“Vietnam’s Stock Market: The Race for Capital and the Advent of Digital Assets”

As Vietnam’s stock market anticipates a potential upgrade to attract foreign investment, the country is also bracing for a wave of digital assets that could change the game. According to recent estimates by HSBC, Vietnam may account for approximately 0.6% of the FTSE Asia index and 0.5% in the FTSE Emerging Markets. This move is expected to attract around $1.5 billion from passive funds, mainly from FTSE EM and FTSE Global ex US.

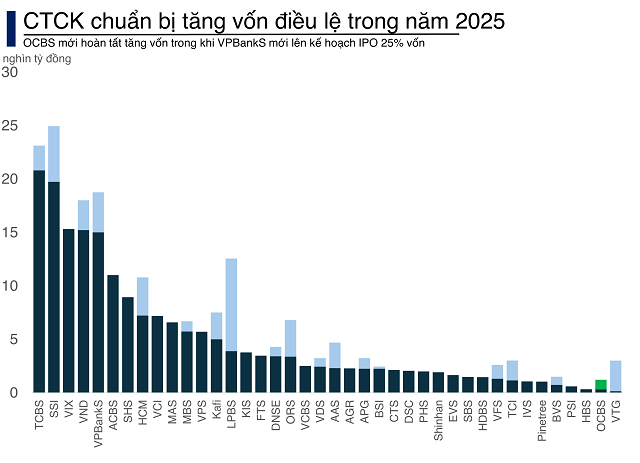

Leading the Race: TCBS and VPBank’s Ambitious Plans

TCBS, the securities arm of Techcombank, is making headlines with its IPO of over 231 million shares, priced at VND 46,800 per share, aiming to raise more than VND 10,800 billion. This landmark IPO in the securities industry will not only bolster their capital for proprietary trading, margin lending, and technology infrastructure investments but also positions TCBS to venture into the realm of digital assets.

Meanwhile, VPBank Securities, a young but rapidly growing company, faces unexpected pressure as its paid-up capital has been surpassed by VIX. VPBank Securities plans to accelerate its IPO to maintain its competitive edge, offering up to 25% of its existing shares, equivalent to 375 million shares. This move will increase its total shares to 1.875 billion and boost its chartered capital from VND 15,000 billion to VND 18,750 billion.

Industry Leaders Gear Up for Capital Increases

SSI, another industry leader, has proposed a capital increase to nearly VND 25,000 billion at an upcoming extraordinary general meeting in late September 2025. VPS is also planning an extraordinary general meeting in October 2025 to discuss new strategies, with a focus on their IPO plans. Additionally, HSC is in the process of increasing its chartered capital to VND 10,800 billion, expected to be completed by the end of September 2025.

The Race for Capital: Embracing Digital Assets and Robust Technology

Alongside capital increases, the industry is abuzz with anticipation as the government plans to grant licenses to approximately five digital asset exchanges. These exchanges will not only facilitate trading in popular cryptocurrencies like Bitcoin and Ethereum but also introduce the concept of Real World Asset (RWA) tokenization, enabling capital raising. Notably, this pilot model may be connected to international exchanges to ensure liquidity and competitiveness.

To join this new era of digital assets, securities companies must invest significantly in technology and hold substantial reserves of coins and financial resources to meet margin requirements. The race for capital is far from over and is expected to intensify as the industry transitions into the digital asset era.

In mid-August 2025, Military Commercial Joint Stock Bank (MB) signed a cooperation agreement with Dunamu, the operator of Upbit, South Korea’s largest digital asset exchange, at the Vietnam-Korea Economic Forum 2025.

TCBS and VIX have also established separate legal entities for their digital asset exchanges, TCEX and VIXEX, respectively.

