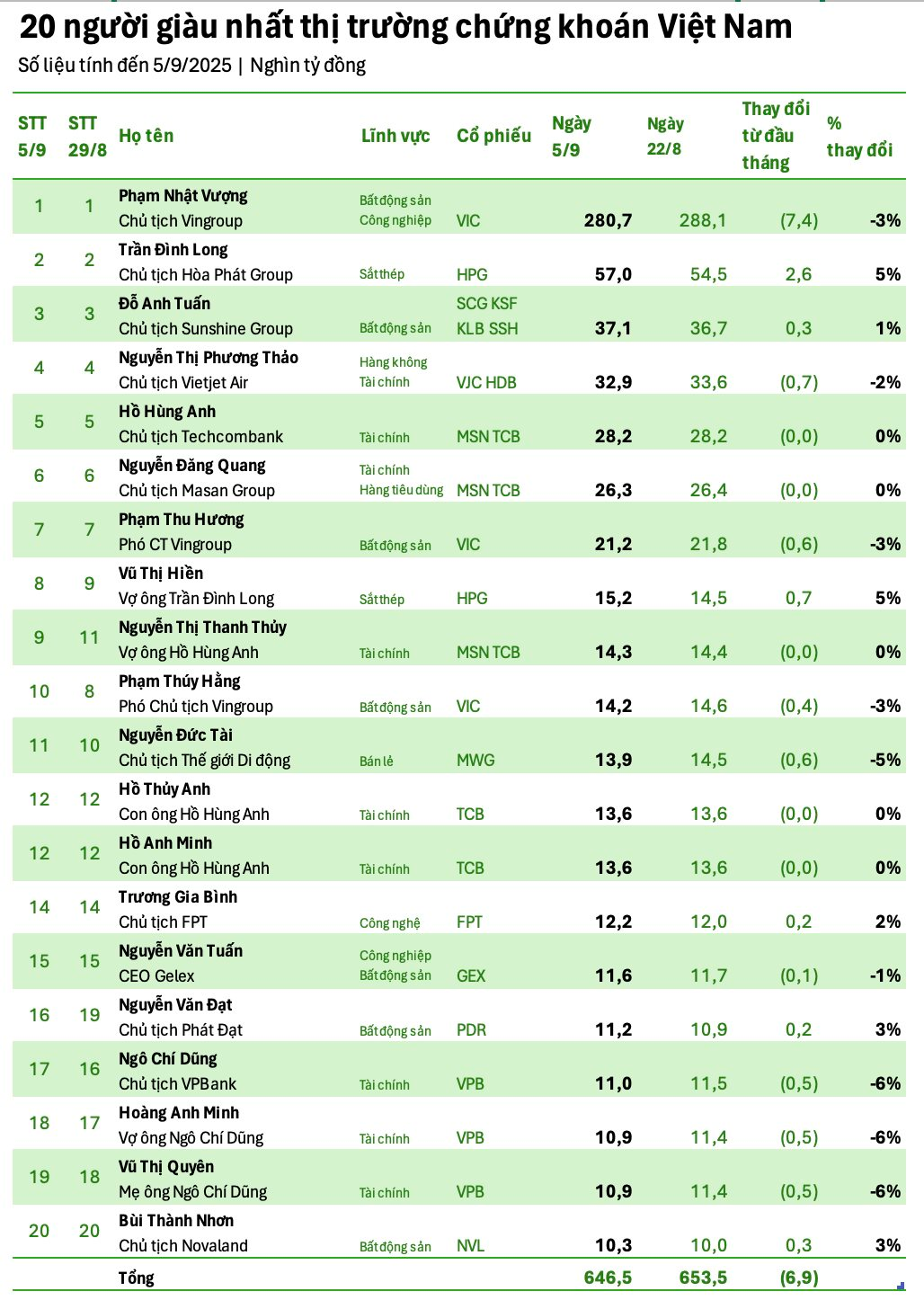

As of September 5, 2025, the total wealth of the 20 richest people in the Vietnamese stock market reached 646.5 trillion VND, a decrease of 6.9 trillion VND compared to the end of August.

Most of the wealth of the top 20 richest individuals remained stagnant or saw a slight decrease.

Figure 1: Wealth of the 20 Richest People in the Vietnamese Stock Market as of September 5, 2025

Mr. Pham Nhat Vuong, Chairman of Vingroup (VIC), maintained his leading position with a wealth of 280.7 trillion VND. However, compared to August 22, his wealth decreased by 7.4 thousand billion VND (-3%) due to adjustments in VIC stock prices. In addition to Mr. Vuong, two Vice Chairwomen of Vingroup, Pham Thu Huong and Pham Thuy Hang, also recorded a 3% decrease in their wealth.

The couple, Mr. Tran Dinh Long and Mrs. Vu Thi Hien, witnessed the highest increase in their wealth, with a 5% growth. Mr. Long is the Chairman of Hoa Phat Group, one of the largest steel producers in Vietnam.

According to statistics, Mr. Long currently owns 1.9 billion shares, holding 25.8% of the charter capital. As of September 4, his stock holdings were valued at 59,103 billion VND.

Mrs. Hien, Mr. Long’s wife, holds 528 million shares worth 15,700 billion VND. Their son, Tran Vu Minh, owns 176 million shares with an estimated value of over 5,000 billion VND.

Additionally, Dai Phong Trading and Investment Company, where Mr. Minh is the director, holds 3.6 million HPG shares with an estimated value of 108 billion VND.

Thus, the total wealth of Mr. Long’s family exceeds 80,000 billion VND.

The total wealth of the Hoa Phat Group’s management team and their families surpasses 100,000 billion VND. Apart from Mr. Long’s family, five other senior executives and their families hold assets worth over 1,000 billion VND.

Meanwhile, the wealth of the Chairman of Phat Dat and Novaland witnessed a 3% increase, while Mr. Truong Gia Binh, Chairman of FPT, experienced a slight 2% growth in his assets.

Stock Market Week Sept 03-05, 2025: The Unexpected Drop After Hitting 1,700 Points

The VN-Index took a surprising tumble during the week’s final session, bringing an end to four consecutive weeks of gains. This sudden shift highlights the intense profit-taking pressures at play in the higher price ranges, with persistent foreign sell-offs further exacerbating the situation and significantly impacting investor sentiment.

“The Revenue Generated by Vingroup’s Education Arm: A Comprehensive Overview”

The education segment raked in a whopping 3.204 trillion VND in pure revenue for the first half of 2025, marking an impressive near 14% increase from the same period last year.