In Novaland’s 2024 Annual Report released in April, the Chairman of the Board of Directors of Novaland Group, Mr. Bui Thanh Nhon, emphasized that 2025 is considered a pivotal year, marking Novaland’s comeback with a lean and highly efficient operating strategy. Mr. Nhon asserted that Novaland’s restructuring is not just about survival but about breaking through.

The Chairman affirmed, “Novaland will not only overcome challenges but also become a new symbol of sustainable development, a powerful resurgence, and a generation of Vietnamese enterprises going global.”

Billion-dollar projects unblocked

Novaland’s large-scale projects and abundant land funds were once a source of pride. However, at the height of their fame, with vast land banks spanning multiple provinces and a massive asset portfolio, Novaland suddenly faced a storm in the real estate market in late 2022. Several billion-dollar mega-projects encountered delays due to legal complications and a lack of capital, including Aqua City, Nova World Phan Thiet, and Nova World Ho Tram.

By mid-2025, the company received a series of good news as these critical projects gradually revived and overcame legal hurdles.

Specifically, on June 16, the Chairman of the People’s Committee of Bien Hoa (former) signed and issued decisions approving adjustments to the detailed construction planning at a 1/500 scale for the component projects of Aqua City: Aqua City and Aqua Waterfront City.

Simultaneously, the assignment of the task of adjusting the detailed planning at a 1/500 scale for the Cù Lao Phuoc Hung High-end Commercial and Service Urban Area (Phoenix subdivision) was officially approved on the same day.

These approved decisions have helped Aqua City complete its legal dossier as required, ensuring synchronization between planning levels. This will facilitate the project’s continued implementation.

On September 5, the leaders of Dong Nai province also chaired a meeting with the Novaland Group to discuss the progress and resolve obstacles in the Aqua City cluster of projects.

At the meeting, the Novaland Group proposed to implement the construction of technical infrastructure (including land leveling) and the projects immediately after obtaining approval for the detailed planning at a 1/500 scale. They also requested to carry out these activities concurrently with the process of the Department of Construction’s appraisal of the feasibility study report.

The investor committed to ensuring that the construction works comply with the feasibility study report during the subsequent acceptance process.

Some land plots in Aqua City are currently being divided into plots (Photo: Quoc Hoang)

To facilitate its business, the Novaland Group requested the People’s Committee to direct the departments and branches to consider granting a sales license after the technical infrastructure is accepted according to the detailed planning at a 1/500 scale and the approved project progress.

Aqua City is considered a pivotal and critical project for Novaland. The project has a total investment of approximately $8 billion and enjoys a prime location along the Dong Nai River, opposite Vinhomes Grand Park.

Good news also arrived for the NovaWorld Phan Thiet project, which officially completed a critical legal step in late June.

Specifically, on June 27, the People’s Committee of Binh Thuan (former) issued a decision allowing the conversion of land use form for the Ocean Valley Tourist Complex project in Tien Thanh ward, Phan Thiet city, Binh Thuan province (NovaWorld Phan Thiet project).

The decision clearly states that an area of 3,810,986.7 sqm out of a total area of 7,994,306.5 sqm of commercial and service land in the project is permitted to convert from the form of annual land rent payment to a one-time land rent payment for the entire lease term.

The People’s Committee of Binh Thuan assigned the relevant authorities to calculate the land rent to be paid for the area with a one-time land rent payment for the entire lease term. They also handed over land use right certificates and ownership of assets attached to the land to Delta – Valley Binh Thuan Company Limited (the project investor) after fulfilling its financial obligations as prescribed.

Previously, on June 24, the People’s Committee of Binh Thuan province also issued a decision on approving the adjustment of the investment policy for the NovaWorld Phan Thiet project. This adjustment focused on updating the project’s objectives and progress.

With these recently approved decisions, the critical legal step for the NovaWorld Phan Thiet project has been completed, providing a prerequisite for Novaland to continue working with credit institutions to secure funding for the project’s continued implementation and early synchronized operation.

As of June 2025, NovaWorld Phan Thiet has officially handed over 1,500 villa and townhouse products to customers. Among them, more than 750 completed villas are in operation for rent.

