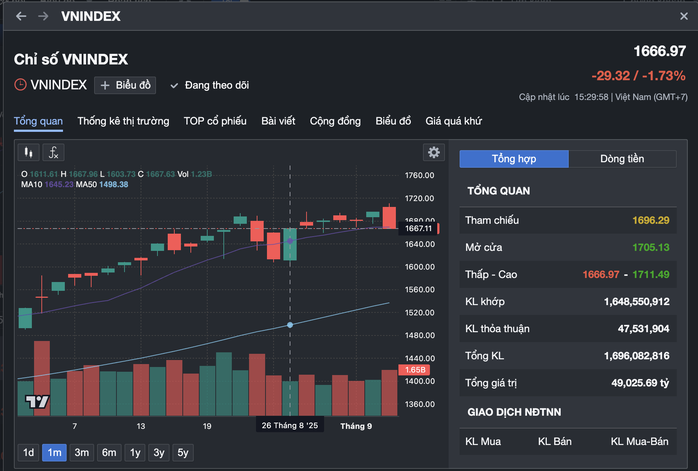

Wrapping up the first trading week of September, the VN-Index stands at 1,666 points, a 0.91% decrease from the previous week, retreating from its historic peak of 1,700 points. Meanwhile, the VN30 dipped to 1,845 points, and the HNX Index also fell back to 280 points.

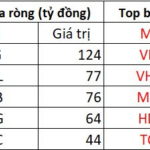

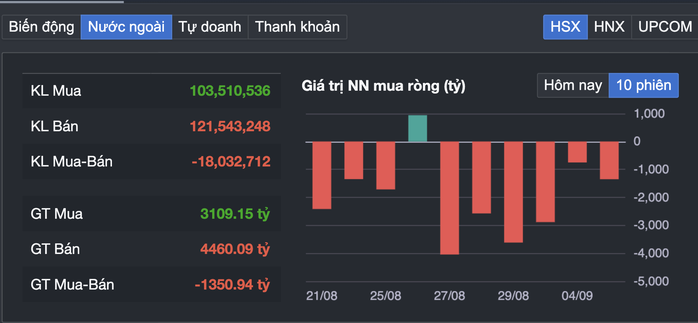

Capital flowed between industry groups, with strong inflows into steel, construction, industrial parks, seafood, oil and gas, and technology sectors. In contrast, heavy selling and profit-taking were observed in securities, banking, and real estate stocks, which had witnessed substantial gains. Foreign investors continued to offload holdings, with net sell orders exceeding VND 5,000 billion on the HOSE during the past week.

Many investors are concerned about the market’s short-term trajectory, fearing a downward correction after four consecutive months of gains. Notably, some investors still bought stocks during the last trading session of the week when the market surpassed 1,700 points.

“Brokers in my advisory group recommended purchasing real estate and oil and gas stocks last Friday. However, the stocks had not even been credited to my account before incurring losses of 5-6%,” shared Ms. Khanh Thy, an investor from Ho Chi Minh City, expressing her anxiety.

VN-Index plunges unexpectedly in the late trading session last week

According to SHS Securities Joint Stock Company, the recent sessions witnessed the VN-Index climbing with low liquidity, rising sell volumes, and signs of peaking around the 1,690-1,710 point range.

The market indicates a conclusion to the exceptional bullish phase, ushering in a period of adjustment and consolidation. Numerous stocks are facing intense selling pressure. Investors are advised to maintain a reasonable portfolio mix, focusing on fundamentally robust stocks, industry leaders in strategic sectors, and outperforming segments of the economy.

Mr. Nguyen Tan Phong, an analyst at Pinetree Securities Company, remarked that the VN-Index commenced September with two consecutive gaining sessions. Capital flowed from banking stocks to other sectors, including steel, real estate, and mid-cap stocks.

According to statistics, foreign institutions net bought nearly VND 9,000 billion in July but have since net sold approximately VND 29,000 billion throughout August and the first week of September. Domestic investors have had to absorb this selling pressure to sustain the VN-Index’s upward trajectory.

Hold Off on Buying New Stocks Next Week?

“The upcoming week’s first trading session will be crucial in signaling the market’s short-term direction. The VN-Index has support at 1,645 points, and if it holds above this level, a technical rebound and consolidation around the 1,670-point zone are likely.

In a more pessimistic scenario, the VN-Index could retreat to the 1,580-1,600 range. Investors should proactively manage their portfolios, reducing equity exposure to safe levels, and refrain from initiating new stock purchases during this period,” forecasted Mr. Phong.

Foreign investors net sell over VND 5,000 billion in the past week

Vietnam Construction Securities Joint Stock Company (CSI) also assessed that the last trading session’s intense selling pressure, which pushed the VN-Index into negative territory, erasing the gains from the previous five sessions, serves as a strong warning sign of an impending correction.

With the VN-Index trading at historic highs, the probability of a corrective phase following four months of upward momentum is relatively high.

“Adopting a cautious stance, investors should refrain from rushing back into net buying positions prematurely. Instead, it is advisable to remain patient and await a balanced corrective phase to identify safer entry points,” advised CSI.

Numerous investors bought stocks as the VN-Index breached 1,700 points, only to incur losses during the same session

Will the VN-Index Regain its 1,700-Point Mark? A Look at Vietnam’s Stock Market Outlook for the Week Ahead.

The VN-Index surpassed the 1,700-point resistance level after the holiday, but this victory was short-lived as it swiftly turned downwards. As profit-taking pressures mounted, liquidity dried up, and foreign investors remained net sellers, the market closed the week in negative territory, sparking concerns about a potential short-term peak.

Mirae Asset: VN-Index to Surge Past 1,800 Points in September, Brace for More Volatile Swings

Mirae Asset envisions a bullish trajectory for the VN-Index in September, anticipating a rebound from the 1,650-point support level, paving the way for a surge towards the 1,800-point mark.

Expert Insights: VN-Index Expected to Resume Uptrend Soon, But Hold Off on New Investments for Now

The MBS expert believes that the market remains on a positive trajectory and is poised to rebound swiftly. The underlying strength is evident as buying pressure absorbs profit-taking, indicating a robust foundation for a potential upswing.