Fed Rate Cut Expectations and VN-Index Outlook

Source: CafeF – Vietnam Finance and Stock News

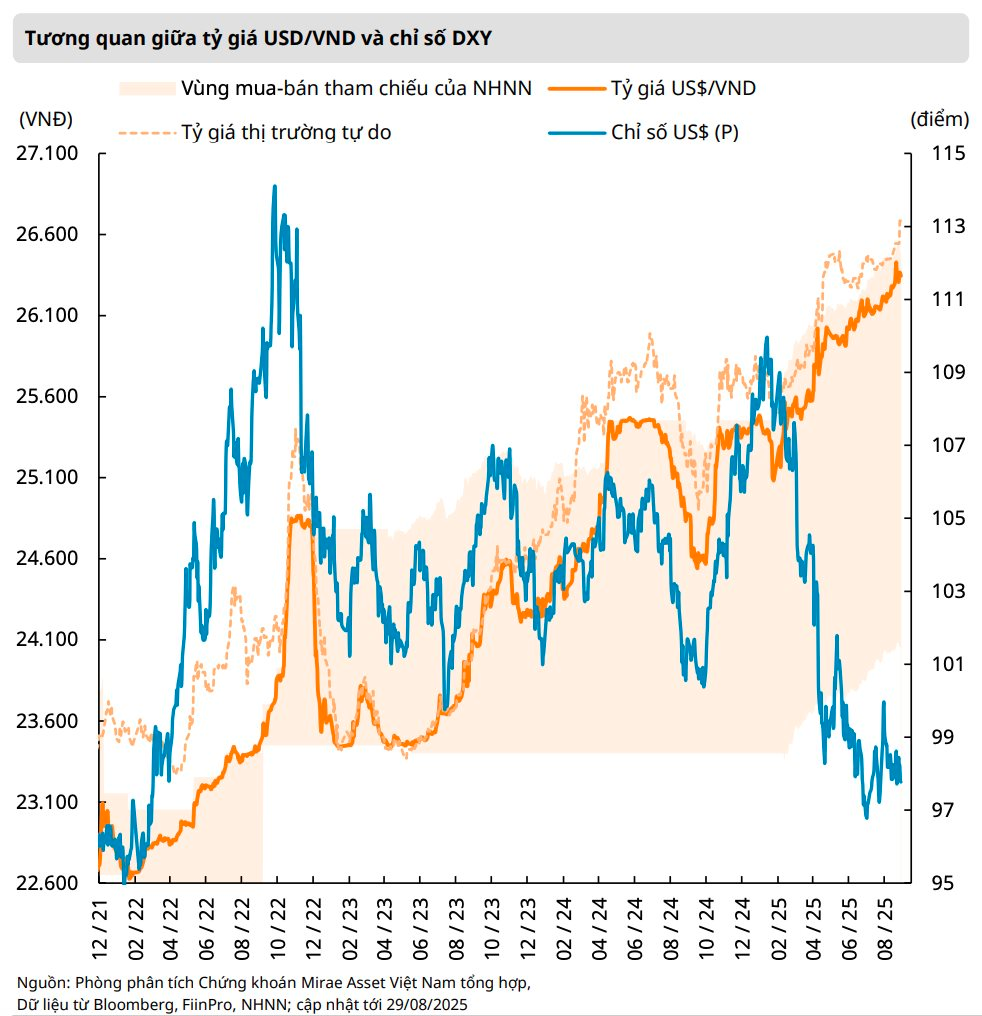

In its latest strategic report, Mirae Asset Securities stated that Fed Chairman Jerome Powell’s speech at the Jackson Hole conference signaled a potential rate cut this year. However, the resurgence of inflation in recent months has created a dilemma for the Fed, limiting the scope for significant rate cuts in 2026. This implies that Vietnam will continue to face exchange rate pressures for the remainder of 2025 and throughout 2026.

Mirae Asset believes that the State Bank of Vietnam (SBV) will opt for a more measured approach, relying on foreign exchange inflows from remittances, FDI, trade surpluses, and potential market upgrade-driven investment. They will also manage interest rates through open market operations and liquidity adjustments to influence interbank lending rates and ease pressure on the exchange rate.

