Saigon – Lam Dong Investment and Tourism JSC (Saigon – Lam Dong Tourism) recently announced abnormal information regarding the interest payment of SLTCH2328001 bond to the Hanoi Stock Exchange (HNX).

Specifically, on August 26, Saigon – Lam Dong Tourism and the bondholder’s representative signed an agreement to extend the interest payment period for the SLTCH2328001 bond.

As planned, Saigon – Lam Dong Tourism was supposed to pay nearly VND 320 billion in interest for the above bond on August 29, 2025. After being approved by the bondholder, the company will pay the above interest on October 15, 2025, without any additional payments.

It is known that the SLTCH2328001 bond was issued in December 2023, with a value of VND 1,607 billion, a term of 5 years, and an interest rate of 12%/ year. The owner of this bond is Petroleum Securities Joint Stock Company. In the first half of 2025, the company paid more than VND 528 million in interest on this bond.

Notably, Saigon – Lam Dong Tourism delayed the bond interest payment after reporting a net loss of nearly VND 143 billion in the first half of 2025.

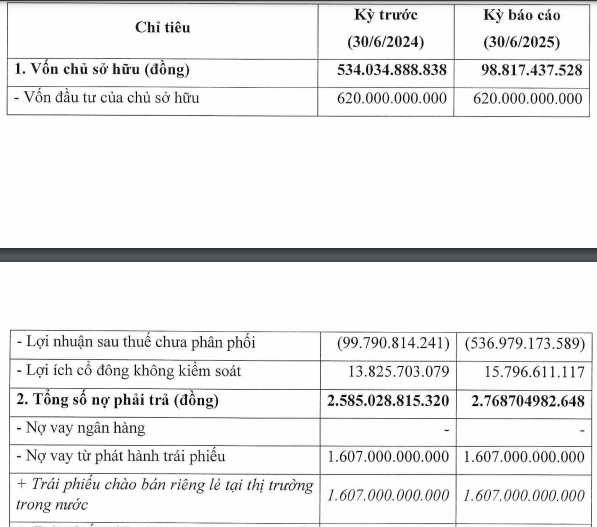

Consecutive losses have caused the company to incur a cumulative loss of VND 537 billion, while eroding equity to just under VND 100 billion.

Source: HNX

As of June 30, 2025, total liabilities increased to VND 2,769 billion. The debt-to-equity ratio jumped to 28.02 times. Of which, bond debt remained at VND 1,607 billion, other payables were over VND 416 billion, and there was no bank debt. The ratio of short-term assets to short-term liabilities is only 0.31 times.

About the issuer, Saigon – Lam Dong Investment and Tourism JSC was established in 2005. The main business lines are hotel, hostel and resort services. The company is headquartered at Robin Hill Cable Car Tourist Area, Ward 3, Da Lat city, Lam Dong province.

Before September 2018, the company had a charter capital of VND 200 billion. The founding shareholder structure included: Saigon Investment Joint Stock Company contributed 40%, Saigon Investment and Construction Joint Stock Company contributed 40%, and Mr. Dang Thanh Tam contributed 20%.

Mr. Dang Thanh Tam is the Chairman of the Board of Directors of Kinh Bac City Development Holding Corporation (Stock code: KBC) and Saigon Telecommunications Joint Stock Company (Saigontel, Stock code: SGT).

In December 2021, Saigon – Lam Dong Tourism increased its charter capital from VND 200 billion to VND 310 billion. At that time, Ms. Nguyen Thi Cam Phuong was the General Director and legal representative of the company. It is known that Ms. Cam Phuong is also the General Director of Saigontel.

In December 2023, Saigon – Lam Dong Tourism continued to increase its capital to VND 620 billion. At the same time, Mr. Nguyen Hoang Ky Lan (born in 1996) took the position of General Director.

In addition, this 9x businessman also represents many enterprises such as: Lang Ha Investment Joint Stock Company, Robin Hill Resort Joint Stock Company, A&E Logistics Limited Company, 3H Vietnam Investment and Construction Limited Company, NMID Investment and Development Limited Company …

Saigontel’s financial statements recognized Saigon – Lam Dong Tourism as a company with the same key members. Along with that, the report also recorded a number of transactions of this company with Saigon – Lam Dong Tourism.

It is known that Saigon – Lam Dong Tourism is the investor of the Saigon – Da Lat Tourism, Resort and Outdoor Recreation Project with an area of 153ha. Meanwhile, Robin Hill Resort Joint Stock Company is the investor of Robin – DaLat Resort Project.

PV’s data shows that in February 2024, Saigon – Lam Dong Tourism pledged its capital contribution at a bank with secured assets being the entire capital contribution at A&E Logistics Limited Company worth VND 965 billion and the entire capital contribution at 3H Vietnam Investment and Construction Company Limited is worth VND 945 billion.

The Great C-Suite Exodus: Unraveling the Reasons Behind the High Turnover of Top Executives

The recent spate of resignations among key personnel in several companies is noteworthy. Vinaconex Tourism Development and Investment Joint Stock Company witnessed the resignation of five members of their Board of Management and three members of the Supervisory Board for the 2021–2026 term. Meanwhile, International Dairy Company Lof JSC replaced their CEO, and Vietnam Enterprise Investment and Development Joint Stock Company received resignation letters from two leaders serving as members of their Board of Management.

The Pennies-for-Dollars Stock List

As of the market close on 11/10/2024, the VN-Index stood at 1,288 points, marking a notable 14% year-to-date gain, equivalent to a rise of 157 points. However, not all stocks have fared equally well. Some have plummeted or stagnated for almost a year, hovering around extremely low prices, often referred to as the “tea and chat” zone.