VN-Index’s First Time Past 1,700 Points

On September 5th, Vietnam’s stock market once again surprised investors. Right after the ATO session, the VN-Index surged nearly 13 points, officially crossing the 1,700-point threshold – a historic first.

Just a few months ago, when the market was hovering around the 1,400-1,500 point range, few could have imagined that one day soon, the VN-Index would reach the 1,700 level. However, since the deep dip in April, a strong recovery has consistently pushed the market upward, ushering in one of the most exciting periods for Vietnam’s stock market.

By the end of the morning session, the market maintained its upbeat sentiment. The VN-Index temporarily stood at 1,705.3 points, up 9.01 points (+0.53%) from the reference level. VN30 also held a solid gain, reaching 1,890.88 points, up 7.29 points (+0.39%). The HNX-Index rose even higher, to 286.49 points, while the UPCoM dipped slightly by 0.13 points, landing at 111.72 points.

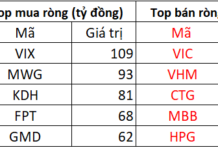

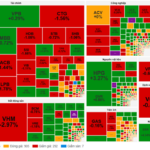

The HoSE saw a dominance of green with 190 gainers, far outpacing the 115 losers. Positive cash flow persisted, focusing on real estate, finance, industrial, and select energy stocks. Morning session liquidity surpassed VND 20,134 billion.

Notably, many industrial real estate and oil and gas stocks broke out, propelling the index upward. In the financial sector, differentiation emerged, but several major banks maintained a slight upward trend.

Vietnam’s stock market successfully conquers the 1,700-point threshold, a 25-year record.

What Opportunities Lie Ahead for Investors on the Sidelines?

As the index continues its upward march, surpassing the 1,700-point mark, both analysts and domestic investors are taken aback.

On stock forums, numerous investors express their regrets. When the market was at 1,400 points, they waited for a correction to buy stocks. The same happened at 1,500 and 1,600 points, and now, as the VN-Index touches 1,700, they are left on the sidelines, both anxious and rueful.

Many investors are in disbelief as the VN-Index hits a new high, crossing the 1,700-point mark in a short span.

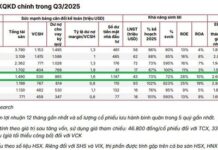

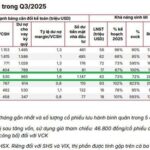

VPS Securities believes the market’s next resistance zone could be 1,740 – 1,760 points, but investment opportunities are no longer widespread and are instead concentrated in stocks with solid fundamentals and reasonable valuations.

Meanwhile, SHS Securities anticipates that short-term opportunities will shift towards stocks that haven’t risen much but boast positive business prospects in Q3, such as residential real estate, construction, and materials.

Mr. Dao Hong Duong, Director of Sector and Stock Analysis at VPBank Securities, notes that the VN-Index’s current P/E ratio is around 15 times, slightly higher than the 10-year average. A key difference from 2021 is that the market’s momentum now stems from corporate profit growth rather than cheap money.

According to this expert, in the first half of 2025, the after-tax profit of listed companies surged significantly while GDP continued to accelerate. This “real growth” factor is instilling investor confidence in the stock market’s potential to go even further.

VN-Index breaching the 1,700-point mark is not just a number but also testifies to the resilience of the economy and the returning confidence. However, the market always holds surprises, and those riding the wave of excitement need to prepare for potential setbacks.

Attracting Foreign Investment Through the Stock Market

In the most optimistic scenario, the FTSE reclassification could bring up to a whopping $10.4 billion to Vietnam’s stock market.

Market Beat: Profit-Taking Pressure Mounts, VN-Index Down Over 29 Points

The market closed with the VN-Index down 29.32 points (-1.73%), settling at 1,666.97; while the HNX-Index fell 3.32 points (-1.17%) to 280.67. The sell-off dominated today’s trading session, with 477 decliners against 319 advancers. The large-cap basket, VN30, mirrored the broader market with 24 losers, 3 gainers, and 3 stocks closing unchanged.

Market Pulse, September 3rd: Foreigners’ Robust Selling of Blue-chips, VN-Index Hanging at 1,680 Points

The trading session concluded with the VN-Index dipping 0.91 points (-0.05%) to 1,681.3. In contrast, the HNX-Index climbed 2.72 points (+0.97%), finishing at 282.7. The market breadth tilted towards gainers, as 468 stocks advanced against 268 decliners. However, the large-cap VN30 index painted a different picture, with 15 stocks falling, 12 rising, and 3 unchanged, resulting in a sea of red.