The Vietnamese stock market witnessed a euphoric rally, reaching new historical highs before reversing course and closing the session on September 5th with a significant decline. The VN-Index ended the day down 29.32 points at the 1,666.97 level. A positive note was the substantial improvement in liquidity compared to the previous session, with the matching value on HoSE reaching VND 47,430 billion.

In this context, foreign investors continued to offload Vietnamese stocks, with a net sell figure of VND 1,452 billion for the day. Here’s a breakdown by exchange:

HoSE: Net foreign selling of approximately VND 1,351 billion

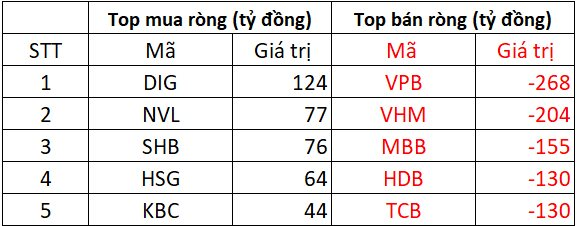

On the buying side, DIG was the most prominently purchased stock by foreign investors, with a net buy value of VND 124 billion. NVL and SHB also witnessed strong net buying, with inflows of VND 76-77 billion each. Additionally, HSG and KBC attracted net buys ranging from VND 44 billion to VND 64 billion.

Conversely, VPB witnessed the largest net sell-off, with foreign investors offloading VND 268 billion worth of the stock. VHM also faced strong net selling pressure from foreign investors, resulting in outflows of over VND 200 billion. Other banking stocks such as MBB, HDB, and TCB experienced notable net selling in the range of VND 130-155 billion.

HNX: Net foreign selling of approximately VND 67 billion

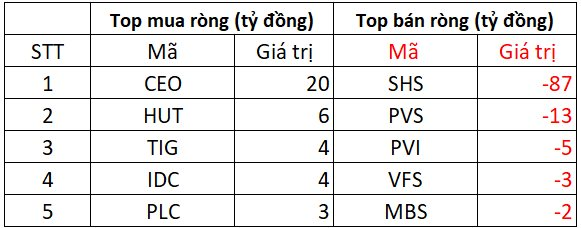

On the HNX, CEO topped the net buys, attracting VND 20 billion in foreign investment. HUT, TIG, IDC, and PLC followed suit with net buys ranging from a few billion VND each.

Conversely, SHS and PVS faced the brunt of net selling, with outflows of VND 87 billion and VND 13 billion, respectively. Foreign investors also offloaded PVI, VFS, and MBS, resulting in net selling figures of VND 2-5 billion for each stock.

UPCOM: Net foreign selling of approximately VND 34 billion

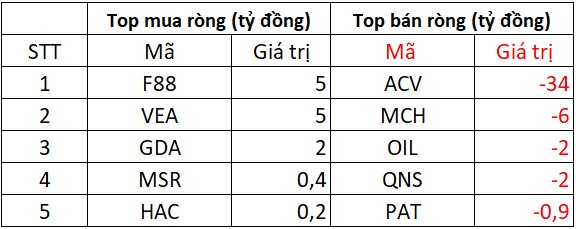

F88 and VEA were the top net bought stocks on UPCOM, with foreign investors infusing VND 5 billion into each. GDA, MSR, and HAC also witnessed net buying interest, with inflows ranging from a few hundred million to VND 2 billion.

On the other side, ACV faced the largest net selling pressure, with outflows of VND 34 billion. MCH, OIL, and QNS also experienced notable net selling, with foreign investors offloading VND 2-6 billion worth of these stocks.

Expert Insights: VN-Index Expected to Resume Uptrend Soon, But Hold Off on New Investments for Now

The MBS expert believes that the market remains on a positive trajectory and is poised to rebound swiftly. The underlying strength is evident as buying pressure absorbs profit-taking, indicating a robust foundation for a potential upswing.

Technical Analysis for September 5th: Breaking the 1,700-Point Barrier

The VN-Index shattered its previous August 2025 peak (which hovered around the 1,680-1,696 range), breezing past the psychological threshold of 1,700 points and reaching an all-time high.

The Rising Titans: HOSE Welcomes Three New Members to the $10 Billion Capitalization Club

In August 2025, the HOSE witnessed a remarkable surge with key indices climbing upwards. This positive momentum was further emphasized by the growth of most sectoral indices compared to the previous month. Riding on this wave of optimism, HOSE proudly welcomed two more businesses with a market capitalization of over USD 1 billion each and an additional three enterprises with a market cap exceeding USD 10 billion.