The Robinhood Model: A Cautionary Tale

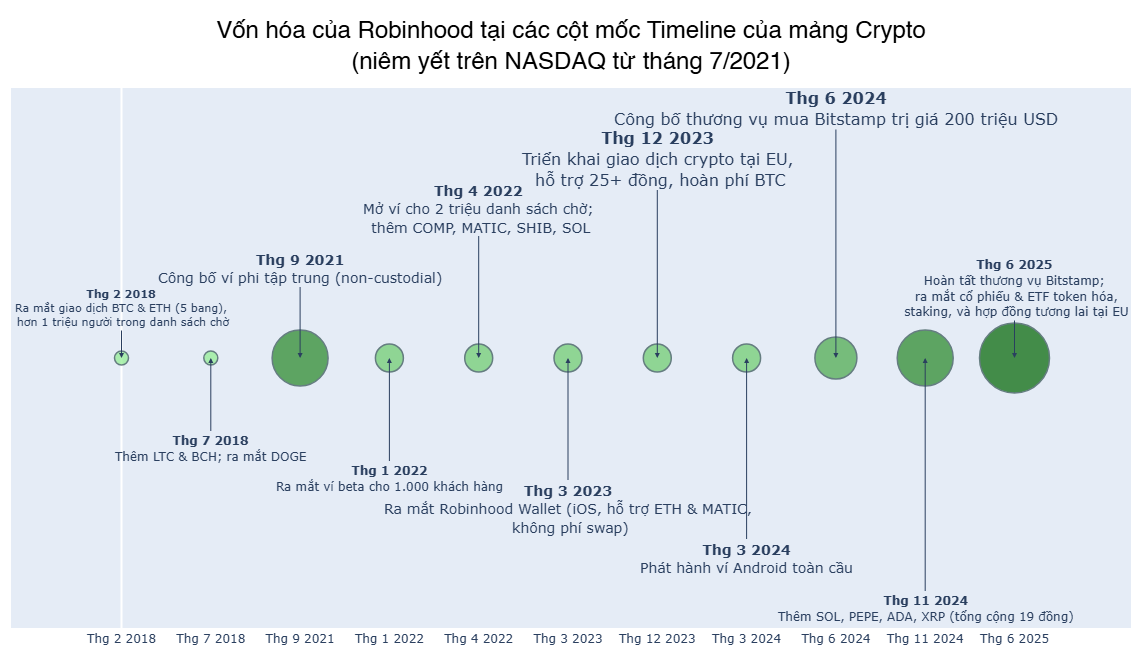

In this context, the development model of Robinhood, a renowned financial platform in the US, serves as a reference for Vietnamese securities companies. Founded in 2013, Robinhood initially offered free stock brokerage services before rapidly expanding into the digital asset space and evolving into a “super app” encompassing multiple financial products.

Here’s a summary of Robinhood’s crypto journey:

2018: Introduced free trading of Bitcoin and Ethereum, attracting millions of new users.

2021–2022: Launched a crypto wallet supporting multiple tokens and direct deposits and withdrawals.

2023: Introduced a global wallet for iOS and Android, supporting Ethereum, Polygon, and Arbitrum.

2024: Expanded into Europe, offering over 25 tokens and a monthly Bitcoin rewards program.

2025: Completed the acquisition of Bitstamp for $200 million and announced plans for stock tokenization, US ETFs, and the development of a proprietary blockchain to support digital asset trading.

|

Robinhood’s strengths lie in its near-free trading, integration of stocks, ETFs, and crypto on a single platform, and its self-custodial wallet offering. Most importantly, the company pioneered the tokenization of traditional assets on the blockchain, enhancing cross-border liquidity and expanding the investment landscape.

However, Robinhood’s journey into crypto hasn’t been without challenges. In early 2021, the GameStop event led to a demand for additional collateral in the billions and restricted trading, sparking intense debates about liquidity and credibility. Crypto brought even higher risks due to its 24/7 volatility, forcing Robinhood to continuously shore up its capital and reserves.

Additionally, Robinhood faced investigations by the SEC and other regulatory bodies regarding its crypto unit’s management and risk disclosures to customers during Trump’s second term.

Technical difficulties also posed significant challenges. Crypto custody demands the management of hot wallets, cold wallets, and multi-layer security keys—a single mistake could result in the loss of millions of dollars.

To mitigate these risks, Robinhood opted to develop its wallet while partnering with custody providers and allowing customers to withdraw coins, enhancing transparency.

With their robust capital and technology infrastructure, players like TCBS, VPBank Securities, SSI, and MBS have the potential to become the “Vietnamese Robinhood.” However, venturing into digital assets is not just about capital and technology; it’s also a test of risk management capabilities, including liquidity, legal compliance, security, and trust. A single unexpected shock could wipe out years of progress.

What’s Next for the VN-Index After Hitting an All-Time High?

“With a harmonious blend of robust growth prospects and a still-reasonable price-to-earnings ratio, the VN-Index has the potential to surpass the 1,700-1,800 level,” asserted the expert.