According to VietstockFinance’s statistics, the combined net revenue of 19 marine transportation companies listed on the stock exchange reached 10.7 trillion VND, a 19% increase from the previous year. However, net profits decreased by 15% to 789 billion VND.

The business results showed a clear differentiation, with the container group, notably HAH, maintaining its growth trajectory, while the oil, chemical, and bulk cargo segments, including companies under PVT such as PVP, GSP, and PDV, along with bulk cargo companies like VOS and PCT, faced challenges due to escalating operating costs and weakening demand.

Container transportation maintains growth

Within the container group, Hai An Transport and Stevedoring JSC (HOSE: HAH) remained a bright spot. The company’s Q2 2025 revenue hit a new record of 1.27 trillion VND, a 34% increase. Specifically, in the vessel operation segment, the gross profit margin surged from 15.5% to 32.3%, contributing to a significant jump in profits to 362 billion VND, triple the amount from the previous year.

HAH attributed these results to the addition of three new vessels, Opus, Gama, and Zeta, to its fleet, as well as increased freight rates and charter rates. This profit figure is also the highest ever achieved by HAH.

| HAH’s Q2 2025 profit growth attributed to additional vessels in operation |

Narrowing profit margins in oil transportation

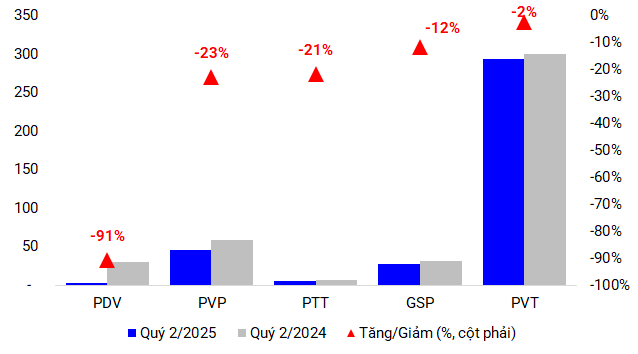

In contrast, the oil transportation group, mainly consisting of PVTrans subsidiaries, exhibited a noticeable decline. While revenue increased significantly due to the trading segment, profit margins remained low, and freight rates were less favorable compared to the previous year.

Revenue for Pacific Petroleum Transport JSC (HOSE: PVP) reached 554 billion VND, a 54% increase, but net profit decreased by 22% to 46 billion VND. Although the Pacific Pride vessel, which began operations in October 2024, contributed to improved revenue, the gross profit margin for the transportation services segment dropped significantly from 49% to 28%.

International Gas Transport JSC (HOSE: GSP) also reported record-high revenue of 1.47 trillion VND, more than double the previous year’s figure, mainly due to trading activities. However, the company’s liquefied gas transportation business weakened, causing a 12% decrease in profit to 27 billion VND, along with a narrowing gross profit margin.

Net profit for Phuong Dong Vietnam Transport and Forwarding JSC (UPCoM: PDV) stood at 2.9 billion VND, the lowest in three years, as two of its vessels underwent prolonged repairs amid a challenging market for oil and bulk cargo transportation, impacted by global conflicts and trade instability.

The gross profit margin for the core transportation services segment of Petrovietnam Transportation Corporation (PVTrans, HOSE: PVT) decreased from 27.8% to 20.9%. Despite a slight 2% dip in net profit to 294 billion VND, the company managed to offset this with reduced operating expenses.

|

PVTrans group’s profits decline (in billion VND)

Source: Author’s compilation

|

Diverging fortunes in petroleum transportation

The petroleum transportation group of Petrolimex presented a mixed picture.

While Petrolimex Petrochemical Waterway Transport JSC (HOSE: PJT) achieved a 12% increase in revenue to 184 billion VND, its profit decreased by 58% to 8.4 billion VND due to higher operating costs and the absence of extraordinary income recorded in the previous year. Vitaco Petroleum Transport JSC (HOSE: VTO) also experienced an 11% decline in profit to 26 billion VND as three of its vessels underwent repairs.

On the other hand, Petrolimex VIPCO Petroleum Transport JSC (HOSE: VIP) recorded a notable 65% surge in profit to 38 billion VND, thanks to an improved gross profit margin, which climbed from 29.6% to 37.5%, and a stable fleet of leased vessels.

Meanwhile, Au Lac JSC (ALC) witnessed a 24% drop in revenue to 322 billion VND, dragging profit down by 26% to 73 billion VND compared to the previous year, due to weakened demand from China and India.

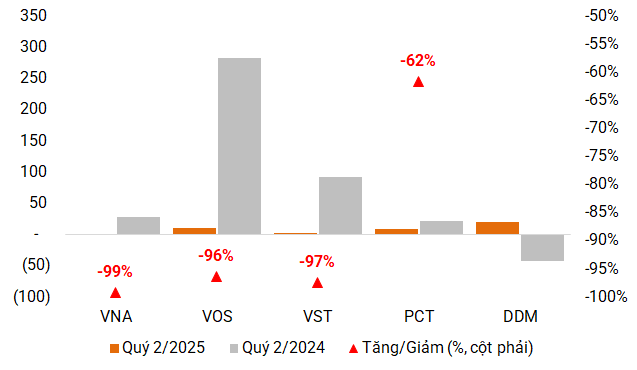

Bulk cargo transportation continues to struggle

In Q2, the bulk cargo transportation segment faced numerous challenges. The international market lacked stability, and the demand for transportation had not fully recovered. Additionally, insurance costs, operating expenses, and interest expenses were on the rise. Geopolitical fluctuations and global trade policy instability led to declining freight rates, resulting in a noticeable reduction in fleet operating efficiency compared to the previous year.