VN-Index Targets 1,800 – 2,000 Points

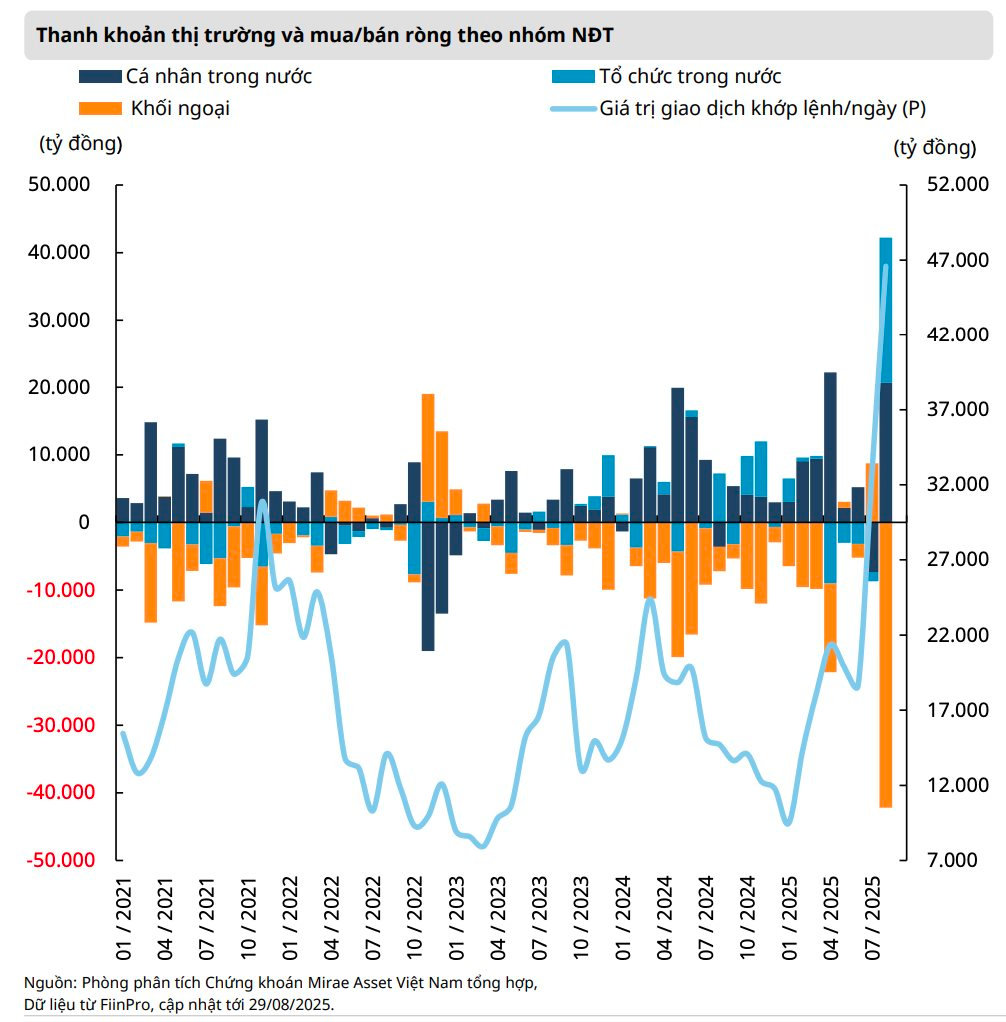

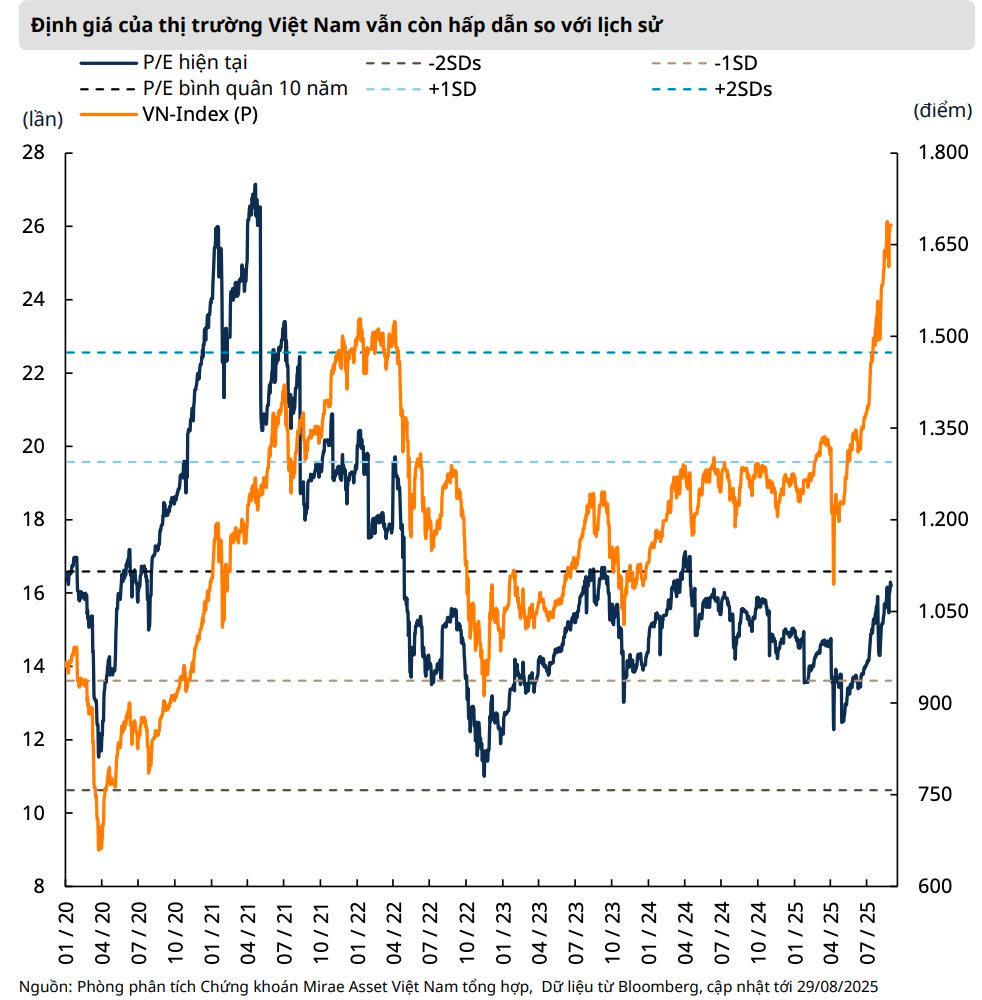

Regarding the stock market, Mirae Asset asserts that the Vietnamese stock market has entered a new growth cycle, characterized by volatile sessions with swings of nearly 100 points. Domestic institutional investors have played an increasingly prominent role, with their transaction value share rising from 6-10% in 2023-2024 to 40-50% in the last four months. This strong participation has been the primary driver of the average daily trading value, which reached VND46.6 trillion in August.

Source: CafeF – Vietnam Finance and Stock News

Mirae Asset anticipates that large swings will persist in September as investors await the realization of positive news that has already been priced into the VN-Index. These include the September review by FTSE Russell for a potential market upgrade to emerging status and the Fed’s decision on interest rates in their upcoming September meeting.

In reality, neither of these stories is new, and any information deviation may trigger profit-taking by investors aiming to secure gains from the recent months’ performance. Regarding the market upgrade potential, Mirae Asset believes that foreign capital inflows following an upgrade decision are a long-term factor. The large-scale nature of such capital requires a suitable disbursement roadmap, and foreign investors’ current buying and selling activities remain relatively cautious ahead of the potential upgrade.

