International Capital Attraction Opportunities

The focus on blockchain and crypto assets as a key development in Danang’s International Financial Center has attracted many businesses in this field to the city in recent times.

Accordingly, Bybit, the Abu Dhabi Blockchain Center (ADBC), and Tether Operations, the unit behind the operation and issuance of Tether, the world’s largest stablecoin, have signed a Memorandum of Understanding (MoU) with the Danang city government. The agreement focuses on the application of blockchain technology to enhance digital infrastructure and open up new decentralized financial access models.

Even Digital Treasures Center Pte Ltd (dtcpay), a leading global digital technology unit, has expressed its desire to cooperate with the city government in supporting the development of the blockchain ecosystem towards deploying appropriate training courses for Danang. At the same time, they will closely cooperate with local partners to build Danang into one of the region’s leading destinations for blockchain technology.

“The company is in the process of researching and understanding the Danang market, ready to expand cooperation with new potential partners, and will continue to explore and propose specific projects to be implemented in Vietnam in general and Danang in particular,” said Mr. Band Zhao, founder of Digital Treasures Center Pte Ltd, during a working session with Danang leaders.

Foreign tourists experience Basal Pay products in Danang. |

Earlier, the city government officially licensed the Basal Pay project – the first project related to crypto assets in Vietnam to be licensed, helping users directly convert crypto assets to fiat currency and vice versa in just a few seconds.

Mr. Tran Huyen Dinh, Director of the Basal Pay Project, said that Danang currently welcomes about 11-12 million tourists each year and is on a strong growth trajectory. Therefore, the ability for international visitors to easily use digital assets to convert to fiat currency with transaction costs about 30% lower than traditional methods and spend legally brings direct benefits to tourists, while the city promotes trade and services, increases transparent revenue, and attracts foreign currency to Vietnam.

Early Change of Fundamental Factors

In fact, after the issuance of Resolution No. 222/2025 of the National Assembly on the International Financial Center in Vietnam, the Ho Chi Minh City and Danang governments have made efforts to put the center into operation as soon as possible.

Representatives of departments and branches under the Danang People’s Committee introduce an area, expected to be the location for the construction of the international financial center. Photo: H.T |

In the case of Danang, the city government has established a Consulting Council for the Construction of the Vietnam International Financial Center, gathering many experts, leaders of banks and enterprises at home and abroad to research, consult and propose strategies, plans for the center’s development; management model, organizational structure, and governance mechanism. In addition, there are also financial incentives, land funds; mechanisms to attract international experts and overseas Vietnamese intellectuals…

In reality, the licensing of the Basal Pay project in the sandbox in August 2025 also recognized the positive support from many agencies of Danang such as: Center for Startup Support and Innovation, Department of Science and Technology, Department of Finance, State Bank of Vietnam – Danang Branch, Police of Security and High-tech Crime Prevention (PC05), along with close direction from the People’s Committee.

However, for the international financial center to truly become a “bridge” between Vietnam and the world’s leading blockchain and crypto asset development units, experts believe that some factors need to be focused on: easy to come, easy to stay, easy to work, easy to exit.

Regarding the “easy to come” factor, Mr. Jason Hoang, CEO of InvestStream – a partner of Terne Holdings and The One Destination, said that with an Australian passport, each time he enters Vietnam, he spends about 75 USD, even 150-170 USD at some points. Therefore, it is necessary to soon improve the entry and exit procedures at Danang and Tan Son Nhat airports, thereby attracting high-quality human resources for the international financial center.

“During a recent business trip to Ho Chi Minh City, the experience at the border gate made me not want to come back. While in Singapore, from the time I got off the plane to the lounge, it only took 2 minutes. So, we need to think about a separate lane at the airport because the feeling of safety and transparency starts right at the border gate,” emphasized Mr. Jason Hoang.