Despite increased revenue from additional vessels, Global Pacific Marine JSC (HNX: PCT) experienced a 62% drop in profit to 8.4 billion VND due to doubling interest expenses and escalating insurance and operating costs caused by geopolitical instability.

Vinaship Marine JSC (UPCoM: VNA) reported a 13% increase in revenue to 193 billion VND, but profit plummeted by 99% to just 243 million VND, partly due to low gross profit margins, higher financial expenses, and the absence of extraordinary income.

Following the return of Dai An and Dai Hung vessels, Vietnam Maritime Corporation (Vosco, HOSE: VOS) saw a decline in its business results, with profit plunging by 96% to 10 billion VND as it no longer received income from vessel sales.

In contrast, Dong Do Shipping Corporation (UPCoM: DDM) surprisingly turned a profit of 21 billion VND after consecutive quarters of losses. This improvement was attributed to the sale of two vessels and reduced financial expenses, despite ongoing challenges in its core business, which remained below cost.

|

Bulk cargo transportation companies faced difficulties in Q2 (in billion VND)

Source: Author’s compilation

|

A string of losses for some companies

Meanwhile, some businesses continued their streak of losses. VP Petrochemical Transport JSC (UPCoM: VPA) incurred an 11 billion VND loss, marking its eighth consecutive quarter in the red, likely due to the downturn in the bitumen market, which led to operating below cost.

Orient Maritime and Commercial JSC (UPCoM: NOS) reported an even more significant loss of 130 billion VND, extending its streak of losses to over a decade.

On a positive note, Logistics Vicem JSC (HOSE: HTV), a domestic water transportation company, improved its performance, with revenue reaching 71 billion VND, a 14% decrease, but net profit increasing by 40% to 5.4 billion VND, the highest in three years.

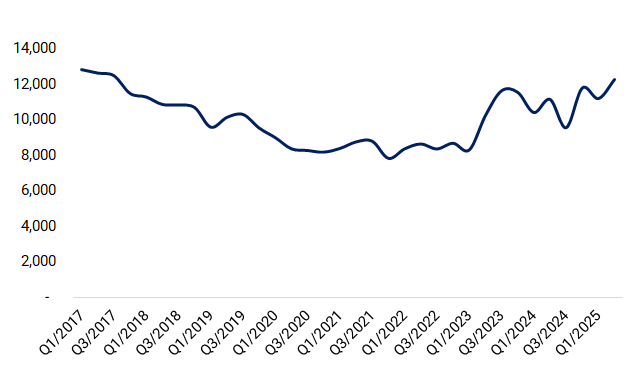

Long-term debt at its highest level since 2017

The continuous addition of new vessels has pushed the long-term debt of marine transportation companies to its highest level since 2017, surpassing 12.2 trillion VND.

PVT leads the way with over 5 trillion VND in long-term debt, one of the highest levels in its history and 2.5 times higher than in Q4 2020. Notably, subsidiaries such as GSP, PDV, PVP, and PTT have also significantly increased their debt, now 1.7 to 4 times higher than at the end of Q2 last year.

PCT has consistently invested in new vessels, pushing its long-term debt to over 1.8 trillion VND, 4.3 times higher than in the same period last year, and continuing to rise each quarter.

HAH currently holds nearly 1.6 trillion VND in debt, lower than its peak in Q4 2024 but still several times higher than five years ago, reflecting its strategy to expand its container fleet.

VOS and VNA have also resumed borrowing to invest in new vessels after a long period of debt reduction, even reaching zero debt at one point.

|

Long-term debt of marine transportation companies has been on an upward trend (in trillion VND)

Source: Author’s compilation

|

Will oil transportation continue to face pressure in the second half of the year?

As the marine transportation market enters the final quarter of 2025, conflicting signals are evident. According to FPT Securities (FPTS), the industry will continue to grapple with global vessel oversupply but benefit from Vietnam’s projected 12% year-on-year increase in imports and exports. This growth in trade is expected to support the container segment’s foundation for expansion, even though freight rates may soften slightly as global fleet capacity increases faster than demand.

Domestic container transportation is anticipated to remain stable, supported by growing cargo volumes and port infrastructure development. Companies like HAH are poised to maintain their market position through fleet expansion and international cooperation.

On the other hand, the oil transportation segment is unlikely to see a significant improvement, as charter rates, particularly for smaller vessels, are forecast to remain stable, similar to the first half of the year, which already witnessed a 25-30% decline compared to the previous year. FPTS predicts that companies like PVP will confront challenges due to narrowing profit margins and USD exchange rate risks.

For VIP, analysts believe that the impact of declining charter rates will be less severe compared to the overall market. While profits may dip this year, the company’s investment in new vessels lays the groundwork for growth in 2026 and beyond.

– 09:00 06/09/2025

“A Lucrative Payout: Pharmaceutical Company Offers Nearly 39% Dividend, Pushing 2024 Cash Dividend to an Impressive 172%”

Our company is proud to announce that we have executed two rounds of cash dividend payments, derived from the post-tax profits of our 2024 business operations. With a total distribution rate of 24%, we are thrilled to share the success of our endeavors with our valued shareholders.

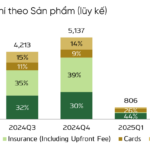

“Vietcombank’s Service Fee Income Takes a Hit: Is Bancassurance to Blame?”

Since the mass waiver of fees in 2022, Vietcombank has experienced a consistent decline in net profit from its service operations. From 2025 onwards, the bank will also no longer recognize upfront fees from its exclusive insurance agreement with FWD, indicating a further decrease in revenue streams.

“TIG Seeks to Divest Its Hungarian Subsidiary”

“TIG is planning to divest its entire stake in RE-G Real Estate Utilization LLC, a company based in Hungary. The proposed transaction is expected to take place in the third or fourth quarter of 2025.”