As of June 2025, NovaWorld Phan Thiet has officially handed over 1,500 villa and townhouse products to customers.

Numerous key projects of Novaland in Ho Chi Minh City have also been promoted to resolve legal complications, with expectations to soon grant nearly 7,000 pink books to residents.

In the Orchard Garden project (Phu Nhuan district), Task Force 5013 assigned the Department of Land Economy to work directly with Novaland to unify financial obligations. Based on this, the steps to determine the obligations will be implemented according to the Land Law, serving as a basis for granting land-use right certificates to 246 officetel units.

The unblocking of these legal “knots” is considered a “launchpad” for Novaland in the coming time. The company expects to collect an additional VND 300,000 billion from unsold products in large projects such as Aqua City, NovaWorld Phan Thiet, NovaWorld Ho Tram, and Ho Chi Minh City real estate. The total value could reach VND 400,000 billion.

“Hundreds of thousands of billion” tumor

Despite unblocking several critical projects, Novaland still faces a cash flow imbalance, even though its financial picture has improved after two years of restructuring.

As of June 30, 2025, Novaland’s total debt was VND 186,476 billion, a decrease of more than VND 26,000 billion compared to the end of 2022 and nearly VND 4,000 billion compared to the beginning of 2025.

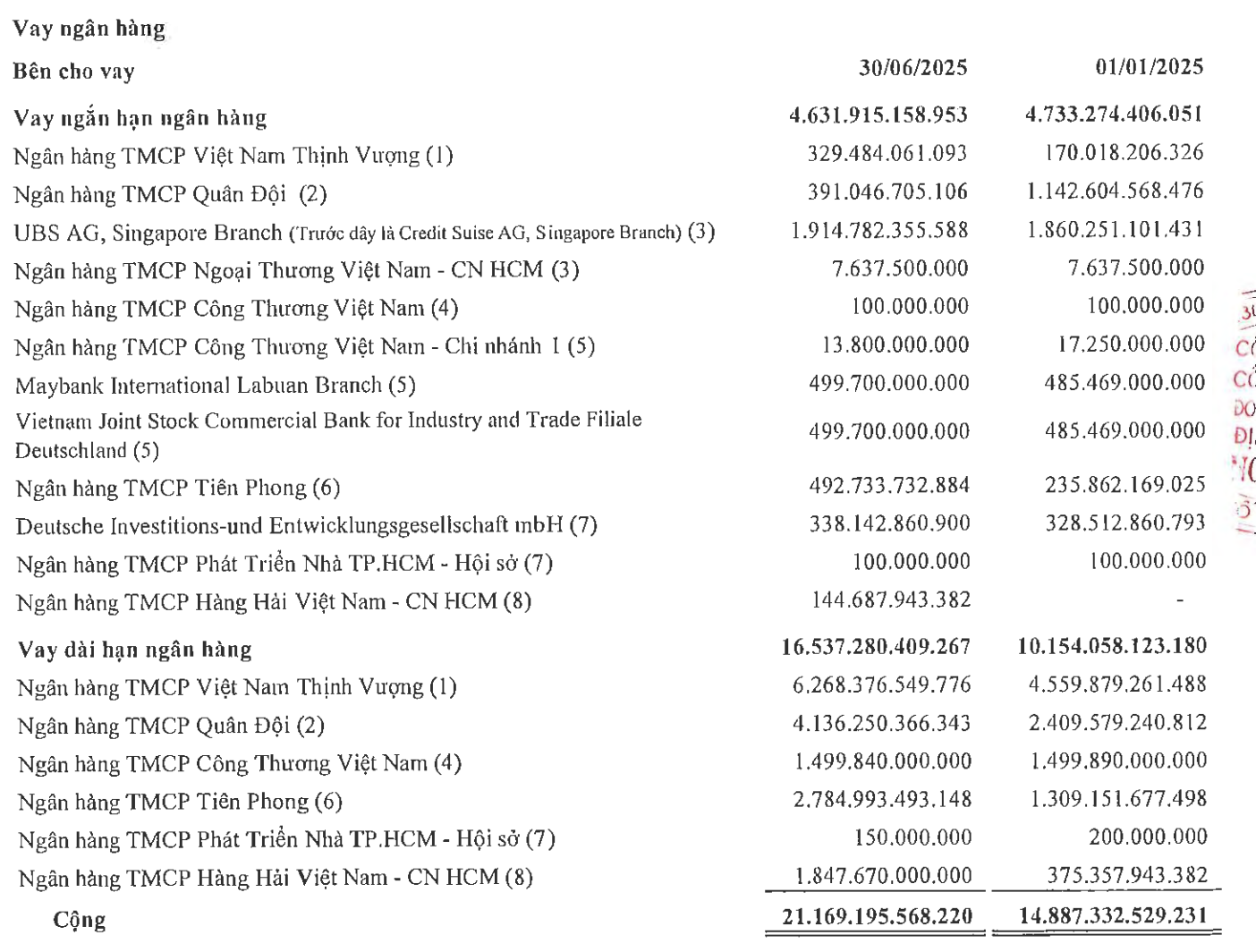

Of this, the company’s total financial debt was VND 61,800 billion. Short-term loans of over VND 32,300 billion include VND 4,600 billion from banks, VND 17,200 billion from bond issuances, and over VND 10,470 billion from third parties. Long-term loans of over VND 29,500 billion are mainly from banks (VND 16,500 billion) and bonds (over VND 13,080 billion).

According to Vietcap’s recent report at the investor meeting, Novaland’s management stated that they had extended the repayment period for VND 24,100 billion of the current debt. The company also has a handling plan for VND 8,060 billion, is negotiating terms for VND 8,700 billion, and the remaining VND 18,200 billion has not yet matured.

As of June 30, 2025, Novaland’s bank debt was VND 21,169 billion, a significant increase from the beginning of the year.

In reality, Novaland and its subsidiaries’ delays in repaying principal and interest have occurred regularly. In the first half of 2025, Novaland delayed the payment of VND 2,523.4 billion in principal and interest for six lots of bonds due to “inability to arrange funds.” By mid-August, the company again delayed the payment of nearly VND 785.8 billion in principal and bond interest.

