The Board of Directors of Soi The Ky has approved a credit limit of VND 1,413 billion for Unitex Dyeing and Spinning Co., Ltd. at Orient Commercial Joint Stock Bank (OCB) – Tan Binh Branch. This long-term loan is to refinance a previous credit facility of VND 993 billion from a group of five foreign banks, along with an additional VND 420 billion to cover the costs of the Unitex factory project.

Unitex will use its rights to the land lease, structures, and equipment in Tay Ninh, as well as its DTY/POY machinery system, as collateral for the loan. STK has guaranteed the entire loan amount.

Unitex Factory Project, located in Thanh Thanh Cong Industrial Park, Tay Ninh Province

|

Unsuccessful private placement increases financial pressure

This borrowing move comes after STK’s unsuccessful attempt to privately place 13.5 million shares at VND 27,500 per share, aiming to raise VND 371 billion for Unitex. On July 22, the company concluded the issuance without distributing any shares. The management attributed this to an unfavorable market and unattractive pricing, despite interest from internal buyers.

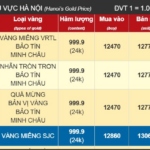

As of June 30, 2025, STK’s total short-term and long-term borrowings exceeded VND 1,815 billion, a 10% increase from the beginning of the year, surpassing its equity of VND 1,736 billion. This includes a long-term loan of VND 993 billion from CTBC Bank with a principal repayment schedule extending from 2025 to 2028 (VND 361 billion due this year) and a VND 180 billion loan from OCB maturing in 2032. Short-term borrowings of VND 642 billion incur interest rates of 3.9-6.7% per annum.

In the first half of 2025, STK reported a negative operating cash flow of VND 157 billion, dragging down net cash flow to a negative VND 93 billion. Cash and cash equivalents at the end of the period stood at just VND 8 billion, a 92% decrease from the beginning of the year.

Notably, STK continues to invest in construction work in progress, mainly at the Unitex factory, totaling nearly VND 2,200 billion, accounting for 56.6% of total assets.

The delay in bringing Unitex into operation (construction started in 2021 and trial runs completed in Q2 2025) has set back the company’s financial performance. STK’s profit declined from VND 278 billion in 2021 to VND 12 billion in 2024, while revenue dropped from over VND 2,000 billion to VND 1,200 billion during the same period.

For 2025, the company targets revenue of VND 3,270 billion and after-tax profit of VND 310 billion, which would be the highest in its history if achieved. However, the semi-annual financial statements show that only 22% of the revenue target (VND 710 billion) and 10% of the profit target (VND 30 billion) have been met so far.

| STK’s Semi-Annual Business Results |

At the 2025 Annual General Meeting of Shareholders, Chairman

On the stock exchange, STK shares are currently trading around VND 26,150 per share, up 6% in the past month and 37% from their April low. However, the market price is still far from the peak above VND 50,000 per share reached in April 2022. Average trading volume over the past year has been modest, at just over 48,000 shares per session.

| STK Share Price Movement over the Past Year |

– 14:34 05/09/2025

Unveiling the Real Estate Sector’s “Hidden Treasures”: A Mid-Year Review

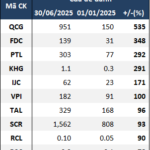

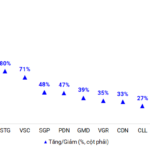

As of the end of June 2025, the reserves of 104 real estate businesses listed on the stock exchanges (HOSE, HNX, and UPCoM) had increased by almost 11% since the beginning of the year, reaching a staggering VND 148.3 trillion. Additionally, their short-term holdings also witnessed a substantial surge of over 35%, amounting to nearly VND 129 trillion.

The Real Estate Renaissance: Navigating the Market with Financial Savvy

The real estate market has been through a tumultuous time, and many property businesses have had to get creative to weather the storm. With core operations struggling, these enterprises have had to look beyond their traditional realms to stay afloat, turning to financial maneuvers to navigate these challenging times.