Food Safety and Health: Top Priorities in Food Selection

Vietnamese consumers are becoming increasingly cautious about unregulated food sources, especially after the fluctuations in livestock diseases and food safety. This has driven a growing demand for branded products with strict quality control and transparent traceability.

According to Cimigo’s 2022 research on healthy eating trends in Vietnam, 61% of consumers reported following a healthy diet, and 72% of those aware of food standards are willing to pay an extra 10% for products with VietGAP, Organic, or ISO certifications. This indicates that safety and health have become paramount considerations in the purchasing decisions of Vietnamese consumers.

The convergence of the “clean eating, healthy living” trend and the rapid development of modern retail channels presents a significant growth opportunity for branded processed meat products that meet stringent quality, source, and convenience requirements.

With its range of chilled and processed meats that adhere to stringent quality standards and a vast distribution network within the Masan ecosystem, Masan MEATLife is well-positioned to directly benefit from this trend.

In addition to strengthening its collaboration with WinCommerce, Masan MEATLife (MML) has proactively prepared to adapt to new market standards and trends by adopting an integrated 3F (Feed – Farm – Food) value chain strategy. This chain includes farms, animal feed production plants, and modern slaughterhouses and processing facilities, ensuring tight control over the entire process from breeding to the final product.

The company owns the MEAT Ha Nam factory, which has been in operation since 2018 and is a pioneer in Vietnam for producing chilled meat according to European standards. With a capacity of 140,000 tons of meat per year, the factory has achieved BRC certification, a global standard for food safety. In 2020, MML also commenced operations at the MEATDeli Saigon factory in Long An, with a similar capacity and plans to expand processed meat production to 25,000 tons per year.

Additionally, MML invested in operating a high-tech pig farm in Nghe An province (on a 200-hectare scale, with a capacity of 250,000 pigs per year) that meets the GLOBALG.A.P. standards. This farm implements international standards for good agricultural practices while utilizing a biogas-powered electricity system, contributing to environmental protection and biosecurity.

Robust Consumer Spending: A Catalyst for Businesses

According to Vietnam’s General Statistics Office (GSO), the country’s GDP grew by 8.0% in the second quarter of 2025. The total retail sales of consumer goods and services in the first seven months reached nearly VND 3,993 trillion, a 9.3% increase compared to the same period last year. The average income per capita in the first six months was approximately $2,625, a nearly 8% increase, bringing Vietnam closer to the $5,000 milestone, a “golden time” for the explosion of high-value food consumption.

In this context, the trend of “eating well and living well” is becoming a priority for consumers. The preference for branded foods that ensure safety and clear traceability continues to spread, providing an opportunity for MML to solidify its market leadership.

Furthermore, in July, WCM opened 36 new stores, bringing the total number of new stores opened this year to 354, completing over 50% of its annual plan (400–700 stores). Approximately 75% of these are WinMart+ stores in rural areas, contributing to a shift in consumer habits. This growth not only strengthens WCM’s position but also serves as a crucial catalyst for MML to expand its reach, as its chilled and processed meat products become accessible to more people in both urban and rural areas.

Through its collaboration with WCM and the robust consumer spending recovery, MML possesses all the necessary elements to expand its reach, enhance its product value, and sustain its momentum.

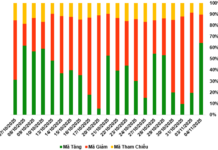

In July 2025, MML’s average daily revenue per store in the WCM chain reached nearly VND 2.3 million. If MML were present in all of WCM’s over 4,100 stores, the estimated average daily revenue scale could reach nearly VND 9.5 billion, reflecting significant growth potential from modern retail channels. Additionally, MML contributed 69% to WCM’s total meat segment revenue, up from 62% in the second quarter of 2025 and significantly higher than in previous years (49% in 2023 and 55% in 2024). This highlights MML’s growing role in driving WCM’s meat segment revenue and underscores its positive and sustainable growth trajectory.

Masan Group is one of Vietnam’s leading companies in the consumer and retail sectors. Guided by the philosophy of “doing well by doing good,” the company aims to provide essential products and services of the highest quality to meet the diverse needs of over 100 million consumers in Vietnam and internationally. The Masan ecosystem comprises subsidiaries and brands across high-potential growth sectors, including Masan Consumer Holdings (Chin-Su, Nam Ngư, Omachi, Kokomi, Wake-Up 247); branded meat products – Masan MEATLife (MEATDeli, Ponnie, Heo Cao Bồi); retail chain – WinCommerce (WinMart, WinMart+); tea and coffee chain – Phúc Long Heritage (Phúc Long); and Masan High-Tech Materials (high-tech materials).

Unleashing the ‘Wave’ of Post-Holiday Consumer Spending

The National Day holiday on September 2nd has passed, but the shopping fever in Ho Chi Minh City continues to thrive. Major promotional programs are being extended, businesses are offering attractive packages, and authorities are tightening market control. These collective efforts aim to sustain consumer momentum, protect the interests of citizens, and boost the city’s economy.

The City of Lights Shines a Spotlight on Mooncake Discipline.

Mooncakes are a traditional delicacy, especially popular during mid-autumn festivals in Vietnam. With the festival approaching, Ho Chi Minh City authorities are taking proactive measures to ensure the quality and authenticity of mooncakes flooding the market. This September, intensified inspections will be carried out to safeguard consumers and uphold the integrity of this beloved seasonal treat.

“The Conundrum of Candy: A Challenging and Costly Endeavor, Says Deputy Health Minister.”

“In a recent statement, Deputy Minister of Health Do Xuan Tuyen highlighted several cases of counterfeit medicine and food scandals in Vietnam. One notable example was a fake medicine ring in Thanh Hoa province, which was uncovered by the Ministry of Health and subsequently dealt with in collaboration with relevant authorities. Another incident involved Kera candies, which, according to Deputy Minister Tuyen, required extensive and costly testing to ensure public safety.”