Sunbay Ninh Thuan JSC has released its periodic financial report for the first six months of 2025 to the Hanoi Stock Exchange (HNX).

According to the report, Sunbay Ninh Thuan recorded a post-tax loss of over 8 billion VND, an improvement from the 10 billion VND loss in the first half of 2024.

As of the second quarter of 2025, the company reported accumulated losses of nearly 290 billion VND. The consecutive losses have also eroded the company’s equity to just under 482 billion VND.

As of June 30, 2025, the debt-to-equity ratio was 8.1 times. Total liabilities stood at 3,901 billion VND, an increase of 12.2% from the previous period. This includes bond debt of 1,547 billion VND and other payables of 2,354 billion VND.

The financial report for this period of Sunbay Ninh Thuan was audited by A&C Audit and Consulting Company Limited – Hanoi Branch.

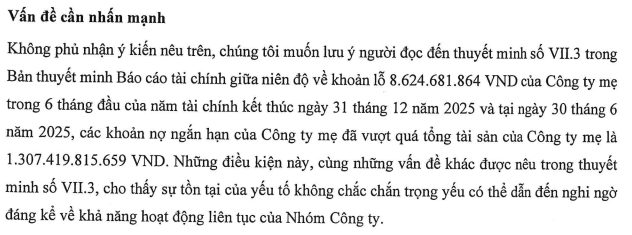

In addition to the loss of over 8 billion VND this period, the auditor also emphasized that as of June 30, 2025, Sunbay Ninh Thuan had short-term debt exceeding the total assets of the parent company by 1,307.4 billion VND.

These conditions indicate the existence of material uncertainty that may cast significant doubt on the group’s ability to continue as a going concern.

Screenshot. Source: HNX

Data from HNX shows that Sunbay Ninh Thuan has four batches of bonds with a total issuance value of 1,700 billion VND and a current circulation value of 1,555 billion VND.

Of these, the SBPCB2124002 bond, issued on December 23, 2021, with an issuance value of 799.9 billion VND, currently has a circulation of nearly 654.9 billion VND. In June 2025, the issuer was approved to extend the bond term to 60 months, with a new maturity date of December 23, 2026.

The SBPCB2225001 bond, issued on May 17, 2022, with a value of 200 billion VND, is expected to mature on May 17, 2025. This bond has also been extended to a 60-month term, with a new maturity date of May 17, 2027.

Similarly, the SBPCB2227002 bond, valued at 300 billion VND and issued on May 17, 2022, has been extended to a 60-month term and will mature on May 17, 2027.

Finally, the SBPCB2228003 bond, issued on May 17, 2022, with a value of 400 billion VND, has been extended to a 72-month term and will mature on May 17, 2028.

SunBay Ninh Thuan was established in April 2017 with an initial charter capital of 110 billion VND. In September 2023, the company increased its charter capital to 770 billion VND.

As of October 2024, Mr. Nguyen Duc Chi is the Chairman of the Board of Directors and legal representative of the company.

Sunbay Ninh Thuan is a member of the resort real estate ecosystem chaired by Mr. Nguyen Duc Chi.

The company is the investor of the SunBay Park Hotel & Resort project. The project was approved on July 17, 2019, with an area of over 3.6 hectares, located along the coastline of Phan Rang-Thap Cham city, Ninh Thuan province (now part of Khanh Hoa province). With a total investment of 4,779 billion VND, the project comprises three towers: Lazurya, Nuvensa, and Crystal Holidays.

“F88 Records a Net Profit of Over VND 252 Billion in the First Half of 2025”

As of the end of the first half of 2025, F88 reported a net profit of VND 252.4 billion, a remarkable 2.8 times higher than the same period last year. The company’s total liabilities stand at over VND 3,612.3 billion.

“A Surprising Turnaround: Stock Surges with a 63% Post-Tax Profit Jump Post-Audit”

With the release of its 2025 half-year audited financial report, TV2 has achieved a remarkable feat, surpassing 60% of its annual net profit plan for the year.