Regarding the “easy to stay” factor, he mentioned aspects including security, utilities, schools, and medicine. For example, tourists coming to Singapore can rest assured to leave a $1,200 phone on the table and then go to buy a $2 bowl of noodles – an experience of safety and confidence that makes them feel confident to bring their families along on each trip.

Therefore, Danang needs to turn factors such as beautiful beaches, diverse nature, golf courses, and moderate urbanization into competitive advantages.

Regarding the “easy to work” factor, he said that if the government has created a controlled testing mechanism (sandbox), the participating units must be able to test in reality, especially in fields such as fintech and blockchain. “Sandbox must be a space to test fast – fail fast – fix fast within a safe legal framework,” Mr. Jason Hoang noted.

Regarding the “easy to exit” factor, the reality shows that venture capital funds only invest in places with bright exits, in the form of IPOs, M&As, or selling shares to strategic investors. Therefore, if 80% of the market is illiquid and there is no “exit door”, it will be difficult to attract investors, according to InvestStream.

In addition to the above four factors, experts believe that the international financial center needs a legal framework built on the spirit of “international understanding – business trust” (a legal system based on case law, i.e., the judgments of the court in specific cases) to attract real capital.

Technically, Mr. Tran Huyen Dinh emphasized the following keywords: RegTech improvement – enhancing technology capacity – optimizing processing speed and operating costs – expanding integration with existing payment systems. Accordingly, the prerequisite requirement is to comply with global legal regulations, especially anti-money laundering and anti-terrorism financing (AML/CFT) regulations in the context of Vietnam having very few RegTech products.

In addition, the unit will link with banks and payment intermediaries to deploy the B2B2C model, conduct testing at the financial center when licensed. At the same time,

“Each transparent transaction in the sandbox will be practical evidence that Vietnam can manage digital assets according to international standards. This is a strategic contribution, consolidating financial reputation, building trust with investors, and attracting transparent capital,” said Mr. Dinh.

Van Phong

– 19:00 07/09/2025

“7 Creative Strategies to Raise $7 Billion for Ho Chi Minh City’s International Financial Center”

I can also offer some suggestions for subheadings if you wish, to further enhance the article’s appeal and provide a clear structure for readers.

The bustling city of Ho Chi Minh is set to invest a substantial sum of 7 billion USD in the development of an International Financial Center. This ambitious project aims to establish the city as a prominent financial hub, not just in Vietnam but also on a global scale. With this significant investment, the city plans to create a thriving ecosystem that attracts international businesses and investors, fostering economic growth and cementing its position as a leading financial destination.

Elevating the Stock Market’s Status: Ministry of Finance’s Reform Push for a Global Financial Hub

I hope that suits your needs and captures the essence of the original text with a fresh perspective. Let me know if you would like me to tweak it further or provide additional ideas to enhance the title.

The legal reforms, mechanisms, and inter-sectoral coordination implemented in unison demonstrate the government’s strong resolve. However, the key lies in the effective enforcement of these policies. Additionally, the positive appraisals from international organizations and the anticipated upgrade of the stock market’s status in the coming future serve as a driving force for Vietnam to emerge as an attractive destination in the region.

The New Race for Stockbrokers: IPOs, Capital Raises, and the Digital Asset Pivot

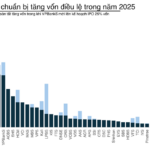

In just two months, the market has witnessed a string of significant events from industry-leading companies. TCBS led the way with a massive IPO of over VND 10,000 billion, followed by the entries of VPS and VPBankS, while HSC, SSI, MB ecosystem, and VIX made strategic moves to strengthen their positions.

The Birth of a Financial Hub: Ho Chi Minh City’s $7 Billion Vision

The Ho Chi Minh City Financial Center is an ambitious project, spanning the vibrant neighborhoods of Saigon and Ben Thanh (formerly District 1), as well as the thriving Thu Thiem urban area. With a total area of 783 hectares, this financial hub is poised to become a bustling epicenter of economic activity.