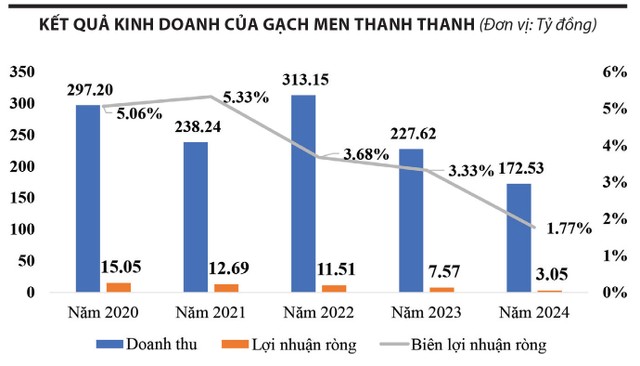

In a move to address declining financial performance, Thanh Thanh Enamel Tile Joint Stock Company (HNX: TTC) has resolved to cease production operations effective July 1, 2025, as it embarks on a comprehensive restructuring plan. This decision comes on the back of years of dwindling profits for the company. A five-year trend from 2020 to 2024 reveals a distinct downward trajectory, with post-tax profits plunging from VND 15 billion to just VND 3.04 billion—a nearly 80% drop—even as revenue peaked at VND 317 billion in 2022.

This decline is further accentuated in the first half of 2025, with TTC recording revenue of nearly VND 66 billion, a 20% drop compared to the same period last year, marking the lowest half-year performance since the company’s listing in 2010. Pre-tax profits stood at a meager VND 24 million, in stark contrast to the VND 1.2 billion achieved in the previous year.

In light of these developments, the management has revised its 2025 business plan, shifting from a target profit of VND 4 billion to an expected loss of VND 7.9 billion, and projecting a continued loss of nearly VND 2.9 billion for 2026.

Amid these challenges, Thanh Thanh Enamel Tile is exploring avenues to recoup its capital. Recently, the company registered to divest its entire holding of over 1.7 million shares (equivalent to a 21.45% stake) in Vitaly Joint Stock Company (VTA), anticipating proceeds of over VND 6 billion. However, the success of this transaction remains uncertain, given the failed attempt to divest in 2024.

Established in 1969 by a group of Chinese individuals and nationalized in 1976, Thanh Thanh Enamel Tile once boasted a leading market position, especially during the 1990-2000 period, when it aggressively invested in technology and imported state-of-the-art production lines from Italy.

However, the company’s fortunes began to wane after peaking at a profit of VND 22 billion in 2015. This downturn can be attributed to a confluence of factors. A slowdown in the domestic real estate and construction sectors led to diminished demand, thrusting the tile industry into intense price competition. With over 90 manufacturers offering largely undifferentiated products and facing pressure from substitute materials like wood, stone, and plastic, many businesses found themselves struggling for orders. Moreover, the company’s machinery, after more than 20 years of operation, became outdated, driving up production costs and eroding TTC’s profits.

The decisive factor leading to the cessation of production, however, was the provincial mandate to relocate businesses from Bien Hoa Industrial Park 1 in Dong Nai, imposing a financial burden for reinvestment that the company could not shoulder.

A glimpse of Bien Hoa Industrial Park 1, which was established in 1963 and has now fulfilled its historical mission, making way for new developments – Photo: H.M. – Tuoi Tre

To address the ensuing challenges, TTC’s restructuring plan focuses on liquidating its current assets. The company intends to sell its over-20-year-old factory, machinery, and equipment, expecting to recoup around VND 20 billion. Additionally, TTC will dispose of its inventory valued at over VND 100 billion, including 1.1 million square meters of finished tiles, following a roadmap that extends until June 2026. To maintain its brand presence and facilitate sales, the “Thanh Thanh Enamel Tile” brand has been franchised to Dong Nam Asia Tile Company for production.

Regarding human resources, 178 out of 215 employees will be laid off after July 15, 2025, with an estimated total severance cost of VND 13.8 billion.

To maintain minimal administrative operations and facilitate the handover of the premises, the company plans to relocate its headquarters to the Binh Chuan Concentrated Production Area in Thuan Giao Ward, Thuan An City, Binh Duong Province, or another suitable location.

Construction Materials Corporation No. 1

The situation at Construction Materials Corporation No. 1 (FICO, UPCoM: FIC), which holds a 51% stake in TTC, is equally challenging. At the 2025 Annual General Meeting of Shareholders, FICO presented a regressive business plan with consolidated revenue of VND 1,369 billion (a 13% decrease from 2024) and pre-tax profits of nearly VND 76 billion (a 20% drop). This plan reflects a significant downturn compared to previous years, such as 2024 (approximately VND 95 billion) and 2022 (VND 134 billion). Coupled with TTC’s cessation of operations, this not only underscores the industry’s widespread difficulties but also poses direct challenges for FICO in the coming years.

The Power of Partnership: Unlocking Sales with Accesstrade’s CEO

In a recent interview in Hanoi, Do Huu Hung, CEO of Accesstrade Vietnam, offered insightful perspectives on the challenges faced by businesses in today’s dynamic market. With a wealth of experience in the industry, Mr. Hung shared his expertise on navigating the complexities of multi-platform marketing and sales strategies.