The USD Index (DXY) – a measure of the greenback’s strength against a basket of six major currencies – ended the 05/09 session with a loss of 0.12 points, settling at 97.74, reversing course lower after a modest gain in the previous week.

The latest report from the US Bureau of Labor Statistics painted a bleak picture of the job market, as only 22,000 jobs were added in August, falling short of the forecasted 75,000 and a sharp decline from July. The unemployment rate rose to 4.3%. Additionally, June’s figures were revised downward by 13,000 jobs, while July’s numbers, though slightly boosted by 6,000, still fell short at 79,000.

These disappointing figures reinforce expectations that the Fed will cut interest rates at its meeting on September 17, with a nearly certain scenario of a 0.25% reduction. This prospect has diminished the appeal of the greenback.

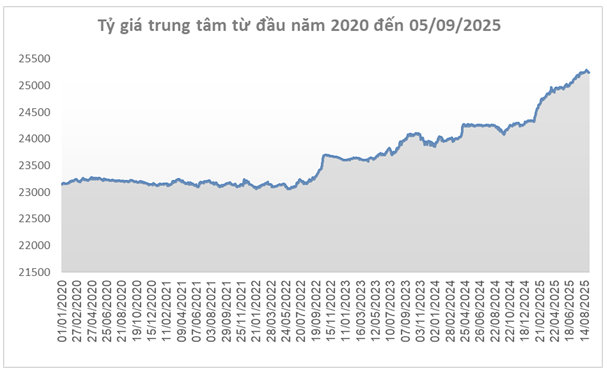

Source: SBV

|

Domestically, the central exchange rate set by the State Bank of Vietnam on September 5 stood at 25,248 VND/USD, a slight increase of 8 VND from the previous week. With a permitted fluctuation margin of ±5%, commercial banks’ exchange rates can range from 23,986 to 26,510 VND/USD.

The reference rates at the Foreign Exchange Management Agency also witnessed a corresponding rise, reaching 24,036 – 26,460 VND/USD (buying – selling).

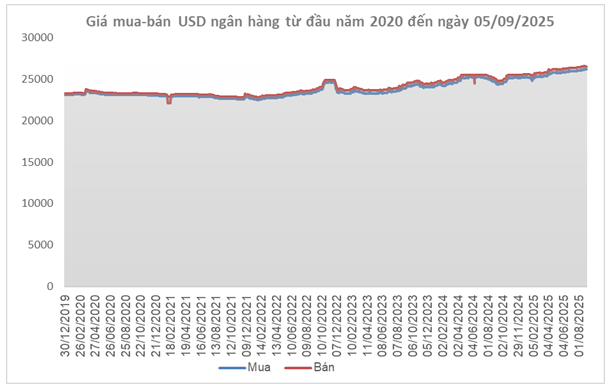

Source: VCB

|

At Vietcombank, USD rates closed at 26,160 – 26,510 VND/USD (buying – selling), marking increases of 28 VND and 8 VND, respectively, from the previous week.

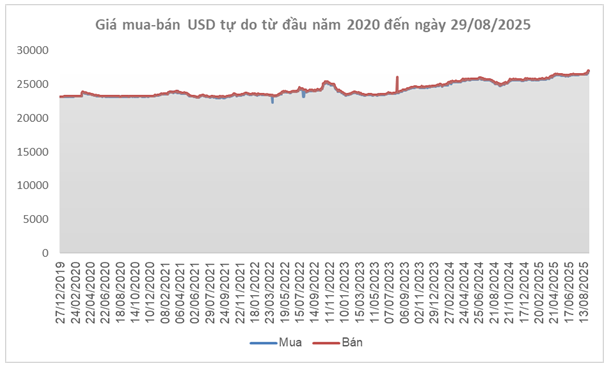

Source: VietstockFinance

|

In the free market, USD rates hovered around 26,915 – 27,015 VND/USD (buying – selling), representing increases of 265 – 295 VND compared to the previous week.

– 19:34 07/09/2025

“Vietnamese Stocks: Multiple Growth Drivers and Attractive Valuations, Says Nguyen Trieu Vinh (VCBF)”

The Vietnamese stock market is anticipated to remain dynamic in the upcoming phase. Valuation – a key concern for investors after the recent surge – is likely to retain its allure due to the promising profit growth prospects of listed companies.

The Time to Adjust: Mastering the Art of Bank Interest Rate Changes

The central bank stated that when inflation rises, it increases interest rates to curb inflation. Conversely, when inflation is under control and aligns with the set targets, the central bank reduces interest rates to stimulate economic growth.