According to a recent announcement by the Hanoi Stock Exchange (HNX), Taseco Land, a prominent real estate investment company (HoSE: TAL), has provided an update on its debt servicing.

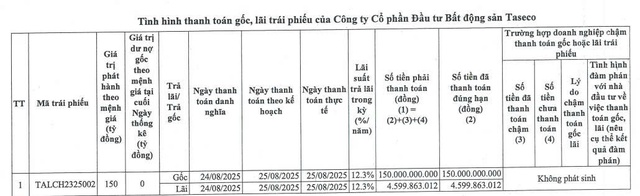

On August 25, 2025, Taseco Land made a substantial payment of VND 150 billion in principal and nearly VND 4.6 billion in interest for the bond series with the code TALCH2325002, successfully redeeming the bonds upon maturity.

The bond series in question comprised 1,500 bonds, each with a face value of VND 100 million, totaling a principal amount of VND 150 billion. These bonds were issued between August 24, 2023, and August 31, 2023, with a two-year term, maturing on August 24, 2025.

Source: HNX

During the first half of 2025, Taseco Land also made timely interest payments totaling nearly VND 9.3 billion for the aforementioned bond series TALCH2325002.

Additionally, the company made a significant payment of VND 130 billion in principal and over VND 3.4 billion in interest for another bond series, TALCH2325001, resulting in an early redemption of this bond series.

The TALCH2325001 bond series consisted of 2,000 bonds, issued on May 30, 2023, with a total value of VND 200 billion. With a two-year term, these bonds were expected to mature on May 30, 2025.

In 2024, Taseco Land had previously repurchased a portion of this bond series ahead of schedule on two occasions. On May 30, 2024, the company repurchased VND 30 billion worth of bonds, and on December 2, 2024, it repurchased an additional VND 40 billion.

In other news, Taseco Land has recently announced its plans to proceed with a private placement of shares, as approved by the General Meeting of Shareholders through Resolution No. 02/2025/NQĐHĐCĐ dated September 3, 2025.

The company intends to offer 48.15 million shares to professional securities investors to raise its charter capital. The offering price is set at VND 31,000 per share.

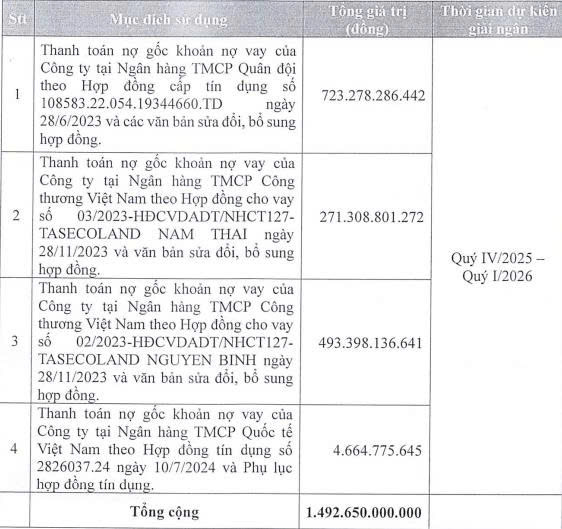

The expected proceeds from this private placement, amounting to nearly VND 1,492.7 billion, will be utilized to restructure the company’s debts as outlined below:

Source: TAL

According to the list disclosed by Taseco Land, 15 professional securities investors from Vietnam are set to participate in this private placement.

Among them, Hanoi-based Saigon-Hanoi Securities JSC (SHS) is expected to acquire 8 million shares, equivalent to a 2.22% stake. VietNam Enterprise Investments Limited, HaNoi Investments Holdings Limited, Amersham Industries Limited, DC Developing Markets Strategies Public Limited Company, and Samsung VietNam Securities Master Investment Trust (Equity), all members of the Dragon Capital group of funds, are slated to collectively receive 20 million shares.

Vietinbank Securities JSC (CTS) is also anticipated to purchase 2 million shares of Taseco Land.

The private placement is scheduled to take place in the third and fourth quarters of 2025, following the submission of the offering registration to the State Securities Commission of Vietnam (SSC).

Upon the successful completion of this issuance, Taseco Land’s outstanding shares are expected to increase from 311.85 million to 360 million, resulting in a corresponding increase in its charter capital from VND 3,118.5 billion to VND 3,600 billion.

“IPA Unveils a Whopping 209 Billion VND Payment for Bond Interest and Principal”

In the first half of 2025, IPA made principal and interest payments totaling over VND 209.4 billion for three bond lots.

Home Credit Vietnam Records Over VND 1,160 Billion in Net Profit for H1 2025

As of the end of the first half of 2025, Home Credit Vietnam reported a net profit of over VND 1,166.6 billion, a significant surge of 146.1% compared to the same period last year. The company’s outstanding debt from bond issuances stood at VND 6,700 billion, marking an increase of 91.4%.