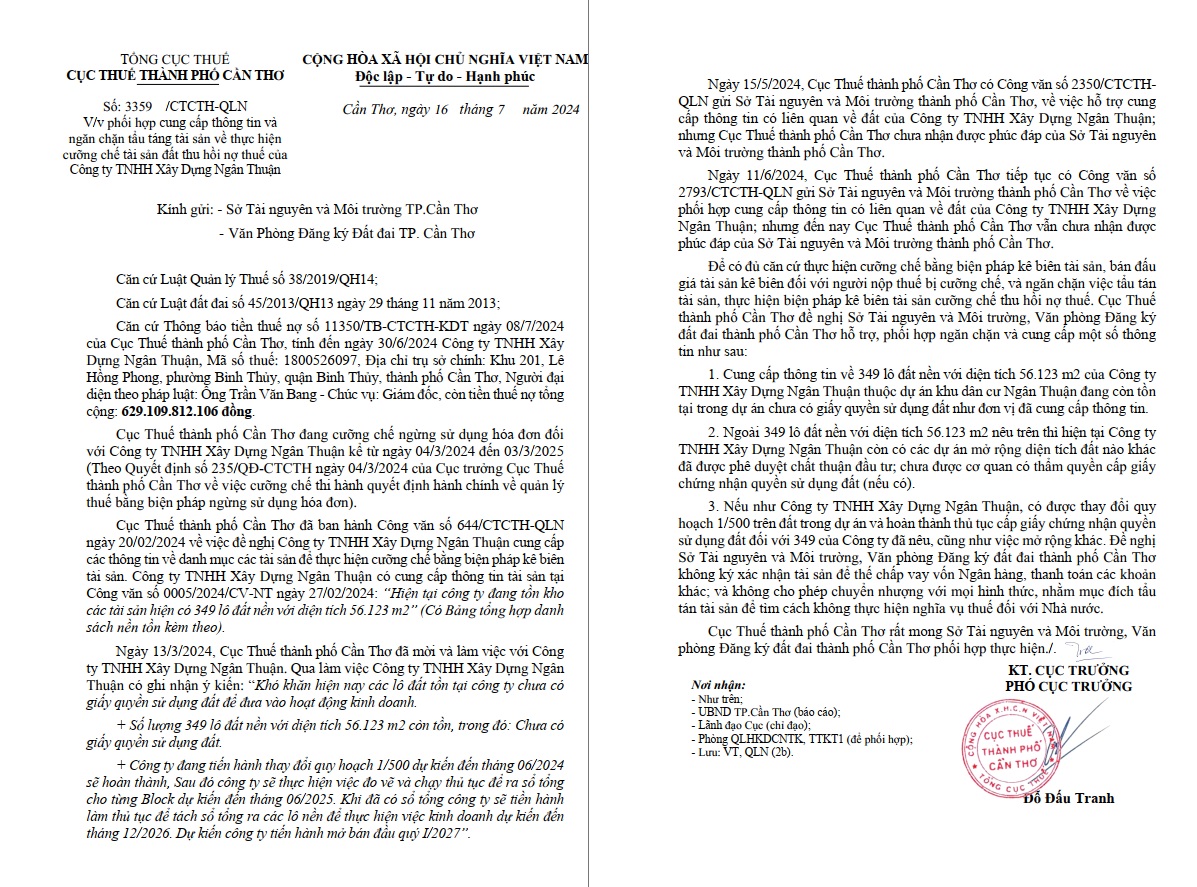

The signing ceremony of the Memorandum of Investment for the Phu Dong Complex Project between the People’s Committee of Gia Lai province and Doan Nguyen Duc – Chairman of Hoang Anh Gia Lai Joint Stock Company.

At the recent Investment Promotion Conference in Gia Lai province in 2025, the People’s Committee of Gia Lai province handed over the investment memorandum for the Phu Dong Complex Project to Mr. Doan Nguyen Duc, Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company.

The Phu Dong Complex Project comprises a 25-story mixed-use apartment complex and a 3.5-story commercial townhouse area, built on a clean land area of nearly 7,000 square meters in Pleiku Ward. The total expected investment is VND 400 billion. The enterprise stated that it has prepared financially and can commence construction as soon as the legal procedures are completed.

Mr. Doan Nguyen Duc – Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company.

