ministry of Finance, two important decrees are being drafted. One decree pertains to the establishment of the IFC in Ho Chi Minh City and Da Nang, providing guidance on the provisions of Resolution No. 222/2025/QH15. The other decree focuses on financial policies within the IFC, encompassing regulations on taxation, incentives, securities, insurance, capital markets, and members of the financial center.

Regarding the decree on the establishment of the IFC, the Ministry of Finance has requested the People’s Committees of Ho Chi Minh City and Da Nang to develop relevant content. Based on this input, the Ministry sent Document No. 12354/BTC-DTNN on August 12, 2025, to seek opinions from seven ministries, two localities, the Vietnam International Arbitration Center, and the Vietnamese-German University, while also making it available for public feedback.

On August 28, 2025, after consolidating the feedback from relevant ministries, sectors, and agencies, the Ministry of Finance sent Document No. 13414/BTC-DTNN to the Ministry of Justice for appraisal of the draft decree on the establishment of the IFC. The Ministry is currently finalizing the dossier for submission to the Government for consideration in accordance with the prescribed procedures.

– 08:15 09/06/2025

“Vietnamese Stocks: Multiple Growth Drivers and Attractive Valuations, Says Nguyen Trieu Vinh (VCBF)”

The Vietnamese stock market is anticipated to remain dynamic in the upcoming phase. Valuation – a key concern for investors after the recent surge – is likely to retain its allure due to the promising profit growth prospects of listed companies.

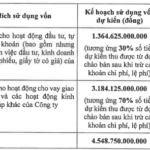

“VPBank’s Upcoming IPO: 375 Million Shares to Double 2025 Profit Plans”

With the written shareholder vote concluded on September 3rd, the plan to initiate an initial public offering (IPO) of VPBank Securities Joint Stock Company (VPBankS) has been approved. The IPO will offer a maximum of 375 million shares to the public. In addition, shareholders have also agreed to double the profit plan for 2025 and appoint an additional member to the board of directors.

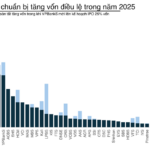

The New Race for Stockbrokers: IPOs, Capital Raises, and the Digital Asset Pivot

In just two months, the market has witnessed a string of significant events from industry-leading companies. TCBS led the way with a massive IPO of over VND 10,000 billion, followed by the entries of VPS and VPBankS, while HSC, SSI, MB ecosystem, and VIX made strategic moves to strengthen their positions.

What’s Next for the VN-Index After Hitting an All-Time High?

“With a harmonious blend of robust growth prospects and a still-reasonable price-to-earnings ratio, the VN-Index has the potential to surpass the 1,700-1,800 level,” asserted the expert.