Source: HNX

|

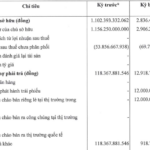

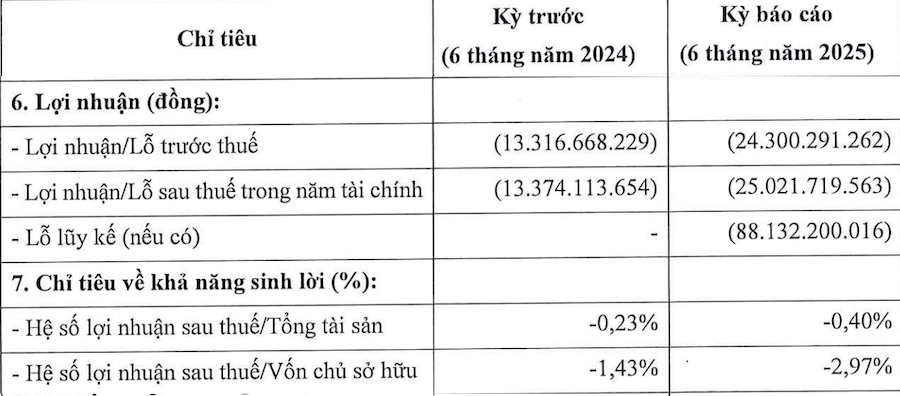

With a registered capital of 800 billion VND, the company’s total liabilities stand at a staggering 5,365 billion VND. The debt-to-asset ratio has increased to 0.86, up from 0.84 in the previous year. Similarly, the debt-to-equity ratio has climbed from 5.19 to 6.36 during the same period.

In terms of liquidity, the current ratio (current assets/current liabilities) has decreased to 1.01, compared to 1.04 in the previous year. Additionally, the quick ratio ((current assets – inventory)/current liabilities) is at 0.7.

Sunshine Marina Nha Trang’s liabilities include no bank loans, with bond debt amounting to just over 50 billion VND. Meanwhile, the company has seen a significant increase in short-term customer advances, totaling nearly 3,010 billion VND, a 75% surge from the previous year. On the other hand, loans and finance leases (excluding bank loans and bonds) have decreased by 22%, now totaling over 1,041 billion VND.

Traded on the HNX, the company also has a bond issue identified as SMNCH2123001, with an outstanding value of over 50.1 billion VND. These bonds, initially issued at 750 billion VND on October 25, 2021, will mature on October 25, 2025, with an interest rate of 11% per annum.

At the time of issuance, the collateral consisted of 4 million common shares with a total par value of 400 billion VND, representing 4.7% of the charter capital of Sunshine Group Joint Stock Company. Additionally, the supplementary collateral included 110 million shares with a par value of 1,100 billion VND, equivalent to 7.33% of the charter capital of S-Homes Real Estate Investment and Trading Joint Stock Company.

Established in 2013 in Hanoi, the founding shareholders of Sunshine Marina Nha Trang were Mr. Do Van Truong, Mrs. Le Thi Tuyet, and Mr. Do Anh Tuan. All of the founding shareholders have since transferred their ownership.

In July of this year, the company appointed a new General Director and legal representative, Mr. Nguyen Trung Kien, who succeeded Mr. Nguyen Dinh Duc.

– 21:29 09/07/2025

“IPA Hydropower Company Reports 14% Dip in Half-Yearly Profits”

“In the first half of 2025, Bac Ha Energy reported a remarkable after-tax profit of over 30 billion VND, reflecting a 14% decrease compared to the same period last year. The company also witnessed a significant reduction in its total liabilities, which fell by 25.6% to 551 billion VND, showcasing a strong financial performance and a positive trajectory for the remainder of the year.”

“F88 Records a Net Profit of Over VND 252 Billion in the First Half of 2025”

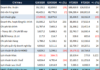

As of the end of the first half of 2025, F88 reported a net profit of VND 252.4 billion, a remarkable 2.8 times higher than the same period last year. The company’s total liabilities stand at over VND 3,612.3 billion.

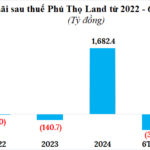

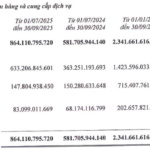

“Phú Thọ Land Plunges into $15 Million Loss in the First Half of 2025”

In a stark contrast to its remarkable performance in 2024, where it achieved a staggering profit of over VND 1,680 billion, Phu Tho Land JSC ended the first half of 2025 with a notable decline, posting a loss of nearly VND 394 billion in after-tax profit. This is a significant deviation from the previous year’s success, where the company recorded a profit of almost VND 60 billion in the same period.