In its recently published report, “The Flying Dutchman,” HSBC states that Vietnam has met seven out of nine criteria in the FTSE’s “Market Quality” framework. The criteria pertaining to market capitalization, liquidity, and the presence of large stocks have all been successfully fulfilled.

There has also been notable progress made towards the remaining two criteria, “Settlement Cycle” and “Failed Trade Costs.” Amendments to the Securities Law at the end of 2024 eliminated the requirement for pre-funding when purchasing stocks and introduced provisions for English-language disclosures.

The implementation of the KRX trading system in May 2025 has helped address issues with order bottlenecks and improved the handling of large transactions. More importantly, KRX paves the way for the adoption of a central counterparty clearing (CCP) mechanism, enabling more efficient and simultaneous trade execution and settlement.

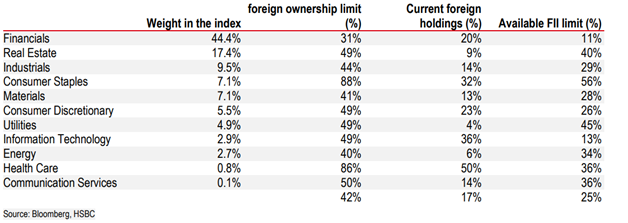

The Issue of Foreign Ownership Limits

One of the concerns raised by FTSE relates to the complex registration process for foreign investors and the restrictions on foreign ownership (FOL) in certain sectors. The banking sector, for instance, has a cap of 30%, while the aviation and telecommunications industries have a limit of 50%.

|

Foreign Ownership Limits by Sector

|

When foreign ownership reaches its limit, trading occurs exclusively among foreign investors, creating a separate pricing dynamic from domestic investors. While this is not a mandatory condition in the FTSE criteria, it could be a point of discussion during the consultation process.

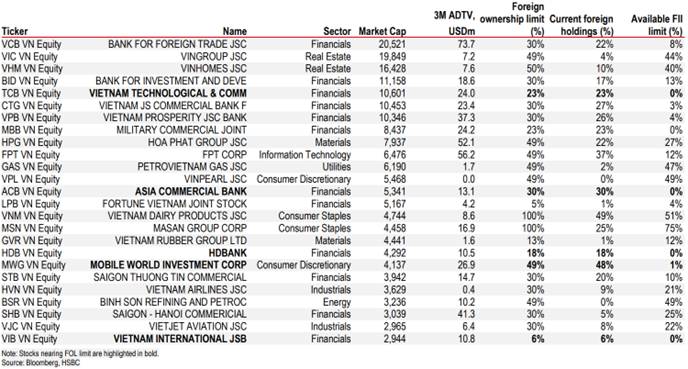

However, actual data reveals that only 12 stocks in the VN-Index have reached their foreign ownership limits. The overall market exhibits an average foreign ownership rate of just 17%, far below the 42% cap.

Among the top 25 stocks by market capitalization, banks such as VCB, BID, and CTG have high levels of foreign ownership but have not yet hit their limits. Conversely, many large-cap stocks like VNM, MSN, and GAS have relatively low foreign ownership compared to the permitted limits.

|

Foreign Ownership in Top 25 Stocks by Market Capitalization

|

“Will Vietnam be upgraded? Market developments are leaning towards an upgrade. Despite US tariffs, the Vietnamese stock market has surged by 40% year-to-date, making it one of the world’s best-performing markets. While we share the optimistic view on the upgrade scenario, it’s worth noting that FTSE will also seek input from investors and brokers before making a final decision,” according to the HSBC report.

If Vietnam is upgraded by FTSE in October, the transition process typically takes 6-12 months to allow funds sufficient time to prepare.

Potential Capital Inflows May Be Modest

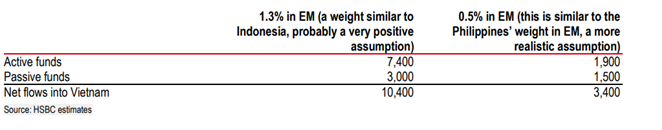

HSBC estimates that following an upgrade, Vietnam could account for approximately 0.6% of the FTSE Asia index and 0.5% of the FTSE Emerging Markets index. This could attract around $1.5 billion in passive funds, primarily from FTSE EM and FTSE Global ex US funds.

In an optimistic scenario (with a weighting of 1.3%, equivalent to Indonesia), passive fund inflows could reach $3 billion, coupled with an additional $1.9-7.4 billion from active funds. The total inflows, at the highest estimate, could amount to $10.4 billion.

|

Two Scenarios for Capital Inflows into Vietnam in the Event of an Upgrade

|

However, HSBC believes that the actual inflows will be significantly lower as a substantial portion of global passive funds use MSCI indices as their benchmark. Already, 38% of Asian funds and 30% of global emerging market funds globally hold Vietnamese stocks in their portfolios, leaving limited room for additional purchases.

Market Has Surged Ahead of the Review

In the first eight months of 2025, Vietnam’s stock market was among the fastest-growing in the world, with a 37% increase over the last six months. This surge surpasses the performance of other markets that were previously upgraded.

International experience shows that the impact of an upgrade is not uniform. Saudi Arabia and Kuwait, after being upgraded by FTSE, witnessed only moderate gains. Qatar and the UAE, on the other hand, experienced more substantial increases following their MSCI upgrade in 2014, although this was also influenced by oil prices.

HSBC suggests that since Vietnam has already witnessed significant growth ahead of the review, further upside potential may be limited if an upgrade is granted. Nonetheless, attaining emerging market status holds significant importance, enhancing the country’s position and laying the groundwork for attracting long-term capital.

– 17:11 04/09/2025

The Original Tupperware: Elevating Modern Living Standards for Vietnamese

“The iconic Tupperware brand and its premium quality plastic containers are back in Vietnam, now exclusively distributed by Cong Ty TNHH Doi Tac Nhãn Hieu. This comeback not only evokes fond memories of a household staple for millions of families but also ushers in a new era, elevating modern and sustainable living for Vietnamese consumers.”

Unlocking Vietnam’s Potential: Businesses Share Their Vision for a Stronger Nation

After a resilient 33-year journey alongside the country, CT Group has achieved notable pioneering milestones.

“Vietnam’s Stock Market Upgrade: A Transformational Story”

As of March 2025, Vietnam is on the FTSE Watch List and is considered a strong contender for reclassification from a Frontier to a Secondary Emerging Market.