In recent days, long queues of people waiting to buy gold despite soaring prices have been a notable phenomenon in Vietnam. Famous gold streets in Hanoi, such as Tran Nhan Tong and Cau Giay, have been bustling and vibrant due to the increased demand for gold purchases, while supply remains limited. Some individuals even spread mats to wait overnight to buy gold, with others complaining that they “have money but cannot buy gold.”

People spreading mats to wait in line to buy gold. Source: Vietnamnet

This phenomenon occurs against the backdrop of record-high gold prices. According to Mr. Doan Thai Son, Vice Governor of the State Bank of Vietnam, the recent gold price hike is due to three main factors. Firstly, the global gold price has surged significantly. Secondly, the market expectation and psychology that gold prices will continue to rise have led to a sharp increase in gold purchases by the people. Thirdly, supply is scarce due to the transition to a new gold management mechanism.

In reality, gold has always been a popular investment channel in Vietnam, with segments suitable for the vast majority of social strata. With the difference between buying and selling prices, people mainly buy gold for the purpose of storing value rather than speculating. With interest rates at a low level as they are now, the demand for gold holdings among the people is even higher.

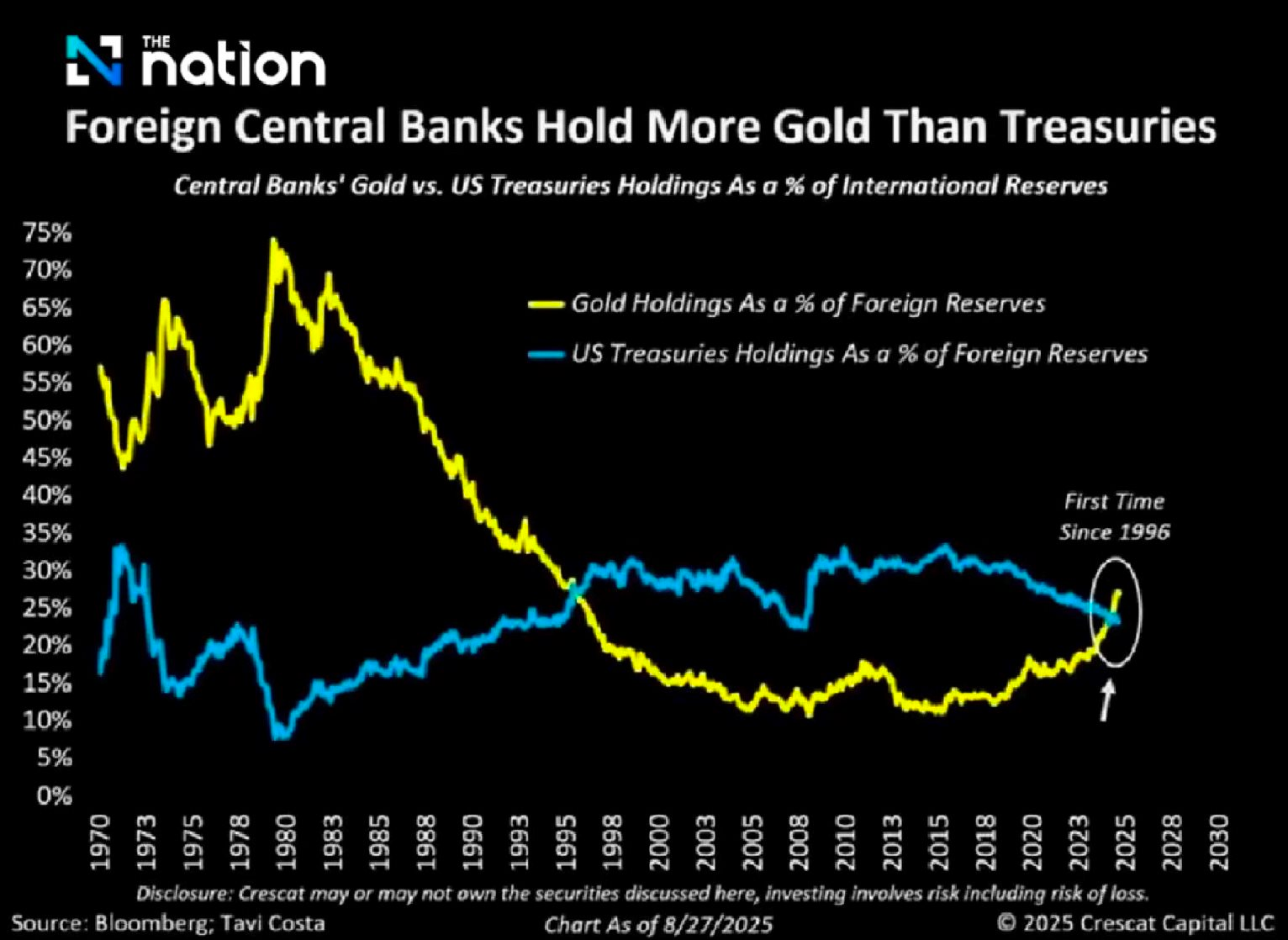

The trend of increasing gold storage is not only happening in Vietnam but is also a “hot trend” globally. According to an analysis by Charles-Henry Monchau, Chief Investment Officer (CIO) at Swiss asset management company Syz Group, global central banks are holding more gold reserves than US Treasury bonds for the first time since 1996. This significant change is described as a “global rebalancing” and is taking place amid increasing geopolitical and trade instability.

According to the World Gold Council (WGC), after years of modest growth, central banks have accelerated their gold purchases significantly. WGC’s 2025 survey found that 43% of central banks plan to add more gold next year, and 95% expect global gold holdings to continue to rise.

