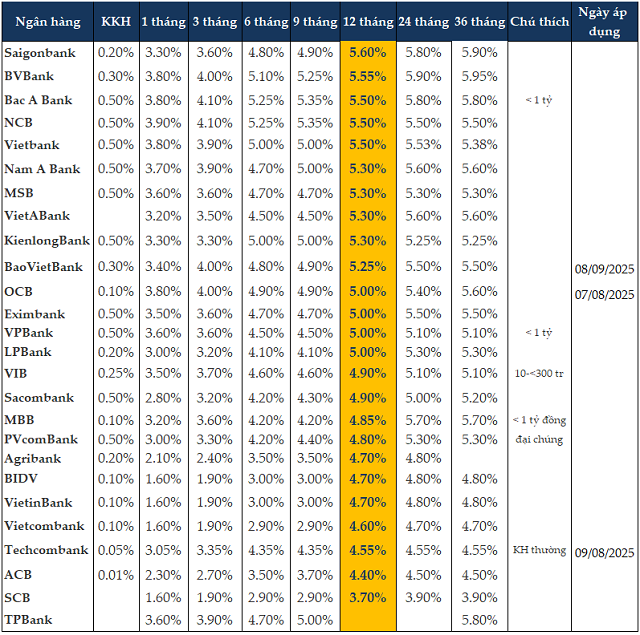

As of early September, there haven’t been significant fluctuations in deposit interest rates. However, there is a noticeable differentiation between joint-stock commercial banks and state-owned banks, indicating that banks are preparing capital for the credit demands of the upcoming months.

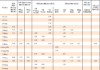

As of September 8, 2025, savings deposit rates for terms of 1-3 months are maintained between 1.6-4.1%/year, 6-9 months at 2.9-5.35%/year, and 12 months at 3.7-5.6%/year.

For the 12-month term, Saigonbank offers the highest deposit rate at 5.6%/year, followed by BVBank at 5.55%/year. NCB, Bac A Bank, and Vietbank offer rates of 5.5%/year.

For the 6-month term, Bac A Bank and NCB lead with a rate of 5.25%/year, followed by BVBank at 5.1%/year.

Meanwhile, for the 3-month term, Bac A Bank and NCB offer the highest rate of 4.1%/year, while BVBank, BaoVietBank, Nam A Bank, and OCB provide a rate of 4%/year.

|

Personal savings deposit rates at banks as of September 8, 2025

Source: Consolidated by the author.

|

State-owned banks (Agribank, Vietcombank, VietinBank, and BIDV) have applied deposit rates for terms of 1-3 months within the range of 1.6-1.9%/year, 6-9 months at 2.9-3.5%/year, 12 months at 4.6-4.7%/year, and over 12 months at 4.7-4.8%/year.

|

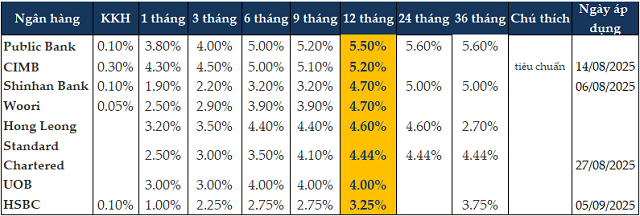

Personal savings deposit rates at foreign banks as of September 8, 2025

Source: Consolidated by the author

|

Foreign banks have also maintained stable deposit rates. As of September 8, the highest 12-month term deposit rate is offered by Public Bank at 5.5%/year, and for the 6-month term, Public Bank and CIMB offer a rate of 5%/year.

At the regular Government press conference for August on September 6, 2025, NHNN Deputy Governor Doan Thai Son stated that as of August 31, the average lending rate was 6.38%, a decrease of 0.56% compared to the end of 2024. However, the overall trend carries potential risks.

Credit debt at the end of August reached VND 17.14 quadrillion, an increase of 11.08% compared to the previous year. It is estimated that credit growth this year will reach about 20.19%, the highest level in many years, compared to the average of about 14.5%.

The Deputy Governor pointed out that the credit growth momentum leads to two consequences. First, banks are forced to increase capital mobilization, possibly pushing up deposit rates and subsequently lending rates. Second, rapid money supply growth can put medium and long-term inflationary pressure.

On September 7, 2025, Prime Minister Pham Minh Chinh signed Dispatch No. 159/CD-TTg on directing and administering fiscal and monetary policies. Accordingly, the State Bank of Vietnam (SBV) will take the lead in coordinating with relevant agencies to proactively, flexibly, timely, and creatively administer monetary policies, coordinating harmoniously and closely with fiscal and other macroeconomic policies to promote growth while ensuring macroeconomic stability, controlling inflation, and maintaining the economy’s major balances.

SBV will direct credit policies in line with macroeconomic developments and monetary policy objectives, meeting the credit demands of the economy. It will instruct credit institutions to continue reducing costs, simplifying administrative procedures, and accelerating digital transformation to create room for lowering lending rates. Credit will be directed towards production and business fields, priority areas, traditional growth drivers of the economy (investment, exports, and consumption), and new growth drivers (science and technology, innovation, digital economy, green economy, and circular economy).

At the same time, monetary policy tools and banking measures will be utilized to manage exchange rates flexibly, harmoniously, and effectively, balancing them with interest rates, and tightly controlling the foreign exchange market to stabilize the value of the Vietnamese dong.

Interest rates are expected to slightly decrease towards the end of the year.

In its latest monetary market report, MBS Securities Company forecasts that the input interest rate will slightly decrease to 4.7% by the end of 2025. By the year’s end, deposit rates are projected to face pressure from high credit growth, especially after the SBV’s announcement of increasing credit growth targets for credit institutions to meet the economy’s capital needs.

However, the SBV also continues to require credit institutions to implement synchronous solutions to stabilize and strive to reduce deposit rates, contributing to the stabilization of the monetary market and creating room for lowering lending rates. This, along with the expectation of the Fed cutting interest rates by 50 basis points in the second half of 2025, will help narrow the VND-USD interest rate gap, thereby enabling the SBV to maintain a low-interest rate environment.

Based on these factors, MBS projects that the 12-month term deposit rate of private joint-stock commercial banks will have room to decrease slightly by 2 basis points to 4.7% by the end of 2025.

In the VCBS Securities Company’s report on the outlook for the remaining months of the year, SBV’s new monetary policy tools, along with the expectation of the Fed reducing interest rates in September, help ease pressure on the interbank market as the bill tool becomes less effective. This also creates room for the SBV to maintain its low-interest rate policy until the end of the year.

In general, securities companies forecast that the deposit interest rate will fluctuate around the current level until the end of 2025. Despite the pressure to increase due to seasonal credit demands and exchange rate factors, with the SBV’s policy orientation and favorable macroeconomic factors, interest rates are not expected to fluctuate significantly and may even decrease slightly.

Cat Lam

– 12:00 09/08/2025

Will Bank Stocks Continue to Rise?

The banking sector’s rally may continue in the short term, but caution is warranted at this juncture, especially for novice investors. This is according to Mirae Asset Securities’ research, which suggests that while the industry’s uptrend might persist, the risks associated with entering the market at the present stage are considerable.

The Evolution of Banking in Q2 2025: A Comprehensive Overview

The recently released investment banking report by Rong Viet Securities (VDSC) offers intriguing insights into the industry’s performance in Q2 2025. This comprehensive report paints a detailed picture of the sector’s health, providing valuable information for investors and industry stakeholders alike.