Hoang Anh Gia Lai Group once had a golden era in the real estate industry. From 2006 to 2012, real estate was the main sector, bringing record revenue to the group. In 2009, with four large projects in Ho Chi Minh City, including New SaiGon, Hoang Anh River View, Phu Hoang Anh, and Hoang Anh Golden House, the company earned more than VND 3,300 billion (accounting for 77% of the total revenue that year). The Hoang Anh Gia Lai brand also left its mark in Gia Lai, Quy Nhon, Dak Lak, Da Nang, and Can Tho.

However, after the financial crisis in 2015, Mr. Doan Nguyen Duc had to gradually withdraw from the real estate sector to restructure. Up to now, when talking about the decision to withdraw from the real estate market at that time, Mr. Doan Nguyen Duc still has no regrets.

Hoang Anh Gia Lai has successfully converted its debt, attracted new shareholders, and escaped from cumulative losses. Currently, the Group is focusing on agriculture, with its main products being two plants and one animal: bananas, durians, silkworms, coffee, and pigs.

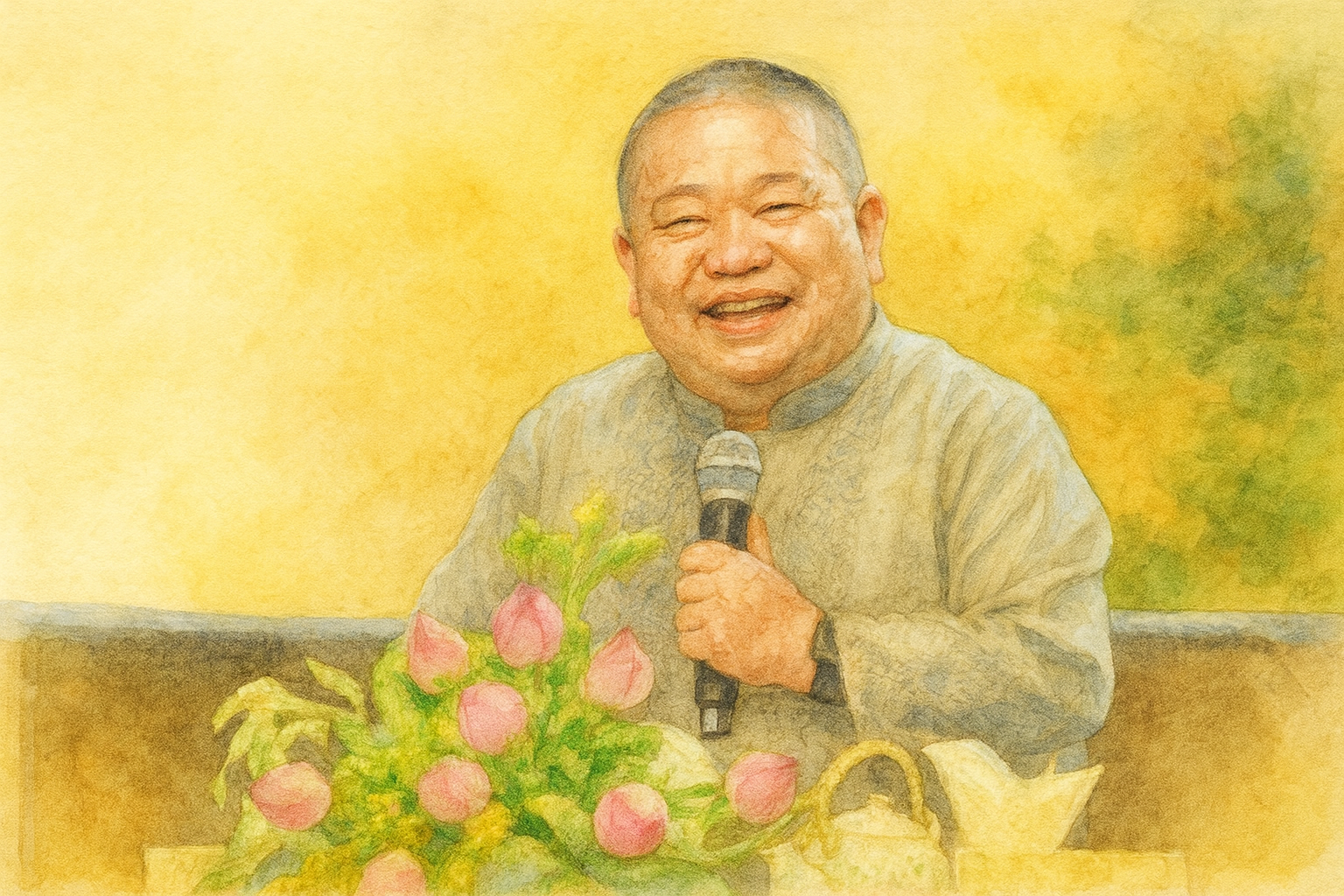

Mr. Le Phuoc Vu – Chairman of the Board of Directors of Hoa Sen Group shared about the Group’s return to the real estate sector.

