T-Cap Securities: Pioneering Foreign Ownership Expansion and Robust Financial Performance

On September 4, 2025, the Board of Directors of T-Cap Securities (HOSE: TVB) took a pivotal step towards enhancing its appeal to international investors. The resolution to raise the limit on foreign ownership to the maximum threshold of 100% of charter capital showcases T-Cap’s bold integration ambitions and its commitment to global best practices in governance.

A Transformational Reorganization: Following the 2025 Annual General Meeting, T-Cap embarked on a comprehensive restructuring, streamlining its operations for enhanced efficiency. The company strategically invested in bolstering its team of expert analysts while focusing resources on top-performing stocks across key sectors, including banking, steel, and retail.

By raising the foreign ownership limit to 100%, T-Cap aims to further enhance its transparency and align its governance with international standards. This move also opens the door to attracting foreign strategic investors with robust financial resources, cutting-edge technology, and modern management expertise.

Robust Financial Health and Quality Investments: T-Cap boasts a robust financial position, with a focus on short-term financial assets, including cash and proprietary stocks, comprising 60% of its short-term financial assets. Notably, the company has no short-term borrowings, presenting significant potential for capital mobilization to fund investments and margin lending, optimizing profitability.

As of August 31, 2025, T-Cap’s operating cash flow/total debt ratio stood at an impressive 50.34x, the highest in recent periods. This underscores the company’s exceptional cash flow generation capabilities, enhancing its solvency and significantly reducing financial risks. T-Cap has also prudently set aside provisions of VND 512 billion against its total receivables of VND 780 billion, with the remaining amount secured by listed stocks. The robust performance of its proprietary trading business has led to a notable improvement in the company’s operating cash flows.

T-Cap’s core business of proprietary trading holds a positive outlook on the Vietnamese stock market in the upcoming period. The company has strategically increased its investments in leading stocks across banking, securities, steel, and retail sectors, including CTG, SSI, HPG, and MWG. With a current investment portfolio of nearly VND 700 billion and a proven track record of impressive investment returns averaging 20%/investment cycle, T-Cap’s proprietary trading business is poised to drive significant contributions to the company’s overall performance through 2025.

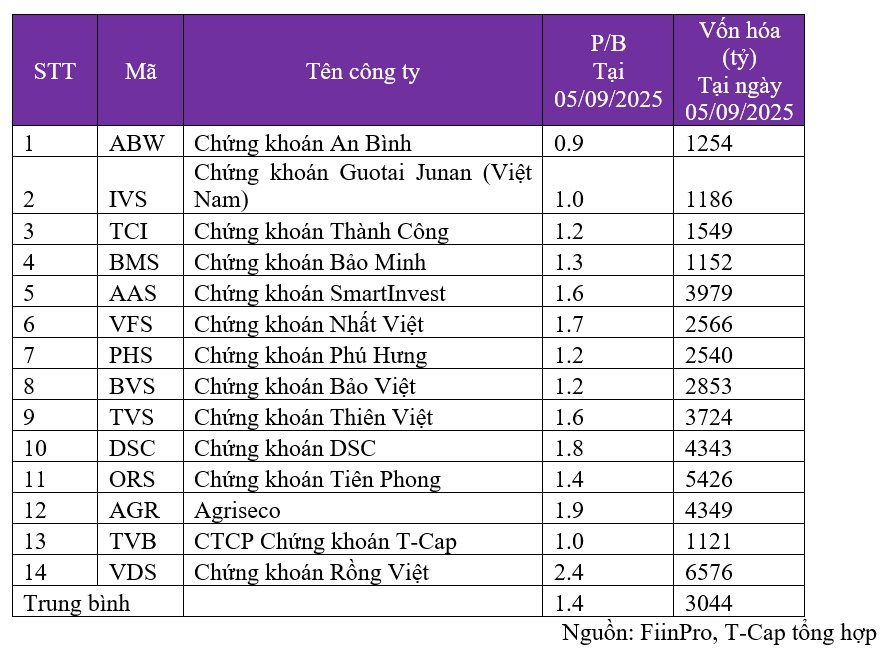

TVB – An Attractively Valued Stock: The Vietnamese stock market witnessed robust growth in the first half of 2025, with the VN-Index surpassing the 1,700-point mark. Many securities stocks also witnessed a surge, pushing the industry’s average P/B ratio to approximately 1.4x. In contrast, TVB’s current P/B ratio stands at a modest 0.93x, indicating untapped valuation potential. With its ongoing transformation journey and comprehensive restructuring efforts, TVB is well-positioned for significant growth in the upcoming period.

The Ultimate Guide to IR for Small and Medium-Sized Businesses

Investor Relations (IR) cannot be an effective, efficient, and results-driven activity if it is merely considered a “side task” for the accounting department or corporate secretary. True investor confidence is built when IR is recognized by leadership as a long-term strategy intertwined with sustainable development, rather than a “short-term campaign” solely focused on equity issuance.

“Revenue Soars, Profits Surge: The Power Giant Enters a Billion-Dollar Growth Cycle”

This company is Vietnam’s second largest independent power producer, with an impressive installed capacity of 4,230 MW. A true powerhouse in the industry, this enterprise illuminates the nation with its bright ideas and innovative energy solutions.