Prudential Vietnam Life Insurance Joint Stock Company (Prudential Vietnam) has just announced its semi-annual financial report for 2025 with total assets as of June 30 reaching VND 192,507 billion, up 1.8% from the beginning of the year. With this scale, Prudential Vietnam continues to be the second-largest insurance company in Vietnam in terms of assets, only after Bao Viet Holdings.

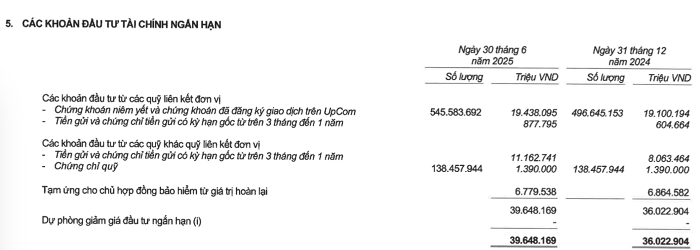

Delving into the asset structure of Prudential Vietnam, financial investments account for nearly 88% of total assets. Of this, short-term financial investments amounted to VND 39,648 billion, with more than half invested in listed stocks and stocks traded on UPCoM (VND 19,438 billion), and the rest in bank deposits and fund certificates. Prudential Vietnam does not provide a detailed breakdown of its stock portfolio.

(Source: Prudential Semi-annual Financial Report 2025)

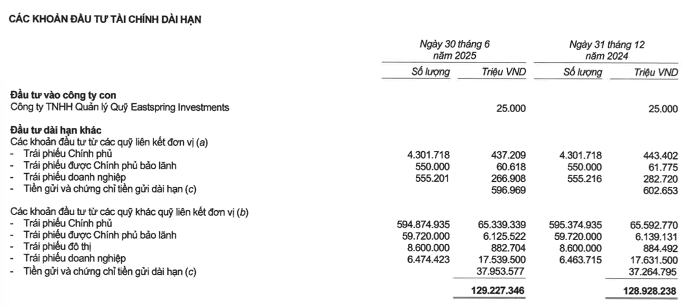

On the other hand, Prudential Vietnam’s long-term financial investments are mainly in the form of government bonds and government-guaranteed bonds, amounting to nearly VND 72,000 billion; long-term bank deposits and certificates of deposit amounted to VND 38,550 billion.

In addition, the company also held more than VND 17,806 billion in corporate bonds as of June 30, down 0.6% from the beginning of the year.

(Source: Prudential Semi-annual Financial Report 2025)

In the first six months of the year, Prudential Vietnam’s pre-tax profit decreased by nearly 26% over the same period in 2024 to VND 812 billion.

In the first half of the year, Prudential’s insurance business lost VND 831 billion, halving from a loss of VND 1,672 billion in the same period last year. Prudential Vietnam continued to make losses in its insurance business as operating expenses still exceeded net revenue. Accordingly, net insurance premium revenue decreased from VND 10,968 billion to VND 9,576 billion (equivalent to a decrease of 12.7%) and insurance business operating expenses decreased by 17.7% to VND 10,407 billion.

Financial business activities also declined as net profit decreased by 37% over the same period to VND 3,896 billion. Accordingly, financial revenue decreased by 35.1%, reaching only VND 4,221 billion, due to unrealized profit from the revaluation of linked fund investments decreased by up to nearly 79% over the same period; investment securities sales activities lost more than VND 291 billion, while in the same period last year it made a profit of more than VND 719 billion.

Prudential’s selling expenses in the first half of the year decreased by 55% over the same period last year, thanks to a significant reduction in insurance agent incentives, support, and other benefits, from VND 2,117 billion to VND 954 billion. Meanwhile, management expenses remained the same at over VND 1,300 billion.

Title: Hano-Vid Records Nearly VND 10 Billion Profit in H1, Extends Maturity of VND 5.6 Trillion Bond Notes to 2027

The first half of 2025 saw Hano-Vid Real Estate record a promising performance with a net profit of nearly VND 10 billion, a remarkable surge of 4.6 times compared to the same period last year. Despite this impressive feat, the company still grapples with a substantial bond debt that necessitates a two-year extension to alleviate impending cash flow pressures.

“Debt Surpasses VND 10.1 Trillion: Tien Phuoc Group Reports Profit of Nearly VND 452 Billion in First Half of Year.”

This is Tien Phuoc Group’s record profit since 2021. A remarkable achievement, this financial success story is a testament to the group’s unwavering dedication, innovative strategies, and exceptional performance. With a sharp eye for market trends and a commitment to excellence, Tien Phuoc Group has navigated the economic landscape with prowess, solidifying its position as an industry leader. This milestone underscores the group’s resilience and fortitude, setting a new benchmark for prosperity and growth.

“IPA Hydropower Company Reports 14% Dip in Half-Yearly Profits”

“In the first half of 2025, Bac Ha Energy reported a remarkable after-tax profit of over 30 billion VND, reflecting a 14% decrease compared to the same period last year. The company also witnessed a significant reduction in its total liabilities, which fell by 25.6% to 551 billion VND, showcasing a strong financial performance and a positive trajectory for the remainder of the year.”

“F88 Records a Net Profit of Over VND 252 Billion in the First Half of 2025”

As of the end of the first half of 2025, F88 reported a net profit of VND 252.4 billion, a remarkable 2.8 times higher than the same period last year. The company’s total liabilities stand at over VND 3,612.3 billion.