Another “big player” who has signaled his return to real estate is Mr. Le Phuoc Vu, Chairman of the Board of Directors of Hoa Sen Group (HSG). At the General Meeting of Shareholders in March 2025, Mr. Le Phuoc Vu shared that Hoa Sen is working on a real estate project, but it is not yet complete, so he cannot provide specific details.

He revealed: “We are not as reckless as other real estate corporations, collecting money from people without having the legal framework in place and failing to deliver houses. We have the resources, money, and the advantage of low-cost materials. We must build a township of 600-700 hectares. We will utilize our resources from one side and channel them to the other.”

Mr. Le Phuoc Vu, Chairman of the Board of Directors of Hoa Sen Group, is ambitious: “Hoa Sen must build a township of 600-700 hectares instead of a small-scale project.”

This is the third time that this steel enterprise has decided to “venture” into real estate. The first time was in 2009, when Hoa Sen, with its orientation to become a multi-industry group, simultaneously invested in real estate with five projects. Just two years later, in 2011, Hoa Sen unexpectedly announced its withdrawal from this ancillary business to focus on its core steel business. The company divested and withdrew all capital from four projects, only retaining the Pho Dong – Hoa Sen project, which was under construction.

The second “attempt” at real estate was in 2016, when Hoa Sen established four subsidiary companies specializing in real estate investment. However, by 2018, Hoa Sen also dissolved these companies.

