Bitcoin Plunges as US Jobs Data Fuels Fed Rate Cut Expectations

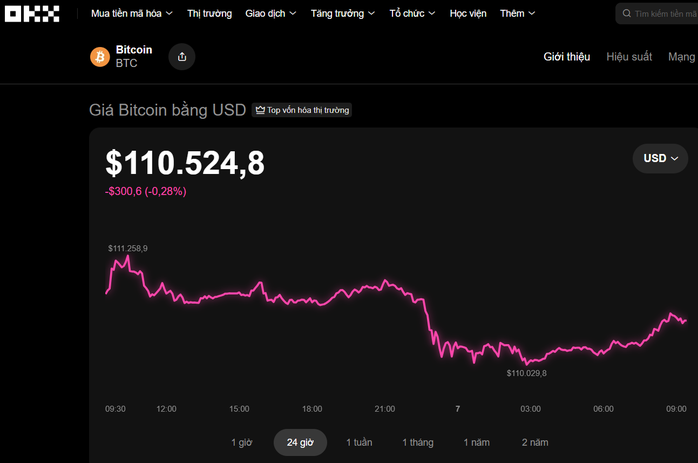

As per OKX data at 9:30 am on September 7, Bitcoin (BTC) witnessed a decline of nearly 0.3% in the past 24 hours, trading around $110,500.

Bitcoin Could Dip to $75,000

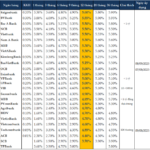

Other major cryptocurrencies also followed a similar downward trajectory, with Ethereum (ETH) dropping by 0.4% to below $4,300 and Solana (SOL) losing over 0.5% to trade at $202.

Conversely, a few coins exhibited a slight recovery, such as XRP climbing to $2.81 and BNB surging by more than 1% to reach $861.

Notably, Pi Network, which was listed on OKX on February 20 at $0.8 and quickly soared to $3, has now plummeted to around $0.34, marking a staggering decline of over 88%.

This downward trend has inflicted significant losses on investors, especially those who purchased at the peak.

The negative performance in the crypto market coincides with the release of the US jobs report for August, which showed a meager addition of 22,000 jobs, falling far short of expectations, according to CoinDesk.

Bitcoin is currently trading around the $110,500 mark. Source: OKX

Moreover, the figures for the previous months were revised downward, raising concerns about the weakening labor market. This has led analysts to almost unanimously predict that the Federal Reserve will cut interest rates at their meeting on September 17.

Typically, a Fed rate cut is considered positive for Bitcoin, but this time, prices reacted by turning south instead of surging.

Bitcoin briefly surpassed the $113,000 mark but quickly fell back below $112,000. Its failure to sustain this crucial level has investors worried about further declines, with strong support expected around the $101,700 region.

Some experts even speculate that Bitcoin could retrace to the $75,000 level witnessed earlier this year.

In the coming days, the market is expected to experience heightened volatility as the US releases inflation data for August. If the inflation rate remains elevated, causing bond yields to climb again, Bitcoin and other risky assets will likely face continued pressure.

6 Top-Tier Businesses With Robust Profit Growth Prospects and Fair Valuations for Q3 2025

“While Agriseco acknowledges potential risks, such as robust foreign net selling, profit-taking after a sharp rally, and short-term volatility arising from ETF portfolio rebalancing, it remains confident in its ability to navigate these challenges effectively.”