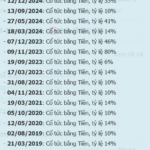

IMGC, a leading investment company in Huế, has announced its financial results for the first half of 2025, with a remarkable after-tax profit of over 30 billion VND, an eleven-fold increase compared to the same period last year. Consequently, the after-tax profit/equity ratio (ROE) has surged from 0.83% to 8.62%.

These figures surpass the profits of both 2023 and 2024, which stood at over 27 billion VND and 10 billion VND, respectively. It is worth noting that 2021 was the company’s most profitable year, with earnings of nearly 42 billion VND.

Source: Consolidated by the writer

|

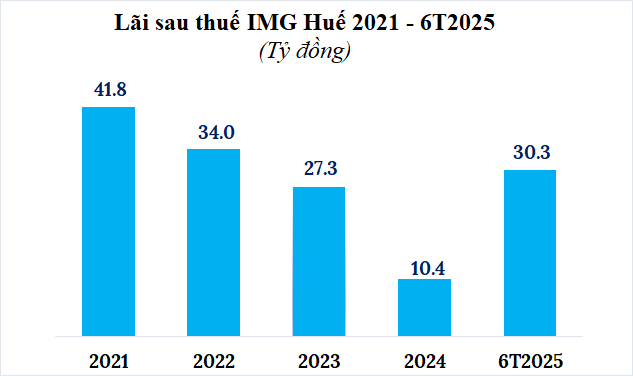

As of the end of June, IMGC’s total assets exceeded 1,982 billion VND, a 2% increase from the beginning of the year. Owners’ equity rose by 9% to over 351 billion VND, including nearly 103 billion VND of undistributed after-tax profits.

The company’s payables stood at over 1,631 billion VND, including nearly 400 billion VND in bank loans and over 1,231 billion VND in other payables. Additionally, IMGC has spent over 4 billion VND on interest payments for four bond lots in the first half of the year.

Source: Consolidated by the writer

|

Earlier in January, IMGC repurchased all four bond lots with codes IMGCH2126001, IMGCH2126002, IMGCH2126003, and IMGCH2226001 ahead of schedule, totaling 350 billion VND, thereby clearing its bond debt.

According to its website, IMGC, established in 2008 (formerly known as Petro Quang Ngai Branch in Huế), is the investor of An Cuu City, a large-scale urban area project spanning over 32ha in An Dong Ward, Huế City.

As of February 2015, the company had a charter capital of 97 billion VND, with three founding shareholders: Investment Joint Stock Company holding 98.97%, Ms. Do Thi Hiep owning 0.41%, and Ms. Le Thi Hien Mai holding 0.62%. Currently, IMGC has a charter capital of nearly 248 billion VND, with Mr. Nguyen Hong Phuc serving as both Director and legal representative, while Mr. Le Tu Minh is the Chairman of the Board of Directors.

An Cuu City, An Dong Ward, Hue City. Source: IMGC

|

IMGC is an integral part of the IMG Group ecosystem, founded by entrepreneur Le Tu Minh. Other member companies include Investment Joint Stock Company MHL (formerly known as ACC-Thang Long Joint Stock Company), the developer of the Artemis project in Hanoi; IMG Phuoc Dong Joint Stock Company, which is developing an industrial park and port with an area of 128.8ha in Long An; and IMG Singapore and IMG Australia.

|

Member companies of Investment Joint Stock Company

Source: IMG

|

Mr. Le Tu Minh, born in 1959 in Huế, started his entrepreneurial journey with Gili Taxi in Vung Tau in 1996. He later ventured into real estate, establishing the IMG ecosystem in 2007.

Mr. Le Tu Minh – Chairman of IMG

|

Since then, Mr. Minh has consecutively founded several subsidiary companies to undertake various real estate projects, including notable developments such as An Huu City, the mixed-use building Artemis 1 in Hanoi, the high-rise apartment building at 448 Nguyen Tat Thanh Street in District 4, Ho Chi Minh City, the office building Athena at 146-148 Cong Hoa Street in Tan Binh District, Ho Chi Minh City, and the Hoan My Hue Hospital, among others.

– 11:54 05/09/2025

“Debt Surpasses VND 10.1 Trillion: Tien Phuoc Group Reports Profit of Nearly VND 452 Billion in First Half of Year.”

This is Tien Phuoc Group’s record profit since 2021. A remarkable achievement, this financial success story is a testament to the group’s unwavering dedication, innovative strategies, and exceptional performance. With a sharp eye for market trends and a commitment to excellence, Tien Phuoc Group has navigated the economic landscape with prowess, solidifying its position as an industry leader. This milestone underscores the group’s resilience and fortitude, setting a new benchmark for prosperity and growth.

“Sovico Group of Vietnam’s Billionaire Nguyen Thi Phuong Thao Records a Profit of VND 657 Billion in the First Half of the Year.”

With a staggering owner’s equity of nearly VND 70,000 billion, Sovico Group stands as a formidable entity. The Group’s total assets are equally impressive, reaching an astonishing VND 230,000 billion.

“Unveiling IJC’s Strategic Move: A Near 190 Billion Dividend Declaration and the Story Behind the 17% Profit Dip”

“Infrastructure Development Joint Stock Company (HOSE: IJC) is delighted to announce a dividend payout for the year 2024. Shareholders are in for a treat as the company has declared a cash dividend, with the record date set as September 16th. Mark your calendars, as this is a date you wouldn’t want to miss out on!”

The Real Estate Renaissance: Navigating the Market with Financial Savvy

The real estate market has been through a tumultuous time, and many property businesses have had to get creative to weather the storm. With core operations struggling, these enterprises have had to look beyond their traditional realms to stay afloat, turning to financial maneuvers to navigate these challenging times.