In the morning session, the VN-Index surpassed 1,700 points for the first time in history. However, the market quickly turned around due to profit-taking pressures at higher prices. Blue-chip stocks witnessed intense selling pressure, causing the market to plunge.

VN-Index plunges after hitting a peak of 1,700 points

On September 5, the VN-Index dropped by 29.32 points (-1.73%) to 1,666.97.

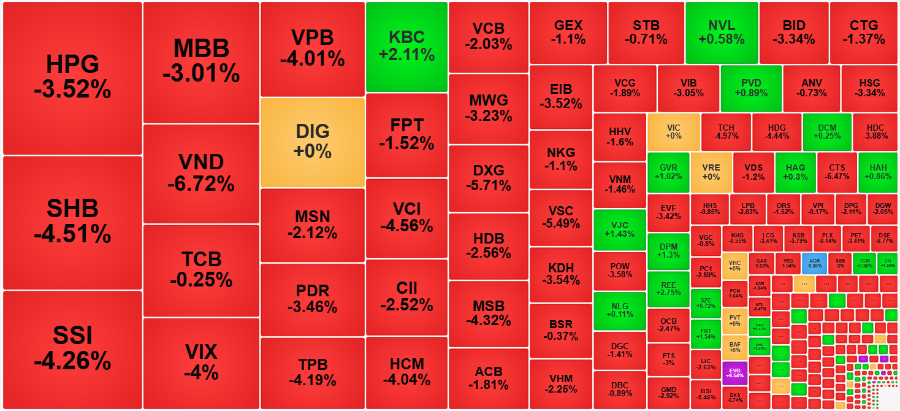

Banking stocks had the most significant impact on the index, with notable declines in VPB, TPB, MSB, and SHB, which fell by over 4%. This was followed by VCB, NAB, OCB, HDB, LPB, MBB, VIB, BID, and EIB, which decreased by more than 2% to 3.5%. Among these, SHB stood out with a dominant matched order volume of over 131.9 million units.

Securities stocks witnessed the sharpest decline in the market. Specifically, AGR plunged by -6.9% to 19,050 VND per share, DSE fell by -6.77% to 30,300 VND, VND dropped by -6.7% to 25,000 VND, and CTS decreased by -6.5% to 41,200 VND. Other securities stocks, including FTS, TVB, VIX, HCM, SSI, VCI, and BSI, also experienced declines ranging from 3% to 5.5%.

In the steel sector, HPG reversed its strong performance from the previous session, falling by 3.5% to 28,800 VND. It ranked second in terms of matched order volume on the exchange, with over 95.2 million units.

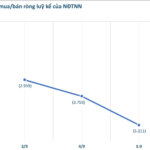

Foreign investors net sold nearly VND 1,351 billion, including a net sell of VND 1,307 billion in the VN30 basket. Notable stocks that were sold included VPB (-VND 268.2 billion), VHM (-VND 204.4 billion), MBB (-VND 154.9 billion), HDB (-VND 129.9 billion), and TCB (-VND 129.6 billion). On the buying side, DIG (+VND 124.4 billion), NVL (+VND 76.9 billion), and SHB (+VND 76.1 billion) were among the notable stocks.

The HoSE saw 100 advancing stocks and 230 declining stocks. Total trading volume exceeded 1.69 billion units, with a value of VND 48,820 billion, marking a 22% increase in volume and a 23% surge in value compared to the previous session. Block deals contributed over 62 million units, valued at VND 1,362 billion.

On the HNX, 72 stocks advanced while 95 declined, and the HNX-Index fell by 3.32 points (-1.17%) to 280.67. The total matched order volume reached over 174.3 million units, with a value of VND 4,254 billion. Additionally, block deals accounted for 2.2 million units, valued at VND 32.1 billion.

The UpCoM-Index decreased by 0.03 points (-0.03%) to 96.8. The total matched order volume exceeded 96.8 million units, with a value of VND 1,121.4 billion. Block deals contributed an additional 3.45 million units, valued at VND 36.6 billion.

