Gold Prices Surge: Insights from PGS.TS Nguyen Huu Huan

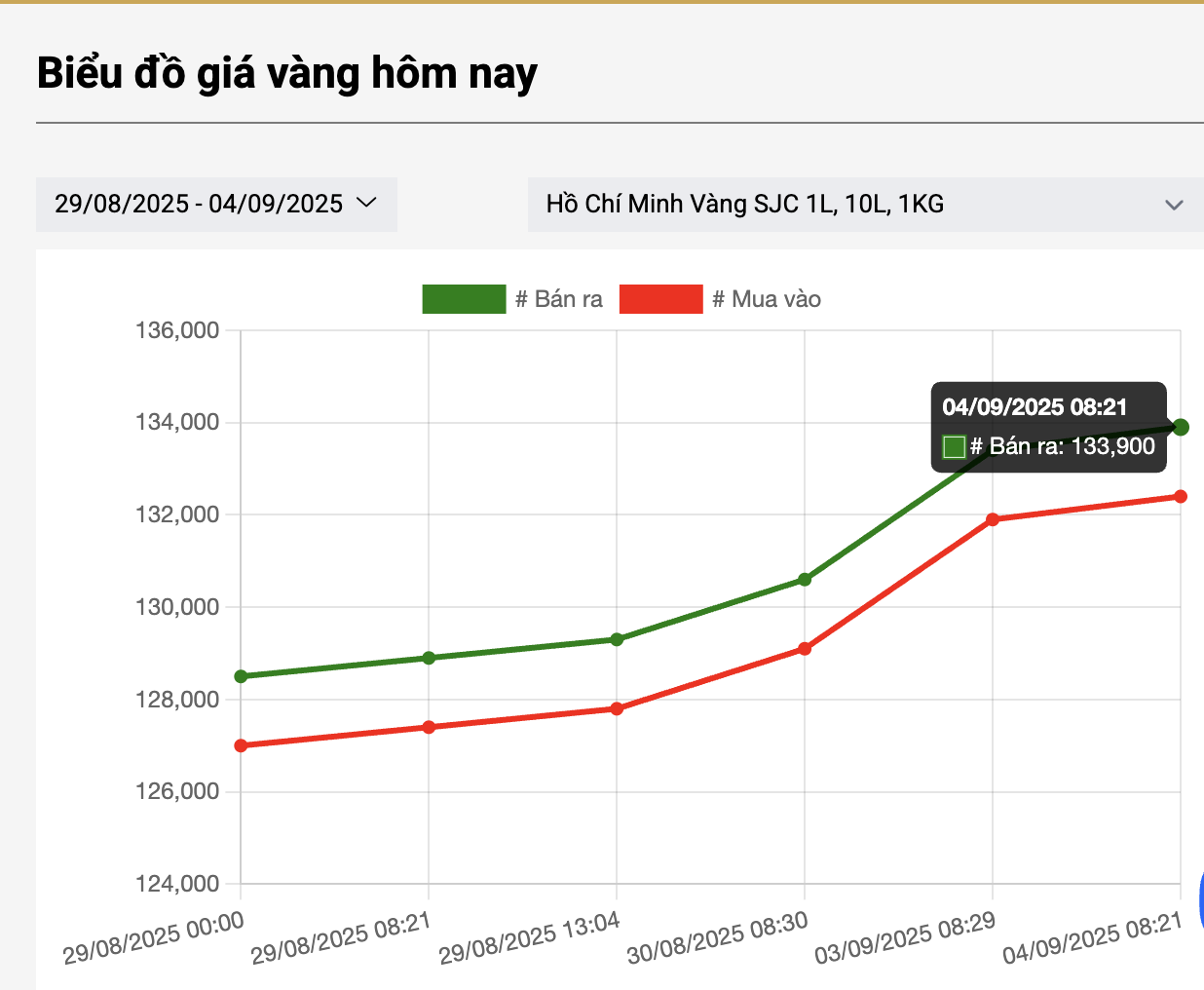

On September 5th, the price of SJC gold bars reached new heights, with prominent companies buying at 132.9 million VND per tael and selling at 134.4 million VND per tael, the highest among major gold firms.

In the free market, the price of SJC gold bars surged even higher, surpassing 140 million VND per tael. Small jewelry shops in Ho Chi Minh City quoted buying prices of 140 million VND per tael and selling prices of 141 million VND per tael in the afternoon, a 1.5 million VND increase from the morning and the highest ever.

The price of 99.99% pure gold rings and jewelry also remained at peak levels, with buying and selling prices of 126.7 million VND and 129.2 million VND per tael, respectively.

As domestic gold prices continue to reach unprecedented highs, surpassing all forecasts, many people are still flocking to buy. Meanwhile, others express concern about whether they should invest in SJC gold bars and rings at this time.

NLD reporters spoke with PGS.TS Nguyen Huu Huan, from the University of Economics Ho Chi Minh City (UEH), to gain insights into the recent volatile gold market.

Reporter: What factors have led to the sharp increase in gold prices, with global prices surpassing the psychological threshold of 3,500 USD per ounce?

– PGS.TS Nguyen Huu Huan: Multiple factors are at play here. The US dollar has started to weaken, and there are expectations that the Federal Reserve will reduce interest rates by 0.5% in the near future, particularly by the end of September. China is also significantly increasing its gold demand. All these factors have contributed to the significant rise in global gold prices, which tends to influence domestic prices.

In my opinion, now that the 3,500 USD per ounce threshold has been broken, there will likely be some retesting of this level, and if it holds, gold prices could continue to reach new highs in the future.

Insights from PGS.TS Nguyen Huu Huan, University of Economics Ho Chi Minh City (UEH), on the recent volatile gold market.

But why are SJC gold bars and rings increasing faster than global prices?

– The rapid and substantial increase in domestic gold prices compared to global prices can be attributed to the relatively scarce supply in the local market. It is challenging for individuals to purchase gold, especially SJC gold bars.

The significant demand-supply imbalance has led people to accept buying gold at higher prices. In the free market, gold bar prices are also significantly higher than the quoted prices at companies and banks.

Crowds queue to buy gold at SJC shops in Ho Chi Minh City in recent days

Some experts have warned about the risks of investing in SJC gold bars and rings at this time, as the price difference with the global market has exceeded 20 million VND per tael. What are your thoughts on this?

– I agree that at such a significant price difference, investors should refrain from buying. Chasing the market out of fear of missing out (FOMO) carries considerable risk.

Additionally, such a large discrepancy also poses policy-related risks. If the State Bank intervenes in the gold market with specific policies, it will undoubtedly cool down the domestic gold market, creating significant risks for investors who buy at the current high prices.

Regarding the government’s recent decision to end the monopoly on SJC gold bars, which takes effect in October, it is a step towards fostering a sustainable gold market. However, the root cause of the issue lies in supply. With the SJC gold bar monopoly broken, people will await subsequent moves, such as the number of enterprises allowed to enter the gold bar market, their import quotas, and whether this gold supply will be sufficient to meet domestic demand.

These are the equations that need to be solved. Only when supply meets the current substantial demand will the domestic gold prices stabilize.

SJC gold bar prices continue to reach new highs

The Golden Contrast: A Tale of Soaring Prices

The gold price surge has left small jewelry shops in a peculiar predicament. While a rise in gold prices typically signals prosperity for gold businesses, smaller retailers are facing a unique challenge. Their primary focus on jewelry sales becomes a double-edged sword when customers flock to purchase gold bars and coins instead. This shift in demand dynamics has small jewelry retailers struggling to adapt, witnessing a stagnant business despite the favorable market conditions.