The insurance industry is making a strong comeback.

After a stagnant period in 2022-2023, the Vietnamese insurance market is stabilizing and recovering positively. In the first six months of 2025, the total insurance premium revenue of the entire market is estimated at VND 115,612 billion, a 5.6% increase compared to the same period last year, with life insurance accounting for 62%.

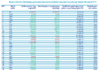

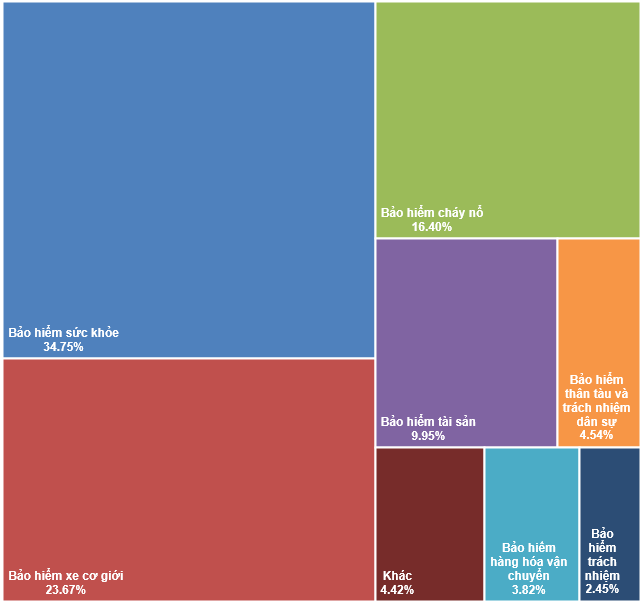

In the non-life insurance sector, revenue grew by over 11% due to the increasing demand for health insurance (accounting for 34.75% market share) and motor vehicle insurance (23.67%). In the life insurance segment, revenue grew by 8.6% year-on-year, with investment-linked insurance (48.3%) and term life insurance (37.3%) remaining the main drivers, reflecting a shift in customer needs for protection and investment.

According to the Ministry of Finance (announced at the end of August 2025), the total insurance premium revenue for the whole of 2025 is estimated at VND 239,636 billion, a slight increase of 5.5% compared to 2024, and the total assets of the industry are expected to reach VND 1,067,825 billion.

**Weight of non-life insurance revenue by business line in the first six months of 2025**

Source: Ministry of Finance

**Weight of life insurance revenue by business line in the first six months of 2025**

Source: Ministry of Finance

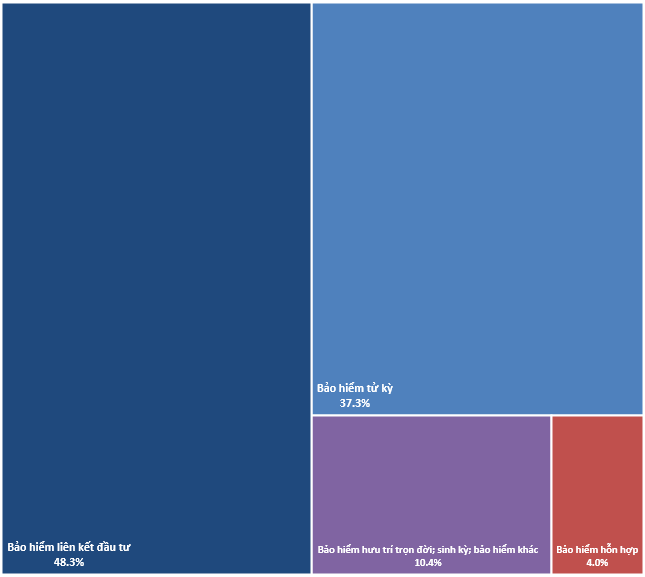

BVH solidifies its number one position in the insurance industry

In the industry landscape, BVH continues to assert its leading role. In life insurance, BVH holds a 23.1% market share, leading the market and far surpassing foreign competitors such as Manulife (16.6%) and Prudential (13.6%).

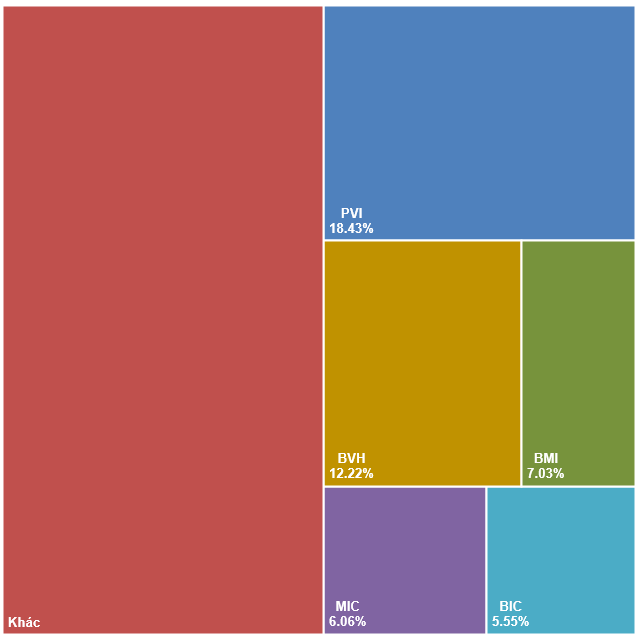

In non-life insurance, BVH is also among the leaders with a 12.2% market share, second only to PVI. A diverse range of products, from investment-linked insurance to term life insurance, helps the company maintain a wide and stable customer base.

**Market share of total life insurance premium revenue in the first six months of 2025**

Source: Ministry of Finance

**Weight of non-life insurance revenue by business line in the first six months of 2025**

Source: Ministry of Finance

The AI race in insurance is heating up

The world is witnessing a strong breakthrough of AI in many fields, including insurance. AI’s ability to process information and interact intelligently helps serve customers quickly and conveniently. On the other hand, the insurance industry generates a huge amount of data daily (customer information, transaction history, claims history…). If businesses do not have a powerful tool like AI to analyze and efficiently exploit this data, they will miss out on valuable information for making accurate business decisions.

According to FPT Smart Cloud, AIA Insurance has applied FPT AI Read to claim file review processes. Thanks to this solution, customers do not need to fill in information themselves, and consultants do not waste time on manual data entry. As a result, the file processing procedure is shortened, saving employees’ time and increasing work efficiency by 60%. FPT AI Read automates document processing procedures or self-service for customers with an extraction accuracy of up to 98%.

BVH is also riding this wave of innovation. As early as April 2019, BVH officially launched the Baoviet Direct digital insurance application on the market. This is the first integrated insurance management application on the phone in the Vietnamese market for individual customers. This platform focuses on optimizing user experience, process transparency, and saving customers’ time. Baoviet Direct’s breakthrough lies in applying AI and Big Data to achieve process transparency in claims settlement. This technology has helped automate data extraction from paper files, eliminating manual errors.

With superior values and a sustainable multi-tasking technology platform, Baoviet Direct was honored at the Sao Khue Awards 2025 in the field of Insurance/Securities/Investment – a prestigious award in the information technology industry in Vietnam. This is a well-deserved recognition of BVH’s continuous efforts in the journey of innovation and comprehensive digital transformation.

Source: Bao Viet Holdings

[Enterprise Analysis Department, Vietstock Consulting]

– 10:00 05/09/2025

The Art of Pleasing Customers: Unveiling the Power of Empathy in the Insurance Industry

The life insurance industry has faced a long-standing challenge of regaining customer trust. It is imperative that these businesses recognize this issue and actively work towards rebuilding and restoring faith in their services.