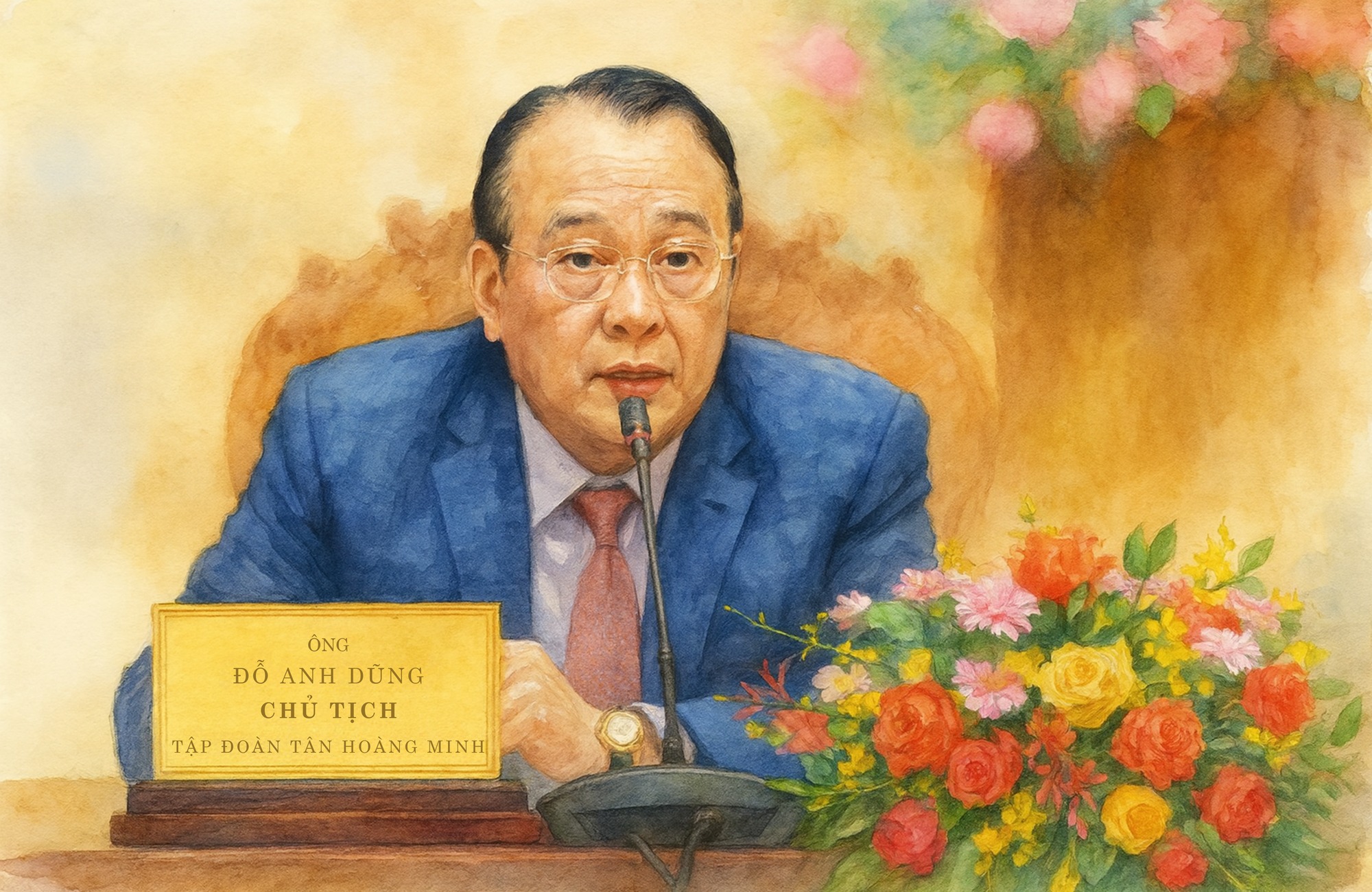

Along with the two “big players” who withdrew from the market but are now returning to real estate, the market has also witnessed the comeback of other prominent names such as Le Thanh Thuan (Muong Thanh Group), Do Anh Dung (Tan Hoang Minh), and FLC Group.

Specifically, Le Thanh Thuan made a surprising comeback in late August 2025 when he worked with the authorities of Tam Hung commune (Hanoi) to accelerate the progress of the My Hung Township project, which started in 2008 but had been stagnant for many years.

Le Thanh Thuan attended the meeting with the authorities of Tam Hung commune, Hanoi, and committed to speeding up the progress of the My Hung project.

Do Anh Dung also marked his return by commencing the construction of the Greenera Southmark project in Hanoi and proposing a super township of 4,300 hectares in Da Lat, integrating high technology, eco-tourism, and an international film studio.

Do Anh Dung, Chairman of Tan Hoang Minh, proposed to continue studying, developing ideas for detailed planning, and implementing the smart township project in Xuan Tho, Da Lat city.

Meanwhile, FLC Group is also actively participating in the market: in June 2025, they held a groundbreaking ceremony for the Hausman Premium Residences project in FLC Premier Parc Township (Hanoi), and earlier, they were allowed by Gia Lai province to research and plan an airport township in Cat Tan.

The return of these real estate enterprises indicates the reactivation of capital and investment plans in the real estate sector. It is also expected to contribute to accelerating the progress of urban development projects nationwide.

The Grandstand of the North: A $22 Million International Standard Stadium Nears Completion

After over two years of construction, contractors are now racing to complete the final touches on Thai Nguyen Stadium, a state-of-the-art sports facility in Vietnam. With the finishing line in sight, the stadium is poised to become a landmark venue, ready to welcome athletes and enthusiasts alike and host a range of sporting events and activities.

An Industrial Hub to Foster Employment for 15,000 and Contribute 1.5 Trillion VND Annually

The project is envisioned to be a catalyst for new growth in the southern region of Lao Cai Province. With its strategic location and well-planned development, it promises to bring about positive transformation and enhance the region’s economic prospects, creating a vibrant and prosperous future for its community.

The Big Two Catalysts Boosting Vietnam’s Banking Sector Valuations: Spotlight on Vietcombank, VietinBank, HDBank, Techcombank, and MB

“The banking sector is poised for a valuation uplift, according to Quan Trong Thanh, Director of Analytics at Maybank Investment Bank (MSVN). He asserts that the industry’s prospects are closely tied to the nation’s economic growth trajectory. With Vietnam’s imminent upgrade to Emerging Market status, the country’s stock market is expected to witness a significant influx of foreign investment. A substantial portion of this inflow is likely to be directed towards the banking sector, further bolstering its valuation.”

Should Single Buyers Opt for a Studio, a 1+1, or a 2-Bedroom Condo?

The modern landscape of condo ownership is evolving, with single individuals joining young families as dynamic players in the market. Amidst a myriad of choices, from compact studios to spacious two-bedrooms, how does one make a wise decision to achieve both a comfortable home and a sound investment?