VN-Index Hits Record High, Surpassing 1,700 Points for the First Time

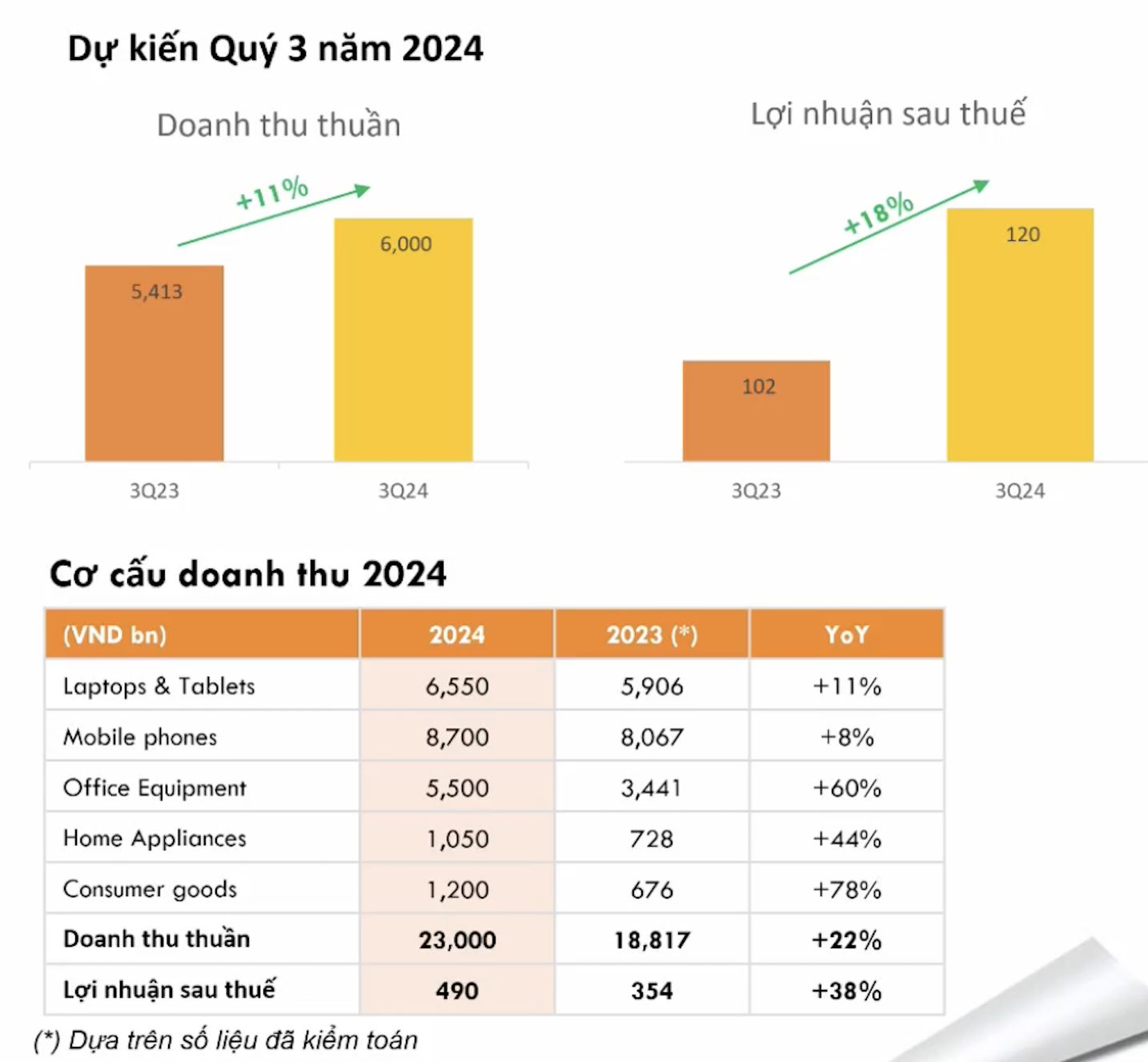

The Vietnamese stock market has been on a remarkable upward trajectory, and this trend has caught the attention of industry leaders and analysts alike. With the VN-Index surging, predictions are now being made that the index could reach a staggering 1,800 points this year and potentially go even higher in the near future. This has sparked excitement and interest among investors, who are now keenly watching this market’s every move.

“Vietnam’s Stock Market Upgrade: A Transformational Story”

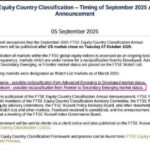

As of March 2025, Vietnam is on the FTSE Watch List and is considered a strong contender for reclassification from a Frontier to a Secondary Emerging Market.