Meanwhile, the analysts are not overly optimistic about a Fed rate cut at this stage. The broad-based trade war will continue to impact inflation in the coming months, further limiting the Fed’s scope for rate cuts in 2026 and maintaining exchange rate pressures on Vietnam.

Source: CafeF – Vietnam Finance and Stock News

For September, Mirae Asset maintains a cautious outlook, expecting continued volatility with a base case scenario of VN-Index finding support at 1,650 points before resuming its upward trajectory towards 1,800 points. A less favorable scenario would see the index testing the medium-term support at 1,550 points as it seeks new growth drivers amid external fluctuations.

Nevertheless, the medium-term outlook remains positive, with growth potential targeting the 1,800-2,000-point region.

6 Top-Tier Businesses With Robust Profit Growth Prospects and Fair Valuations for Q3 2025

“While Agriseco acknowledges potential risks, such as robust foreign net selling, profit-taking after a sharp rally, and short-term volatility arising from ETF portfolio rebalancing, it remains confident in its ability to navigate these challenges effectively.”

The Big Bank Stock Slump: 25 Out of 27 Stocks Plunge as Foreign Investors Dump VPB, TCB, and MBB Shares

As of the market close on September 5th, the banking sector witnessed a downturn with 25 out of 27 stocks trading in the red. SHB, in particular, stood out as the top loser among its peers, experiencing a significant decline and leading the sector in terms of liquidity across all three exchanges.