The world of finance is evolving with the rise of digital and crypto assets, and Vietnam is embracing this trend. The National Assembly’s recent passage of the Digital Technology Industry Law in mid-June paves the way for the industry’s robust development in the country. In anticipation of this, several securities companies have joined the race to establish themselves in this emerging market.

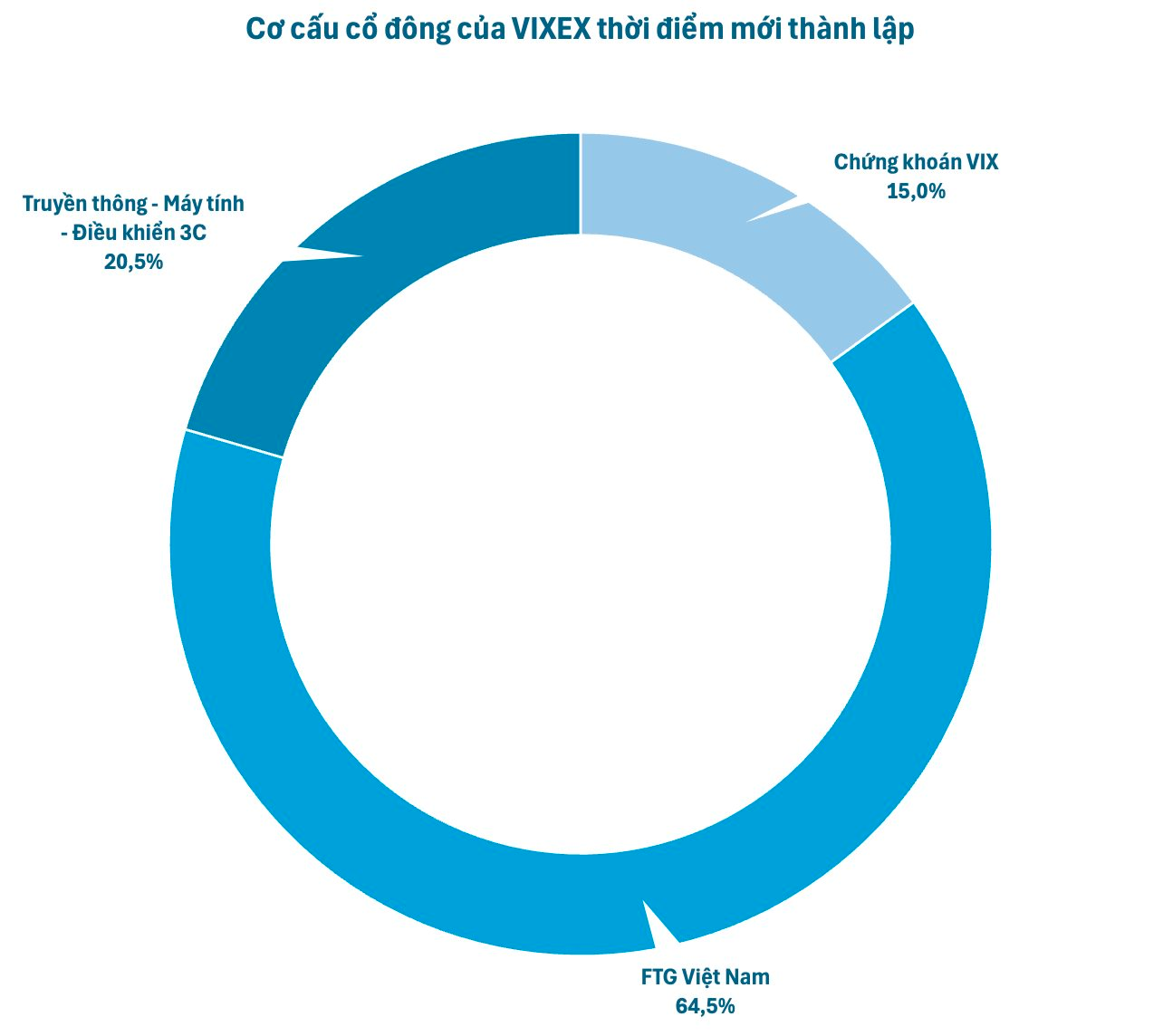

Leading the way is VIX Digital Asset Exchange Joint Stock Company (VIXEX) , established on August 26 with a charter capital of 1,000 billion VND. The founding shareholders include VIX Securities Joint Stock Company contributing 15%, FTG Vietnam Joint Stock Company with 64.5%, and Computer-Communication-Control Joint Stock Company 3C with a 20.5% stake.

Prior to this, Techcom Digital Asset Exchange Joint Stock Company (TCEX) increased its charter capital from 3 billion to 101 billion VND, according to a business registration change on August 8. However, the shareholder structure after this change has not been disclosed. Upon its establishment, TCEX had a charter capital of 3 billion VND, of which Mr. Nguyen Xuan Minh held 89%, Techcom Securities Joint Stock Company (TCBS) contributed 9.9%, and Techcom Capital Joint Stock Company owned 1.1%.

TCEX was established on May 5, headquartered at Techcombank Tower, 6 Quang Trung, Cua Nam, Hanoi. The company’s General Director and legal representative is Mr. Nguyen Xuan Minh, who currently serves as Chairman of the Board of Directors of TCBS, TechcomCapital, and Wealthtech Innovations Joint Stock Company.