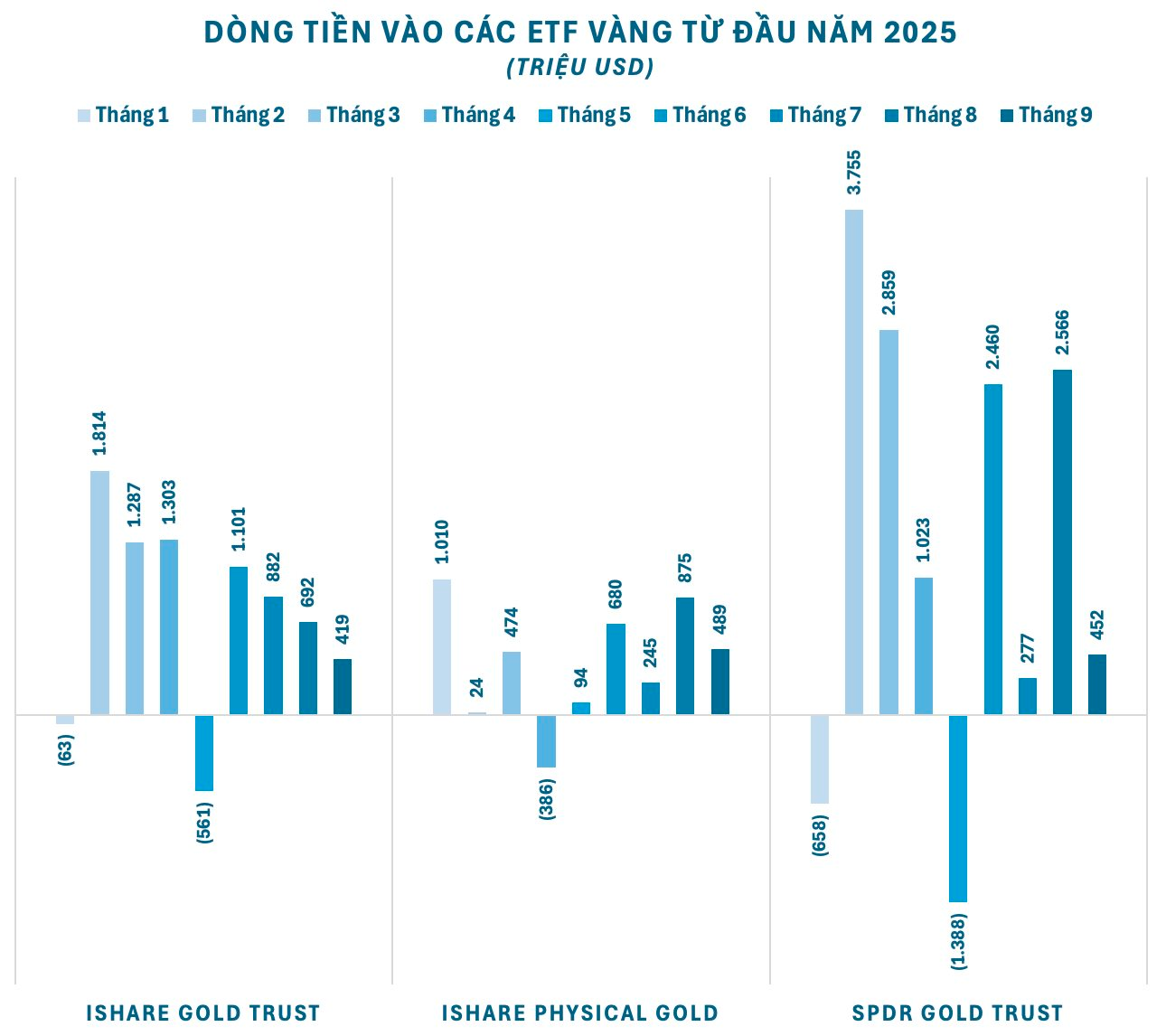

It’s not just central banks around the world; Wall Street “whale investors” have also been aggressively accumulating gold in the past. Gold ETFs from leading global asset management giants like Black Rock and State Street Global Advisors (SSGA) have netted tens of billions of dollars since the beginning of 2025.

Notably, SPDR Gold Trust ETF (managed by SSGA) alone has attracted more than $11.3 billion in net inflows since the beginning of the year. The fund currently holds nearly 982 tons of gold. Meanwhile, iShare Gold Trust ETF and iShare Physical Gold ETF, both managed by Black Rock, have netted $6.9 billion and $3.5 billion in net inflows since the beginning of the year, respectively. The two funds currently hold a total of 692 tons of gold.

Analysts attribute the increased demand for gold storage to the weakening role of the US dollar as the primary reserve currency. Record US public debt, coupled with geopolitical instability and concerns about the global economic outlook, have prompted countries to turn to gold as a “safe haven.”

According to Goldman Sachs experts, the scenario of the Fed losing its independence will lead to various consequences such as higher inflation, lower stock and long-term bond prices, and a weaker US dollar as a global reserve currency. Meanwhile, gold is considered an asset that preserves value and is independent of institutional trust. The bank predicts that gold could soar to nearly $5,000 per ounce.

A Former Da Nang official, a nominal leader, embezzled five land lots

A deceitful couple, Vo Nhi and her husband, were entrusted with a task to hold five land lots under their name. However, they had other plans as they schemed to usurp the property. In a cunning move, they reported the loss of the red book, a crucial document for land ownership in Vietnam, with the intention to sell the land for their own gain.