Faced with significant repayment pressure while cash flow from sales and project handovers is not abundant, Novaland has restructured its debts through various forms, such as share swaps or the sale of assets.

Specifically, at the 2025 Extraordinary General Meeting of Shareholders held in early August, shareholders approved a plan to issue more than 168 million private placement shares to swap for a total debt value of more than VND 2,645 billion from three creditors: Novagroup (VND 2,527 billion), Diamond Properties (VND 112 billion), and Ms. Hoang Thu Chau (VND 6.7 billion).

Additionally, the meeting approved a plan to issue more than 151 million shares to swap for the entire principal debt of 13 bond codes. These bonds were issued from 2021 to 2022, with maturities mainly in 2023-2025, with a total outstanding principal of VND 6,074 billion.

With these two plans, Novaland will issue nearly 320 million shares to swap for a “huge” debt of more than VND 8,719 billion in the coming time.

Besides debt swaps, the company also sold a series of assets to restructure its debt. According to the audited semi-annual consolidated financial statements for 2025, Novaland stated that it had completed the transfer of seven assets, collecting VND 13,506 billion in the first half of the year. Simultaneously, Novaland also signed a contract in principle to sell five assets worth VND 7,667 billion and a memorandum of understanding (MoU) to sell two other assets with a total value of VND 3,400 billion.

Additionally, the group received non-binding letters of interest from investors for four assets, equivalent to VND 1,915 billion. Currently, there are still VND 1,892 billion worth of assets without formal agreements.

This year, Novaland will implement a plan to sell 22 assets with a total expected revenue of VND 28,380 billion.

Concurrently, the group has also reached initial debt restructuring agreements with creditors, including bondholders, totaling nearly VND 14,500 billion.

Tu An

Where Will the New “Hotspot” of the Real Estate Market Be Post-Merger?

“According to the Vietnam Real Estate Brokers Association (VARS), Hai Phong, Da Nang, and Ho Chi Minh City are the three standout performers in the real estate market post-merger. These cities have witnessed a surge in property values and transaction activities, outpacing the broader market and attracting investors seeking lucrative opportunities.”