Other players have also been preparing to enter this space for years, such as SSI Securities Joint Stock Company, which established SSI Digital Technology Joint Stock Company (SSI Digital – SSID) in 2022. Recently, SSID, along with SSI Fund Management Company Limited, signed a cooperation agreement with digital asset companies Tether and U2U Network and Amazon Web Services (AWS) to boost the development of digital financial infrastructure, Blockchain, and cloud computing in Vietnam.

It’s not just securities companies that are getting involved; banks are also recognizing the potential of this emerging market. In mid-August, Military Commercial Joint Stock Bank (MB) announced its collaboration with Dunamu Group to launch Vietnam’s first domestic digital asset exchange. Dunamu will become MB’s strategic partner, sharing technology and infrastructure while providing legal compliance, investor protection, and human resource development advice.

Dunamu Group (established in 2017) manages Upbit, South Korea’s largest digital asset exchange, ranking third globally. Upbit serves over 6 million customers, with a transaction volume of over 1,100 billion USD in 2024 and managing more than 80 billion USD in digital assets. Dunamu has not only propelled Upbit to the top in South Korea but also played a pivotal role in shaping the ecosystem and legal framework for crypto in the country.

Currently, the Ministry of Finance is drafting a Government Resolution on the pilot issuance and trading of digital and virtual assets, including digital money. According to the draft, organizations operating digital asset exchanges must have a minimum capital of 10,000 billion VND. Of this, at least 35% must be held by two or more organizations from the group of banks, securities companies, fund management companies, insurance companies, or technology companies; the remaining 65% can be owned by other organizations.

At a recent event on digital assets, Mr. Phan Duc Trung, Chairman of the Vietnam Blockchain and Digital Assets Association (VBA), revealed that Vietnam plans to grant licenses to approximately five exchanges to pilot the trading of digital assets, with the potential for connectivity to international exchanges to ensure liquidity and competitiveness.

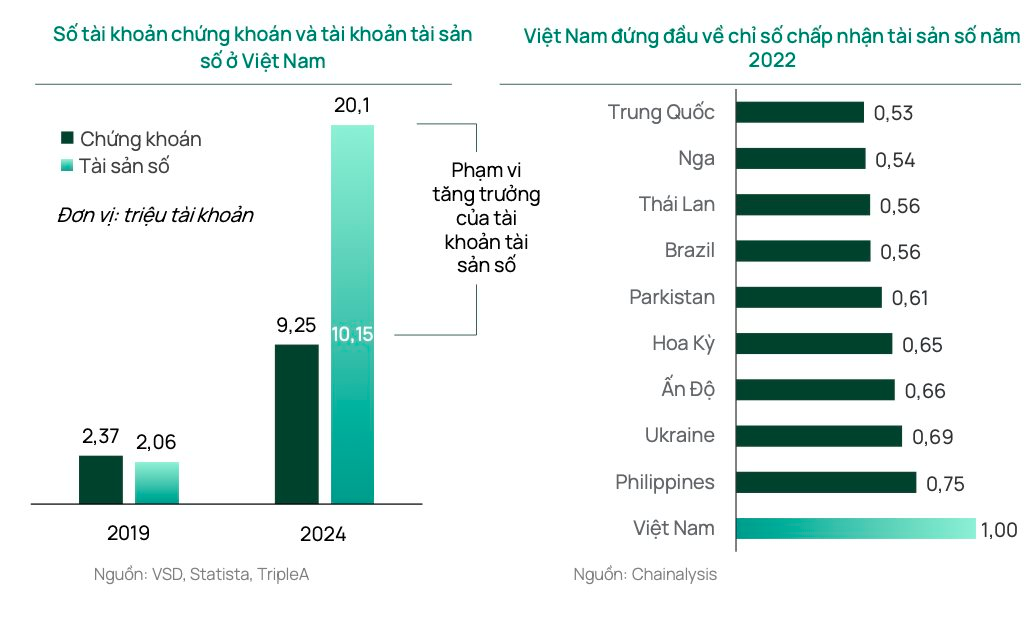

Even before the official legalization, digital assets had already gained remarkable traction in Vietnam. According to Statista’s 2024 statistics, the number of digital asset account users in Vietnam was estimated at 10.15 million, excluding the NFT market, a fivefold increase from 2019. Another estimate by Triple A in 2023 suggests this figure could be as high as 20.1 million accounts.

Vietnam has consistently ranked in the top 5 of Chainalysis’s Global Crypto Adoption Index from 2021 to 2022. This index measures factors such as the number of users, the presence of exchange platforms, and the regulatory environment, adjusted for GDP per capita. This not only demonstrates a high level of acceptance but also reflects a notable shift in individual investors’ capital allocation preferences.

“VND’s Stock Market Upgrade: Understanding Circular 25’s Impact”

The recently issued Circular 25/2025/TT-NHNN by the State Bank of Vietnam introduces significant changes and removes legal obstacles for foreign investors. The new regulations, effective immediately, are expected to provide a strong impetus for the upgrade of Vietnam’s stock market.

Unlocking Green Finance in Vietnam: From a “Common Language” to an International Financial Center

Experts have outlined a clear roadmap to boost sustainable investment in Vietnam. The government’s introduction of a “common language” is seen as a breakthrough policy move, while the future establishment of an International Financial Center is expected to be the “key” to enhancing transparency and investor confidence. These foundational solutions aim to bridge the gap between the massive capital requirements for Net Zero goals and the current market’s modest size.