I. MARKET DEVELOPMENT OF WARRANTS

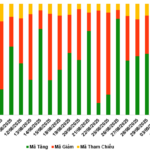

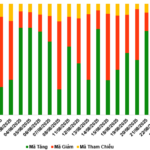

As of the trading session on 05/09/2025, the market closed with 58 advancing codes, 179 declining codes, and 22 reference codes.

Market breadth over the last 20 sessions. Unit: Percentage

Source: VietstockFinance

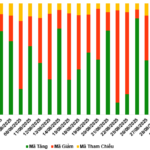

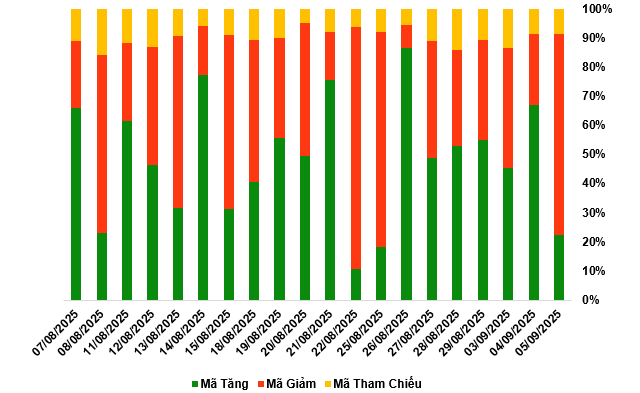

In the trading session on 05/09/2025, sellers returned to lead the market, causing most of the warrant codes to decrease in price. Specifically, the large codes in the declining group were CVPB2513, CVHM2510, CMBB2511, and CTCB2503.

Source: VietstockFinance

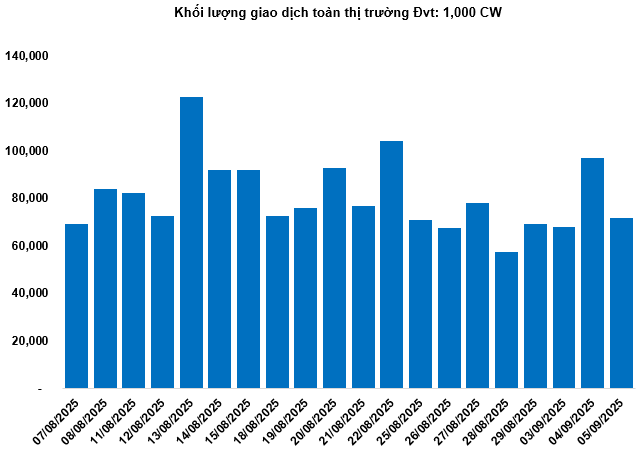

The total market trading volume in the 05/09 session reached 71.51 million CWs, down 26.06%; the trading value reached VND 186.35 billion, down 26.26% compared to the previous session. Of which, CHPG2528 was the code leading the market in volume with 2.99 million CWs; CHPG2524 led in trading value with VND 9.46 billion.

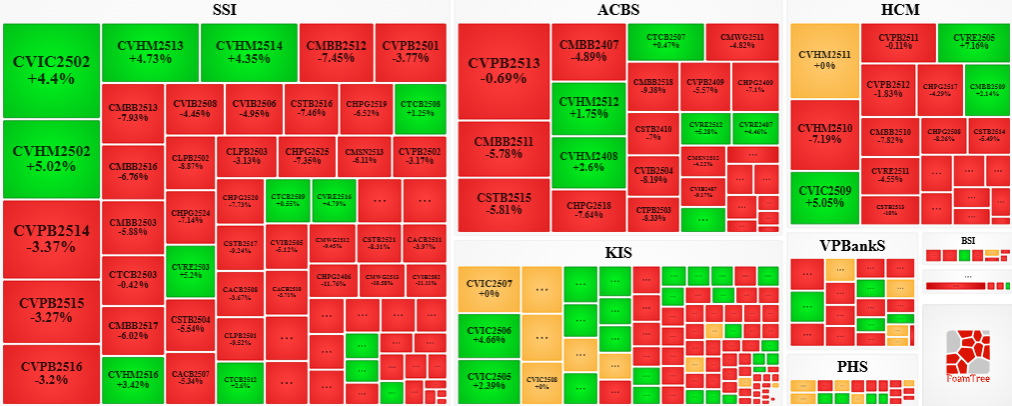

Foreign investors returned to net sell in the session of 05/09 with a total net sell of 491,300 CWs. In particular, CVNM2517 and CHPG2515 were the two codes that were net sold the most. For the whole week, foreign investors net bought more than 1.6 million CWs.

