The VN-Index witnessed a sharp decline in the afternoon session, plunging into negative territory, despite crossing the 1,700-point mark earlier in the day. The sell-off pressure resulted in a sea of red across the market.

At the close of September 5th, the VN-Index fell by 29.32 points (-1.73%) to 1,666.97 points, with 230 declining stocks outweighing 100 gainers. The HNX-Index and UPCoM-Index also experienced losses, dropping by 3.32 points (-1.17%) to 280.67 points and 0.03 points (-0.03%) to 111.82 points, respectively.

Banking stocks, which hold significant sway over the market, took a beating during today’s session, with 25 out of 27 stocks in the sector closing in the red. Only PGB managed to stay afloat with a reference price, while the remaining 26 stocks witnessed declines.

SHB stood out as the worst performer among banking stocks, shedding over 4.5% to close at VND18,000 per share. It also maintained high liquidity, with nearly 132 million shares traded via direct matching on the exchange—the highest across all three exchanges. SHB’s decline comes on the heels of a remarkable rally since early July, during which it surged from VND11,500 to the VND19,000 range, marking a staggering 65% increase in just two months.

Other stocks that had been on a hot streak recently also faced significant corrections today, including MSB (-4.3%), TPB (-4.2%), VPB (-4%), and EIB (-3.5%). Large-cap banking stocks were not spared either, with notable declines in BID (-3.3%), MBB (-3%), VCB (-2%), and ACB (-1.8%), among others.

Foreign investors continued their net selling trend in many banking stocks, with VPB (VND268 billion), MBB (VND155 billion), HDB (VND130 billion), TCB (VND130 billion), STB (VND78 billion), and CTG (VND73 billion) bearing the brunt of their selling pressure. On the flip side, they net bought SHB and EIB.

Prior to today’s session, banking stocks had been on an unprecedented rally, with several stocks delivering returns of 40-50%, and even 80-90% in just two months.

The upward momentum in banking stocks could be attributed to a slew of positive news, most notably the impressive Q2 earnings reports, the legalization of Resolution 42 by the National Assembly, and the State Bank’s decision to ease credit growth limits and lower reserve requirements for banks taking over specially controlled credit institutions.

Additionally, the anticipation of a market upgrade in September, along with individual catalysts such as IPOs of subsidiaries, expansions into digital banking, capital raising plans, and dividend payouts, further fueled the optimism surrounding the banking sector.

Technical Analysis for September 5th: Breaking the 1,700-Point Barrier

The VN-Index shattered its previous August 2025 peak (which hovered around the 1,680-1,696 range), breezing past the psychological threshold of 1,700 points and reaching an all-time high.

The Rising Titans: HOSE Welcomes Three New Members to the $10 Billion Capitalization Club

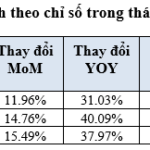

In August 2025, the HOSE witnessed a remarkable surge with key indices climbing upwards. This positive momentum was further emphasized by the growth of most sectoral indices compared to the previous month. Riding on this wave of optimism, HOSE proudly welcomed two more businesses with a market capitalization of over USD 1 billion each and an additional three enterprises with a market cap exceeding USD 10 billion.

Steel Stocks: A Magnet for Investment Funds

With the strong comeback of large-cap stocks, the VN-Index surged towards the 1,700-point mark. Steel stocks attracted significant trading volume in today’s session (September 4th).