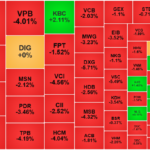

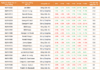

Blue chips made a strong comeback in the VN30 group, with 22 out of 30 stocks trading in positive territory. VCB, the market leader, contributed a significant 3.7 points to the VN-Index. It was joined by other banking stocks at the top, including VPB, LPB, CTG, and MSB, which also witnessed high trading volumes. SHB and VPB followed closely in second and third place, respectively, although SHB experienced a slight dip.

VN-Index inches closer to the 1,700-point mark.

Meanwhile, VPB climbed over 1% following the latest news about the IPO plans of its subsidiary, VPBank Securities (VPBankS). VPBankS has announced a resolution to increase its 2025 profit plan from 2,003 billion VND to 4,450 billion VND.

VPBankS intends to issue a maximum of 25% of its circulating shares to domestic and foreign individuals and organizations, equivalent to 375 million shares. Post-offering, the maximum number of shares will reach 1.875 billion, corresponding to a charter capital of 18,750 billion VND, ranking third in the industry.

Following the banking sector, HPG surged by 6%, along with other steel stocks, providing a significant boost to the VN-Index. Foreign investors also reversed to net buy HPG by over 670 billion VND. HPG led the market in liquidity, with a trading value of more than 4,100 billion VND, nearly 2.5 times that of the second-highest stock.

Hoa Phat has successfully produced the first batch of pig iron from the second blast furnace of its Dung Quat Iron and Steel Production Complex Project. With a total capacity of 12 million tons per year, the complex specializes in producing 9 million tons of hot-rolled steel coils annually. Other steel stocks, including TLH, HSG, and NKG, hit the daily limit, while stocks like TVN, VGS, and SMC rose by 3-4%.

On the other hand, previously hot real estate stocks cooled down, with CII, DXG, PDR, CEO, NVL, GEX, and IJC witnessing adjustments.

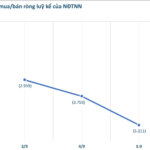

At the closing bell, the VN-Index climbed 14.99 points (0.89%) to 1,696.29. The HNX-Index and UPCoM-Index also posted gains, rising 1.29 points (0.46%) and 0.8 points (0.72%), respectively. Trading volume slightly increased from the previous session, with the value of transactions on HoSE surpassing 39,500 billion VND. Foreign investors narrowed their net selling to 857 billion VND, focusing on stocks like VPB, VHM, MSN, MWG, GEX, and DXG.

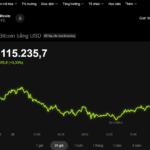

What’s Next for the VN-Index After Hitting an All-Time High?

“With a harmonious blend of robust growth prospects and a still-reasonable price-to-earnings ratio, the VN-Index has the potential to surpass the 1,700-1,800 level,” asserted the expert.

VN-Index Hits Record High, Surpassing 1,700 Points for the First Time

The Vietnamese stock market has been on a remarkable upward trajectory, and this trend has caught the attention of industry leaders and analysts alike. With the VN-Index surging, predictions are now being made that the index could reach a staggering 1,800 points this year and potentially go even higher in the near future. This has sparked excitement and interest among investors, who are now keenly watching this market’s every move.