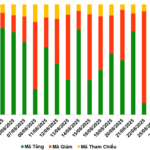

Securities companies SSI, ACBS, KIS, HCM, and VPBank are currently the organizations with the most warrant codes in the market.

Source: VietstockFinance

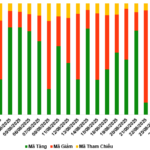

II. MARKET STATISTICS

Source: VietstockFinance

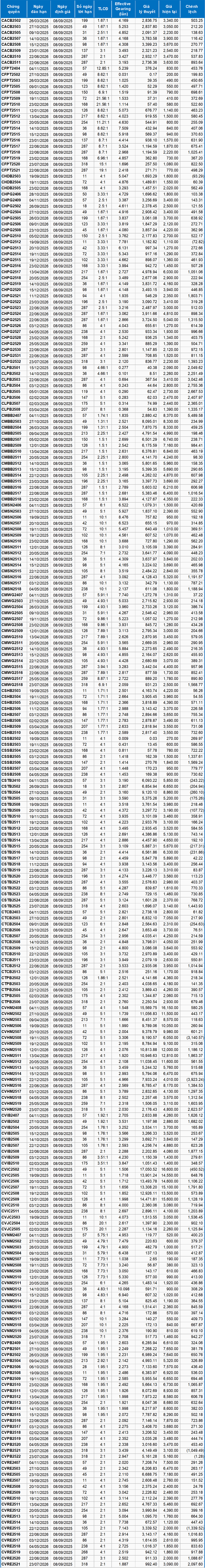

III. WARRANT PRICING

Based on the appropriate pricing method for the starting point of 08/09/2025, the reasonable prices of the warrants currently traded in the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the pricing model is adjusted to suit the Vietnamese market. Specifically, the risk-free bill interest rate (Government bills) will be replaced by the average deposit interest rate of large banks with term adjustments suitable for each type of warrant.

According to the above valuation, CVHM2515 and CVHM2508 are currently the two warrant codes with the most attractive valuations.

The higher the effective gearing ratio of a warrant code, the greater its increase/decrease relative to the underlying stock. Currently, CVNM2512 and CMSN2506 are the two codes with the highest effective gearing ratios in the market.

Department of Economic Analysis & Market Strategy, Vietstock Consulting Department

– 18:58 07/09/2025

The Warrant Market on September 5, 2025: Foreign Investors Turn Net Buyers Again

The market closed on September 4th, 2025, with a positive sentiment. A total of 173 stocks rose, while only 64 declined, and 22 remained unchanged. Foreign investors returned to net buying, with a total net purchase of 3.04 million CW.

The Warrant Market This Week: Foreign Investors Continue Their Selling Spree

The trading session on August 29, 2025, concluded with a mixed performance across the market. Out of all the stocks traded, 142 witnessed an increase in their value, while 89 declined, and 28 remained unchanged. Foreign investors continued their net-selling trend, offloading a total of 3 million covered warrants.

The Warrant Market on August 28, 2025: A Mosaic of Green and Red

The trading session on August 27, 2025, concluded with a mixed performance across the market. Out of all the stocks traded, there were 126 gainers, 104 losers, and 29 stocks that remained unchanged. Foreign investors continued their net-selling trend, offloading a total of 1.18 million covered warrants.

The Warrant Market on August 27, 2025: Is the Outlook Less Grim?

The trading session on August 26, 2025, concluded with a positive note for the market, witnessing 224 advancing stocks, 21 declining stocks, and 14 stocks remaining unchanged. Foreign investors continued their net-selling trend, offloading a total of 2.69 million covered warrants.