Hoang Anh Gia Lai Agricultural Joint Stock Company (HAGL Agrico – stock code: HNG) has just announced its audited semi-annual financial statement for 2025, reporting an additional loss of 61 billion VND compared to the self-prepared report.

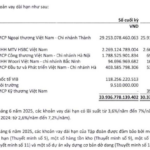

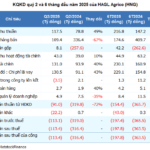

Thus, in the first six months, HNG recorded a gross revenue of over 216 billion VND, a 47% increase compared to the same period last year, but still made a post-tax loss. The accumulated loss of HAGL Agrico rose to 9,643 billion VND. As of June 30, short-term debt exceeded short-term assets by more than 12,955 billion VND.

HAGL Agrico’s accumulated loss rose to 9,643 billion VND.

“These conditions indicate the existence of material uncertainties that may cast significant doubt about the Company’s ability to continue as a going concern,” the auditor emphasized.

HAGL Agrico said that the company is implementing projects to ensure cash flow, restructure debts, and work with related parties to handle debts and regain land use rights certificates in Laos and Cambodia.

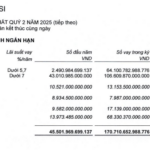

Similarly, the audited 2025 financial statement of Duc Long Gia Lai Joint Stock Company (stock code: DLG) showed that DLG’s consolidated after-tax profit decreased by 31% compared to the self-prepared report, reaching 69 billion VND.

The auditor emphasized that as of June 30, DLG’s consolidated accumulated loss was over 2,411 billion VND, and the company’s short-term debts had exceeded total short-term assets by nearly 530 billion VND. These factors indicate the existence of material uncertainties that may cast significant doubt about the Company’s ability to continue as a going concern.

Duc Long Gia Lai Joint Stock Company has a consolidated accumulated loss of over 2,411 billion VND. Photo: DLG

Moore AISC Auditing and Information Technology Services LLC audited the reviewed semi-annual financial statement for the first six months of 2025 of SMC Trading Investment Joint Stock Company (stock code: SMC) with several emphases.

First, the auditor expressed an exception in the review audit report. Accordingly, SMC had a cash payment of 42 billion VND to Ms. Nguyen Thi Ngoc Loan, Chairwoman of SMC’s Board of Directors, related to advance payment for work. As of the financial statement date, SMC has not provided the necessary documents for the auditor to determine the purpose and recoverability of this advance.

The above advance payment transaction has not been officially approved by the Board of Directors as stipulated in the Company’s Charter and the Enterprise Law. The lack of full approval authority for related-party transactions indicates non-compliance with internal governance regulations and current laws.

“We cannot determine whether adjustments to other related accounts for the six-month period ended 2025 are necessary,” the auditor stated.

In addition, SMC repaid a debt of 2.1 billion VND to Ms. Nguyen Thi Ngoc Loan on January 17 by transferring the amount to Mr. Nguyen Nhat Tien, with the note “payment for Contract No. 79/HDTT/VAC-SMC/2024” as directed by Ms. Loan.

Auditor expresses doubt about SMC Trading Investment Joint Stock Company’s ability to continue operations.

As of the financial statement date, SMC has not provided the contract and other necessary documents and explanations for the auditor to perform audit procedures to determine the existence, recognition amount, and evaluate other potential costs.

Second, SMC’s ability to continue as a going concern is presented in Note X.5 of the mid-year consolidated financial statement. In the first six months, the company incurred a loss of over 102 billion VND, resulting in a cumulative loss of nearly 242 billion VND as of June 30, a negative cash flow from operating activities of 129 billion VND, and short-term debt exceeding short-term assets by more than 971 billion VND.

“These factors raise doubts about SMC’s ability to continue as a going concern in the future,” the auditor emphasized.

The Prodigal Son’s Strategic Maneuver: Unraveling the Persistent Accumulation of Hoang Anh Gia Lai Shares

“In a recent display of confidence in the company, Doan Hoang Nam, son of business tycoon Bầu Đức, acquired 27 million shares of HAG, the stock of Hoang Anh Gia Lai Joint Stock Company. Valued at approximately VND 426 billion, this transaction signifies a substantial investment. Now, Nam is poised to purchase an additional 25 million HAG shares from August 28 to September 12, boosting his ownership stake to 4.92% of the company’s capital, equivalent to a substantial holding of 52 million HAG shares.”

Doubts on Operational Continuity: Hoang Anh Gia Lai (HAG) Addresses Asset Sale and Debt Swap Plans

As of June 30, 2025, HAGL’s short-term debt exceeded its short-term assets by a staggering amount of over VND 2.7 trillion. With short-term assets totaling VND 10,948 billion and short-term debt amounting to VND 13,715 billion, the company finds itself in a challenging financial position.

HAGL Agrico: Overburdened by Financial Debt of 10.2 Trillion VND, Gross Profit Falls Short of Covering Interest Expenses

HAGL Agrico has turned a corner with two consecutive quarters of positive gross profits, marking a significant shift from its historical trend of operating below cost. However, the weight of substantial financial debts, totaling over VND 10,200 billion, primarily owed to its largest shareholder, Thaco Agri, continues to burden the company with interest expenses that erase these hard-earned profits.