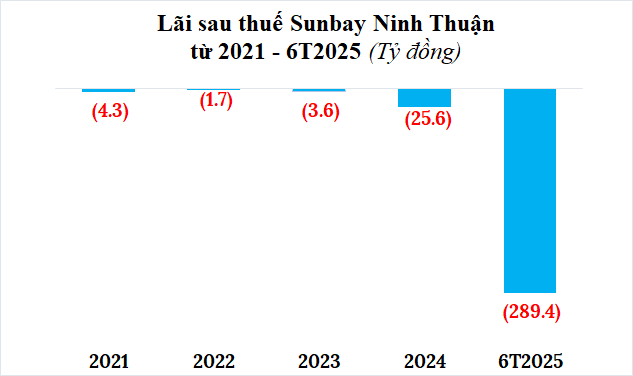

Sunbay Ninh Thuan reports a record half-year loss of over 289 billion VND for 2025, a slight increase from the 281 billion VND loss in the same period last year. This continues a streak of negative financial milestones since the company began reporting to the Hanoi Stock Exchange (HNX) in 2021.

Source: Consolidated by the author

|

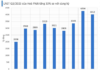

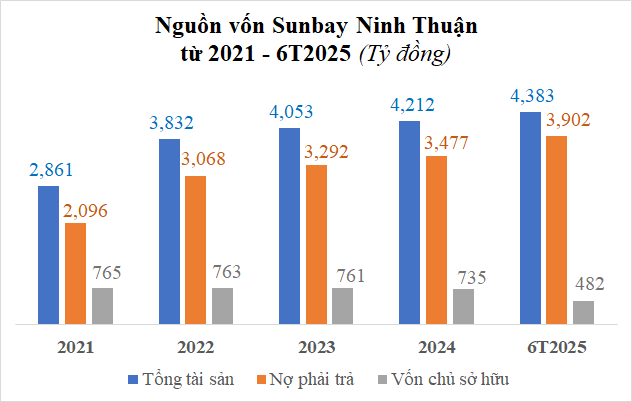

As of the end of June, SBPC’s total assets reached over 4,383 billion VND, a modest 4% increase from the beginning of the year. However, owner’s equity saw a significant 34% decline, falling to nearly 482 billion VND, with a cumulative loss of over 289 billion VND. Payable debt exceeded 3,900 billion VND, including over 1,547 billion VND in bonds and over 2,354 billion VND in other debts.

Source: Consolidated by the author

|

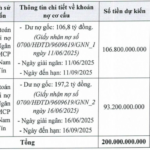

According to HNX data, the company has four batches of bonds issued in 2021 and 2022, with a total remaining value of nearly 1,555 billion VND. All of these bonds carry a 9.5% annual interest rate and will mature between 2026 and 2028.

In March, SBPC added collateral to these bond batches, including nearly 31.2 million shares of Ninh Chu Bay JSC and related rights and interests legally owned by a third party, representing a corresponding 77.99% stake in Ninh Chu Bay; and over 2.6 million shares of Commercial – Resort Hoan Cau JSC, corresponding to a 30% stake in Resort Hoan Cau.

It is worth noting that the shares pledged as collateral for the bonds are owned by Crystal Bay JSC and Mr. Nguyen Duc Chi.

Established in April 2017, Sunbay Ninh Thuan primarily operates in the restaurant and mobile catering services industry. Its initial chartered capital was 110 billion VND, with founding shareholders including Real Estate Investment JSC contributing 52.746%, Mr. Nguyen Van Cuong with 46.254%, and Mr. Nguyen Hong Phuc (serving as Director and legal representative) with 1%. In October of the same year, the founding shareholders divested entirely, and the new shareholder list was not disclosed. Mr. Nguyen Duc Chi took on the role of General Director and legal representative, which he holds to this day. The chartered capital has since increased to 770 billion VND.

Sunbay Ninh Thuan Adds Collateral for Over 1,500 Billion VND Bond Issues

Major SunBay Ninh Thuan Project Owner Continues to Incur Losses

– 11:33 08/09/2025

Former Vice Head of the National Assembly’s Office, Pham Thai Ha, Appears in Court Over Thuân An Case

Former head of the National Assembly Office Pham Thai Ha has been accused of abusing his position to introduce and influence opportunities for Thuan An Group to participate in bidding and construction project implementation.

“Devastating Losses for TTC Phu Quoc: A Grueling First Half with a Staggering $150 Million Deficit, Erasing Four Years’ Worth of Profits”

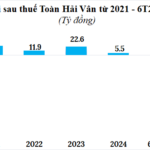

The first half of 2025 saw a surprising turn of events for Toàn Hải Vân (TTC Phú Quốc, THVC), as the company reported a record loss of nearly VND 150 billion. This stark contrast to the previous year’s profits of VND 21 billion during the same period wiped out the cumulative gains of the four years from 2021 to 2024, which totaled just under VND 64 billion.

“Dire Straits for An Thinh Company: First-Half Losses See Debts Quadruple Equity”

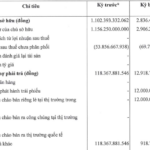

An Thịnh Company reported a loss of nearly VND 12 billion in the first half of 2025, bringing its cumulative loss to nearly VND 70 billion. The company’s total liabilities stand at nearly VND 13,000 billion, 4.5 times its equity.